It is no coincidence that some of best chip makers in the world also have long traditions of wax tie-dye, which requires craftsmanship and cooperation.

If the tech sector cannot solve climate change and social inequality – the two existential issues of our time – the state must step in. Unfortunately, geopolitical tensions are such that governments appear more preoccupied with rivalry and industrial policies than solving problems.

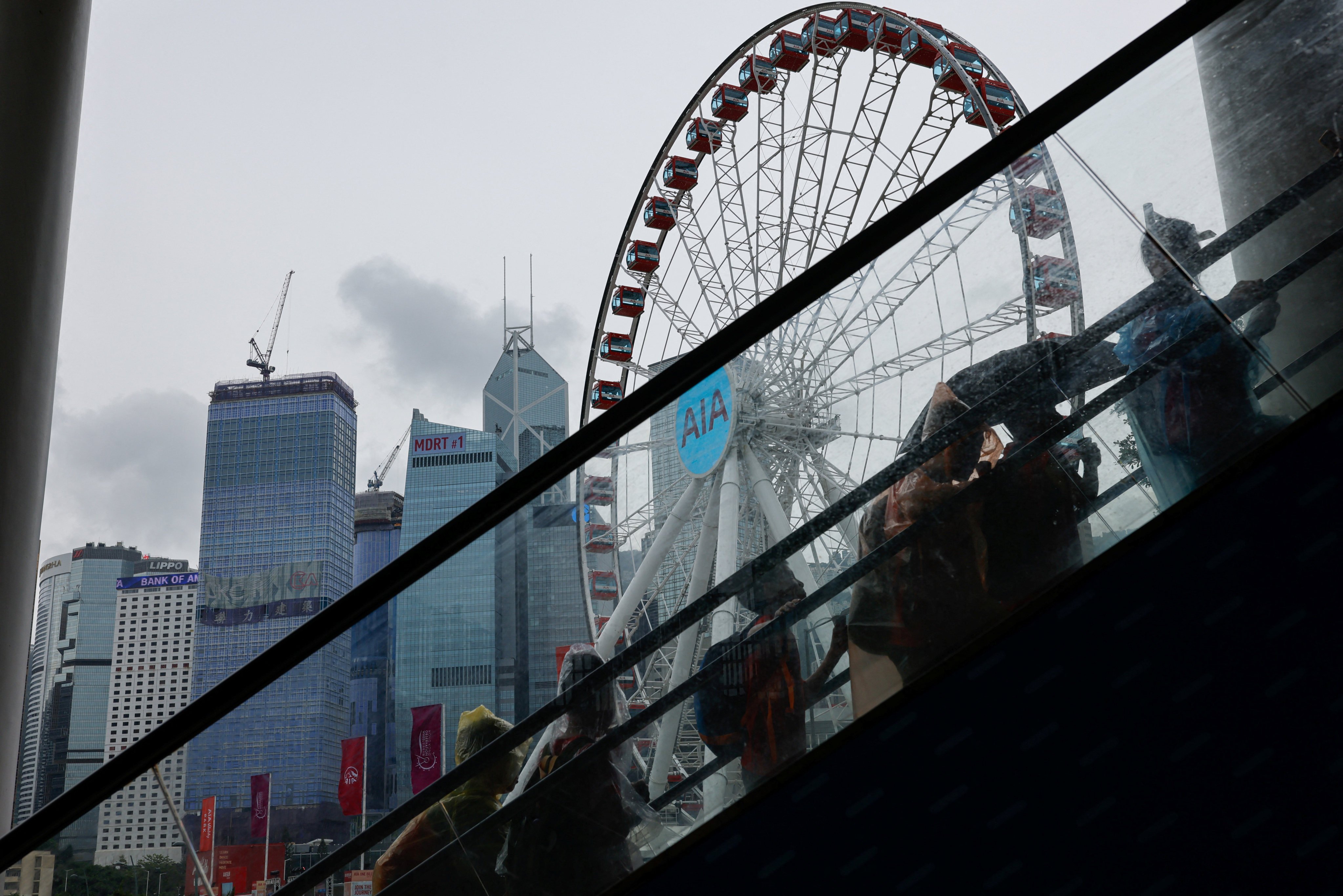

The US has returned to growth, with a strong stock market and lead in AI technology but the global leadership contest is far from over and counting on the US as the key engine of recovery is simply not realistic.

