Advertisement

Advertisement

CITI RESEARCH

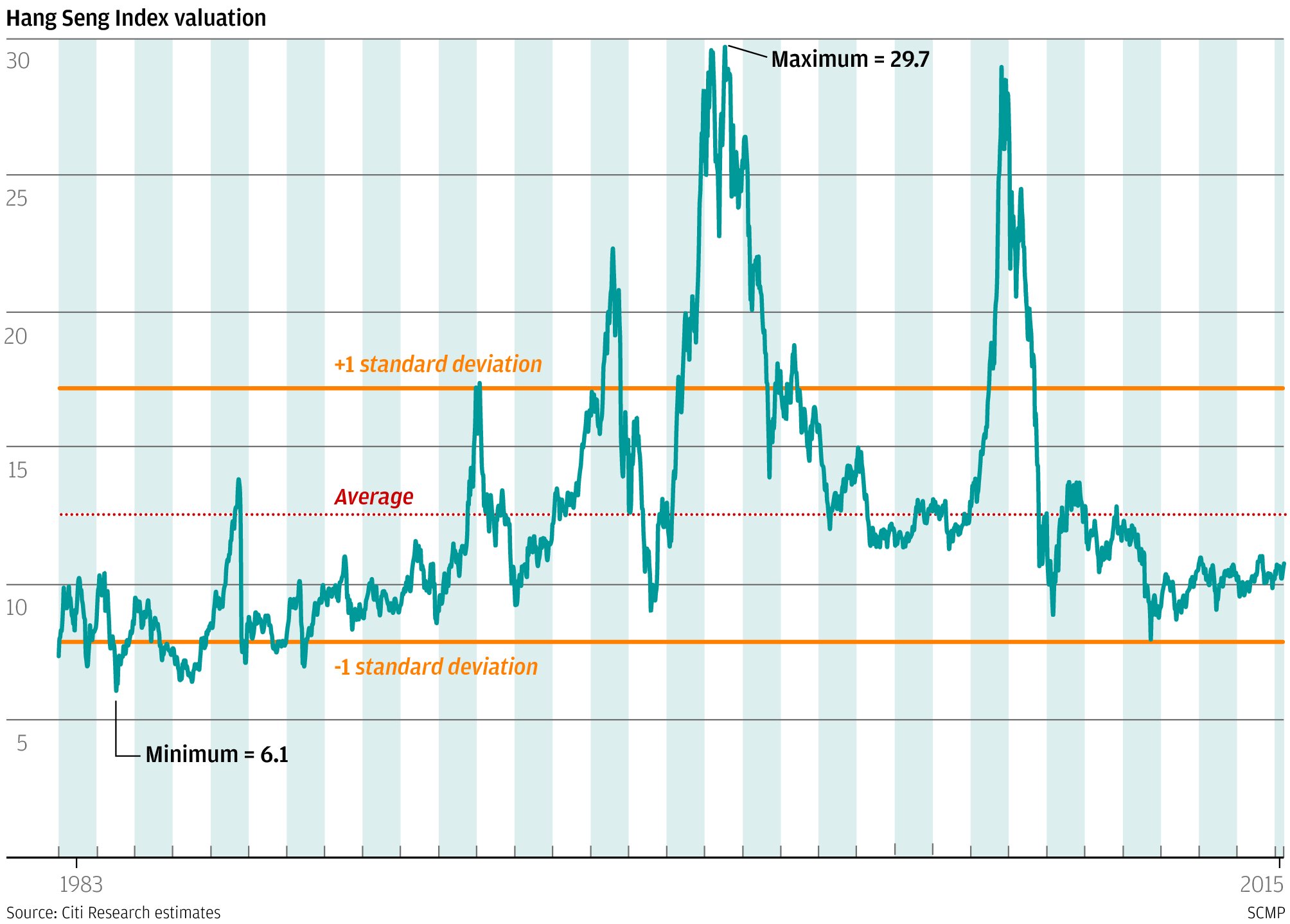

The Hang Seng Index is now trading at 11 times this year's price-earnings ratio, just below the historical average of 12.5 times but higher than the 10.5 times following the global financial crisis.

