Advertisement

A lawsuit over pop star Jay Chou speaks volumes about China’s streaming war

Tencent bought up exclusive rights to some of the biggest names in music, forcing competitors like NetEase to sublicense

Reading Time:3 minutes

Why you can trust SCMP

This article originally appeared on ABACUS

When people are looking to stream the latest surprise album from Beyoncé, they don't have to choose between Spotify or Apple Music. But in China, listening to some of the world’s most popular musicians requires using one of Tencent’s three dominant music streaming apps.

One of those artists is Jay Chou, a Taiwanese singer who’s been immensely popular in mainland China for nearly two decades. The pop idol hailed as the “King of Asian Pop” has been the subject of a lawsuit between Tencent and NetEase over the past year. But just this past week, a Shenzhen court ruled that NetEase had to pay Tencent 850,000 yuan (US$121,500) for allowing users download the Mandopop star’s songs.

(Abacus is a unit of the South China Morning Post, which is owned by Alibaba, which purchased a stake in NetEase Cloud Music in September.)

Meet NetEase, China’s second-largest game publisher

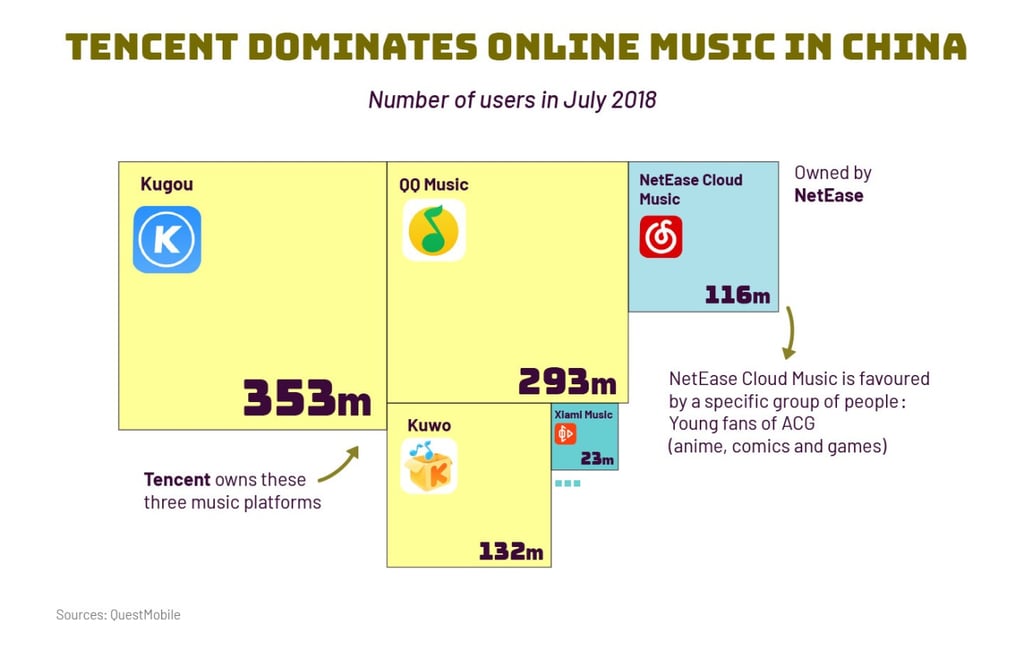

NetEase is Tencent’s biggest competitor in China’s music streaming industry. But its lone streaming app still doesn’t come close to the massive number of people streaming on one of three Tencent Music apps.

Advertisement

China’s music streaming industry has 607 million users, and most of them use Kugou, QQ Music, Kuwo or some mixture of the three. NetEase Cloud Music comes in fourth place behind these three Tencent-owned apps, according to multiple research reports.

Advertisement

So far, NetEase has been the only one that’s been able to hold its own against the Tencent Music behemoth. Its music service has been growing faster than any of Tencent’s, according to QuestMobile. But Tencent has gained an edge through the use of exclusive deals.

In the US, the popularity of music streaming exclusives — once a common strategy for Apple Music — has been waning for a few years. But that’s not the case in China.

Advertisement

Select Voice

Select Speed

1.00x