Whether it’s macroeconomic modelling or export-led industrialisation, the game has changed with peak globalisation, technology diffusion and climate change. Development and how to finance it is the question, and brave countries can adopt very different models from the past.

As the Global South pushes for more opening up, trade will emerge profoundly different, more complex and diffused. Chest-beating isolationism can’t change how the world is more interdependent than ever.

The idea of a Western garden under threat from the unruly jungles of the rest of the world is at the heart of today’s global rifts.

Expect a right-wing agenda, a Ukraine deal with Russia, a restrained Israel, truce with China, and European and other allies treated again as vassals. In other words, distant enemies will have less to fear than close allies.

The West’s imperial history means it has set many global standards since the 15th century, while the solidification of US hegemony after 1945 convinced many former colonies to buy into neoliberal ideology. More recently, though, it has become clear that the Global South must chart its own course to a sustainable future.

Overstretched by wars, undermined by fractious politics, and with the dollar, its most powerful tool, sorely overused, America is clinging on to a unipolar world order. But in putting America first, its leaders are dismantling the world order that Washington helped to build.

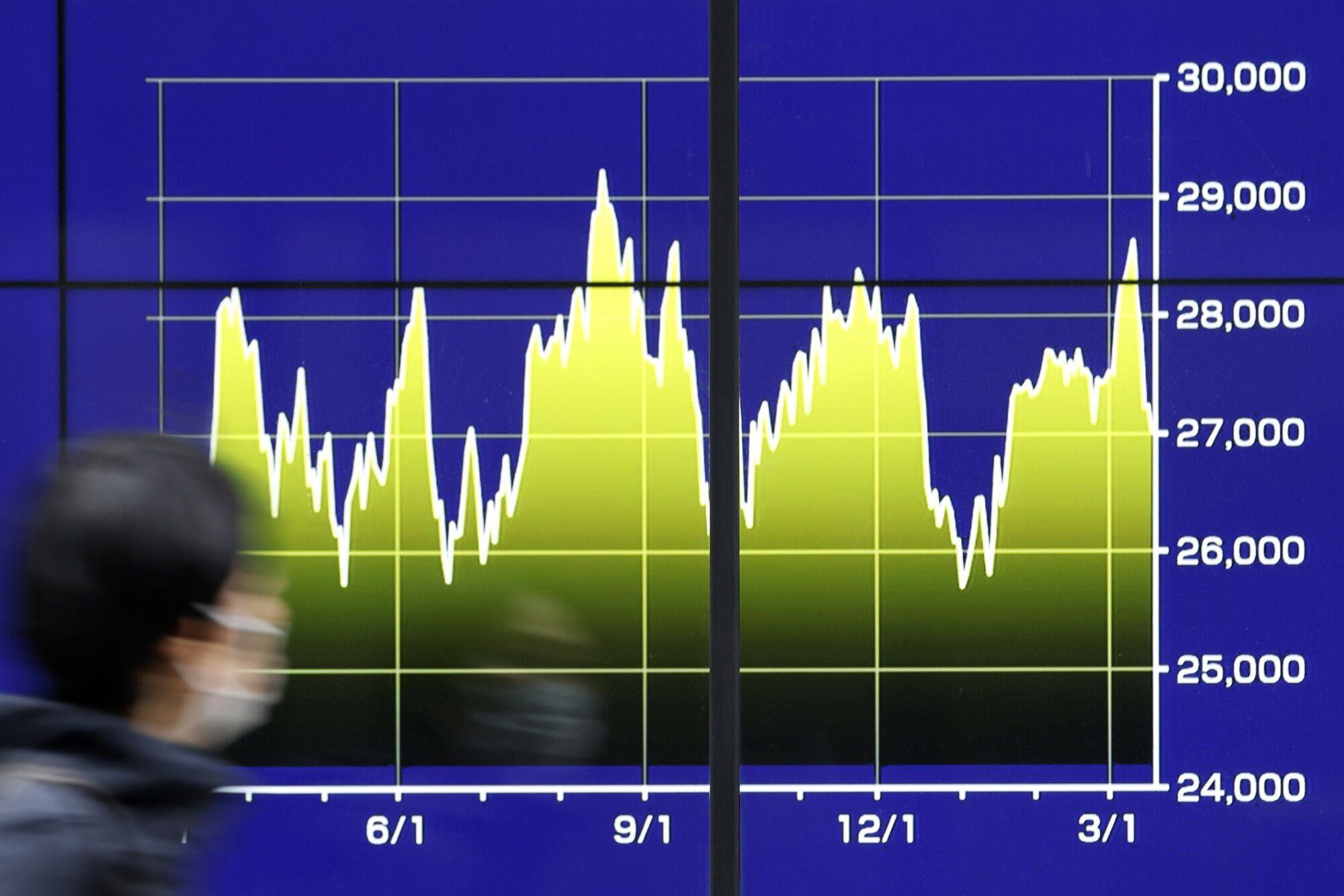

From the collapse of banks in March and the Federal Reserve’s interest rate increases to the impact of geopolitics on trade and the rising number of armed conflicts, this year has seen an acceleration in mega trends.

Tight coupling in a global world is breaking and we need a looser macro-management philosophy that allows for decentralised adjustments to different stresses and strains.

