Advertisement

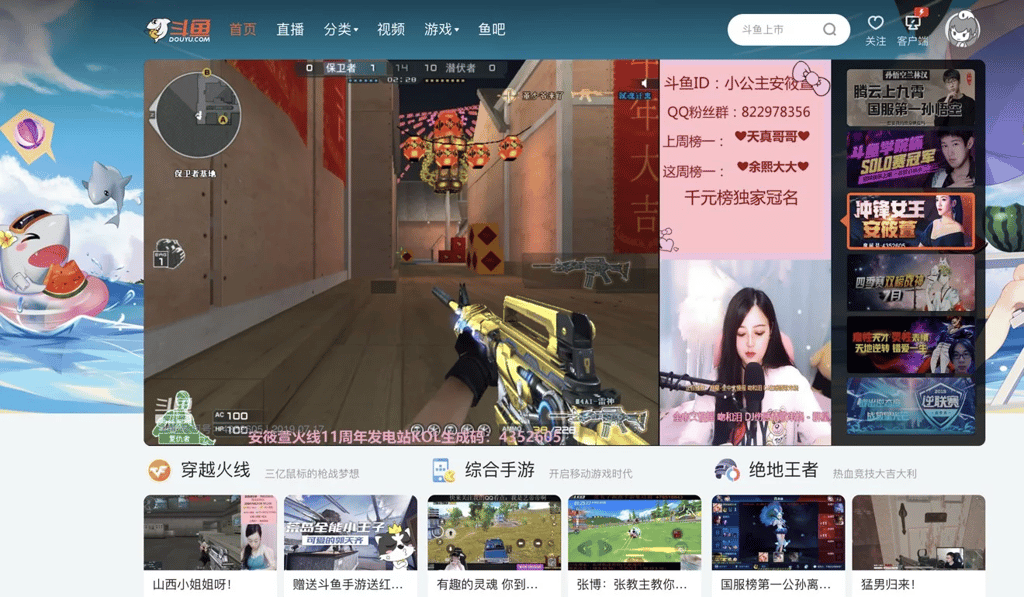

How Douyu won the live-streaming war to become China’s Twitch

Douyu is one of China’s two largest live-streaming sites with a focus on game-related content. By out-fundraising rivals and poaching top streamers, it survived China’s live streaming war in 2016 to become an industry giant.

Reading Time:4 minutes

Why you can trust SCMP

This article originally appeared on ABACUS

Since raising US$775 million on the Nasdaq, Douyu has the largest IPO of any Chinese company on Wall Street in 2019.

With 160 million monthly active users, the Tencent-backed company that focuses on game-related live streaming has more MAUs than Amazon’s Twitch with 140 million. The company is a giant in China’s live-streaming sector, along with rival Huya.

Advertisement

It hasn’t always been smooth sailing for Douyu, though. The company’s rise to dominance was preceded by what industry watchers called the “Thousand Live Stream War” in 2016. Although the name is exaggerated, China’s live-streaming startup boom was astonishing at the time. The country went from having barely any live-streaming platforms to more than 300 in a matter of months.

Amazon’s Acquisition of Twitch made Douyu

Douyu is not an overnight success. The company was founded by Chen Shaojie in 2013 as an offshoot of AcFun, a video platform that gained popularity by implementing bullet chat as a real-time user commentary tool.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x