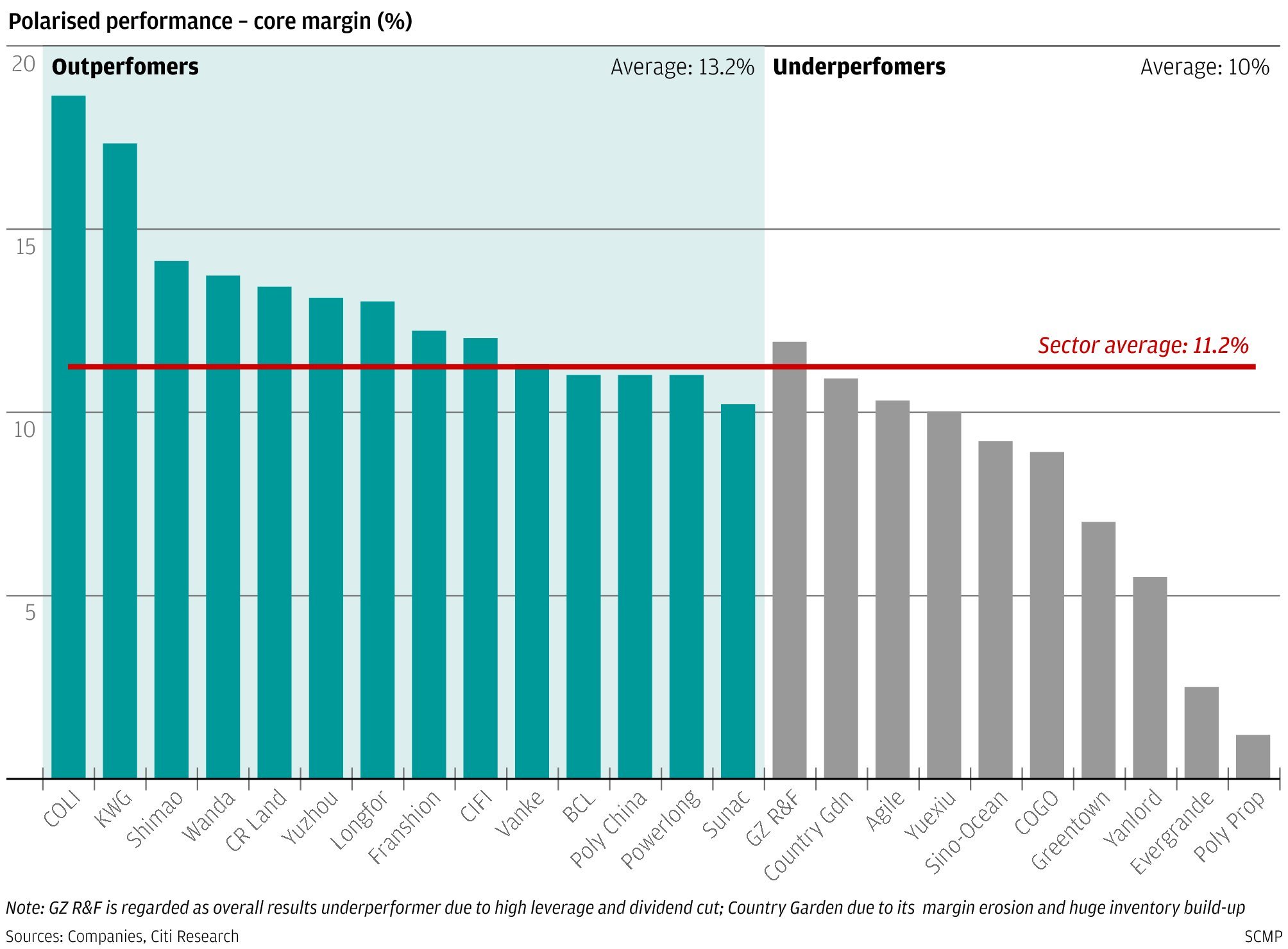

Citi Research said developers' business models divide the mainland property sector into two parts. The disappointing results of companies like Evergrande, Agile and Yuexiu among others showcase problems in the "old business model" of being asset-heavy, focused on low-tier cities, and with high debt and inventory. Without any turnaround, their outlook is gloomy.