As global warming intensifies, the only alternative to destruction is cooperation, as shown by the US-China landmark Sunnylands climate accord ahead of COP28. But where is the money to fund such plans?

The West’s unqualified support for Ukraine and Israel has lost it the support of the rest of the world and arguably hurt its moral standing.

Concerns about global financial stability are growing amid slowing growth, rising oil prices and war in Ukraine and Palestine. Reports released by a series of top economists and regulators suggest many vulnerabilities remain despite efforts to curb systemic risks.

At a time when environmental, economic and political disasters are plaguing the planet, global leaders all seem either distracted or totally absent. Rich countries have a moral duty to take the risk of funding and leading global climate action and addressing social inequities.

The global financial system has failed to divert sufficient assets to support developing countries in meeting the Sustainable Development Goals. If the Global South is to be heard on the global stage and shape its own future, its financial institutions must step up.

Austrian scholar Friedrich Glasl’s model of conflict escalation tracks how disputes deteriorate from tension to total destruction. In the nuclear age, it is vital for political leaders to come to their senses and choose diplomacy, not war.

The world today is caught in a classic confidence trap. More government regulation cannot arrest the downward spiral, and policymakers must take a bet on the markets’ instincts for creativity and innovation.

When it comes to food production, water supply and carbon capture, our best chance of fixing things may be to work on the soil beneath our feet.

Instead of serving markets, we should have markets serving our needs for a fairer, greener world. Enter social stock exchanges – the institutionalisation of doing good.

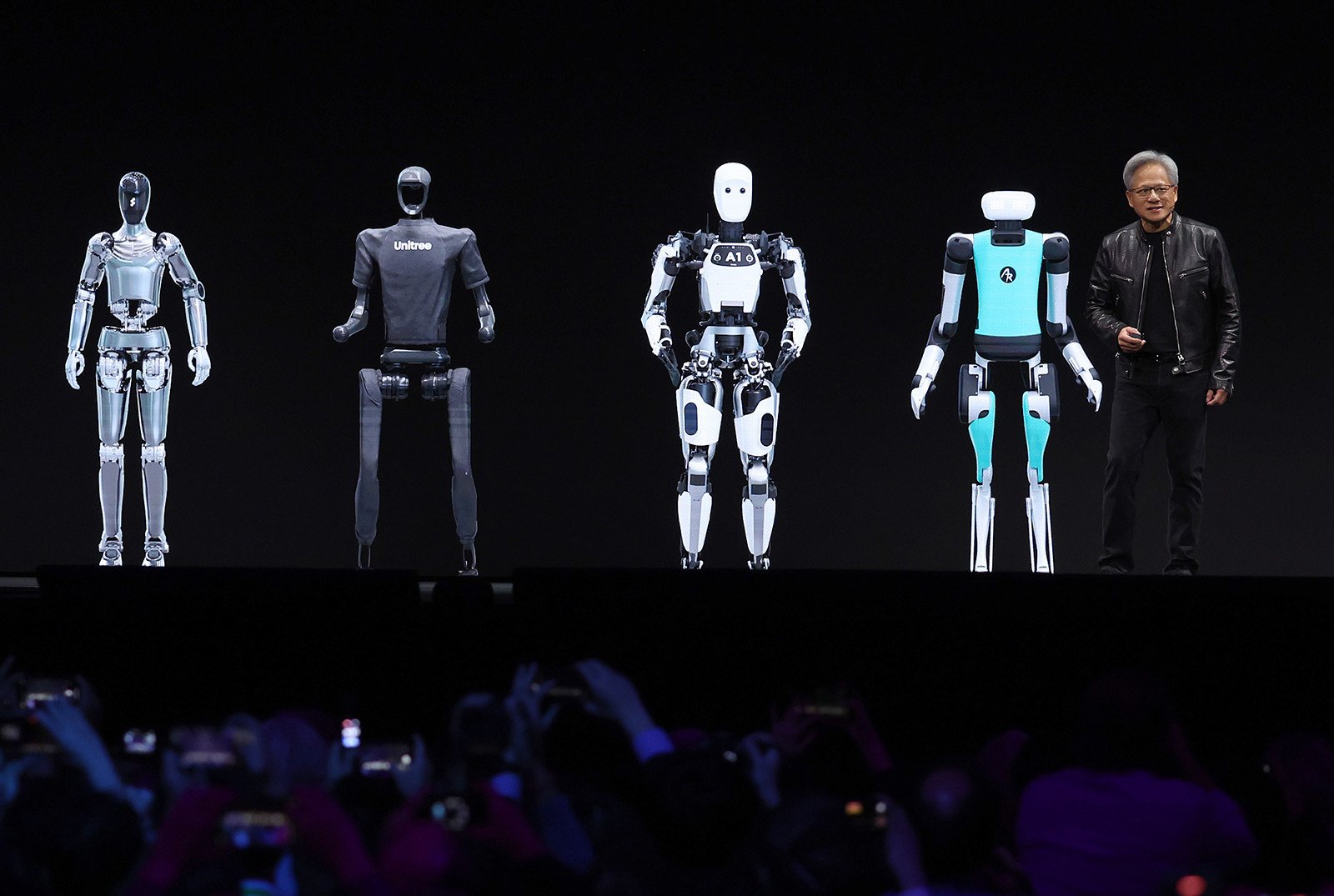

While the US and its allies currently have the upper hand, especially when it comes to advanced chips, China still manufactures workhorse chips and has market scale.

Central banks across the world are responding to the challenge posed by the rise of decentralised finance by creating their own digital currencies to retain control while providing a trusted, transparent, efficient and resilient financial system that avoids scams and enables official oversight.

When elites become predatory through corruption and infighting, their empire or civilisation risks falling through a combination of internal collapse and foreign invasion. Today, elite interests are increasingly out of touch with those of the masses, who want peace, stability, better jobs and healthcare.

The fillip from fast and loose monetary policy has ended, and growth is set to plunge to its lowest level in 30 years. Reviving this requires acting for the long term – and it might take a painful recession to get everyone on board.

Rather than rely on the recently popular ‘Thucydides Trap’, the clashes between Carthage and Rome might offer provide insight into our current predicament. The triumph of political will, military technology and economic power over calls for peace and respect for the environment show how dire succumbing to war can be.

While much as been made of the ‘Thucydides trap’, the Greek historian’s insights are also useful in recognising how emotions fuel war. The US must be willing to end its role as the global cop and share power with the rest of the world to ensure prosperity and avoid catastrophe.

When global finance is used to punish political adversaries and economic competitors rather than promote growth, it undermines a global public good. For the US too, a powerful currency is also a double-edged sword.

Financial contagion fears, a toxic geopolitical environment and a proliferation of sanctions have made investors nervous. When risks are rising and returns are falling, investors can only step with great care.

The war games being played by the US against its two rivals are a combination of chess and Go, in which it must anticipate its opponents moves while claiming as much space on the board as possible. Such a complex game can only end in negotiations with no clear winner, but much damage may be done before then.

Shifting balances of power, the West’s intransigence over Ukraine and the poor outcomes of its foreign interventions have left the Rest wary. The romance with the West is well and truly over.