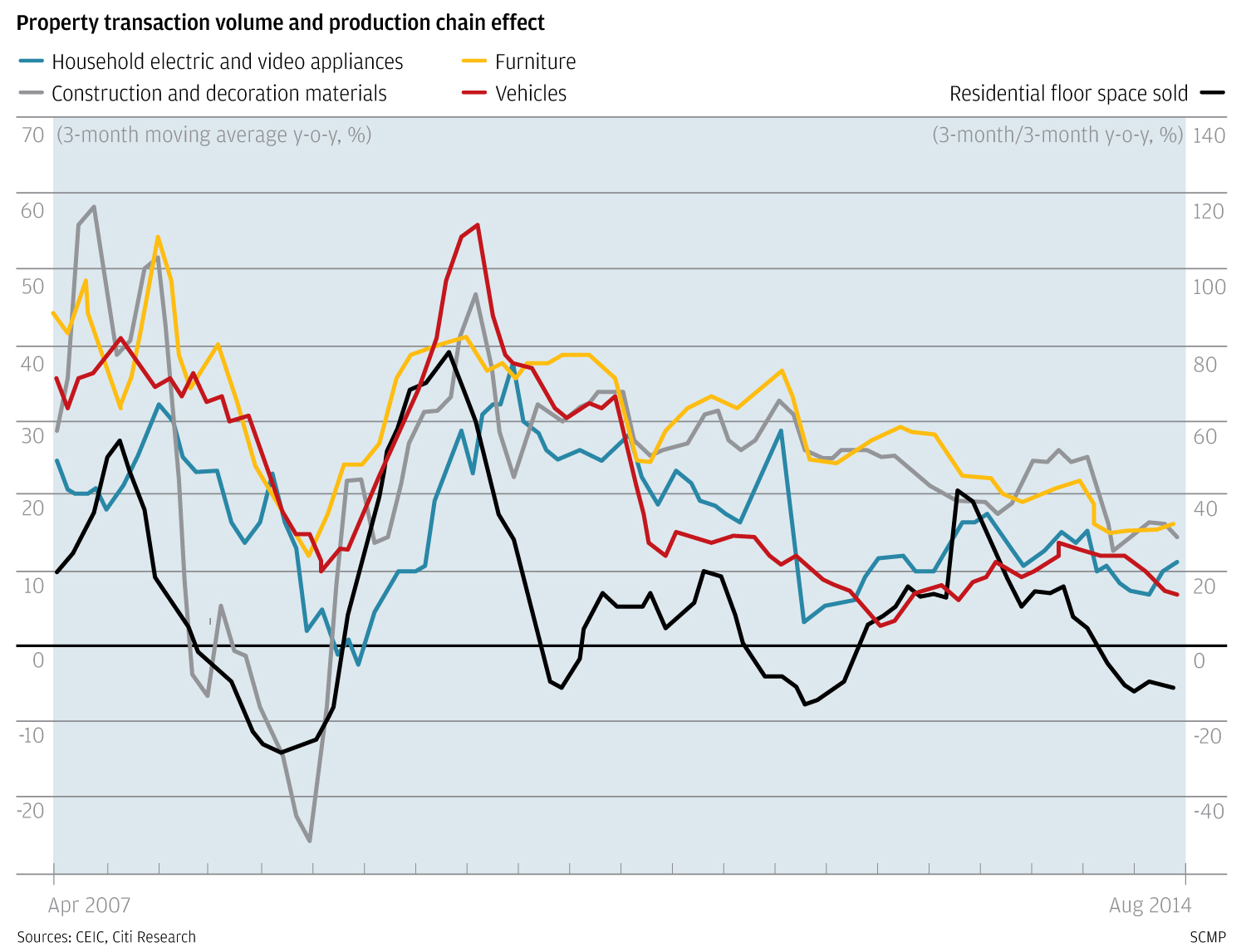

The impact on the production chain of the slowdown in the property sector is lagging the property cycle and has become evident since August.

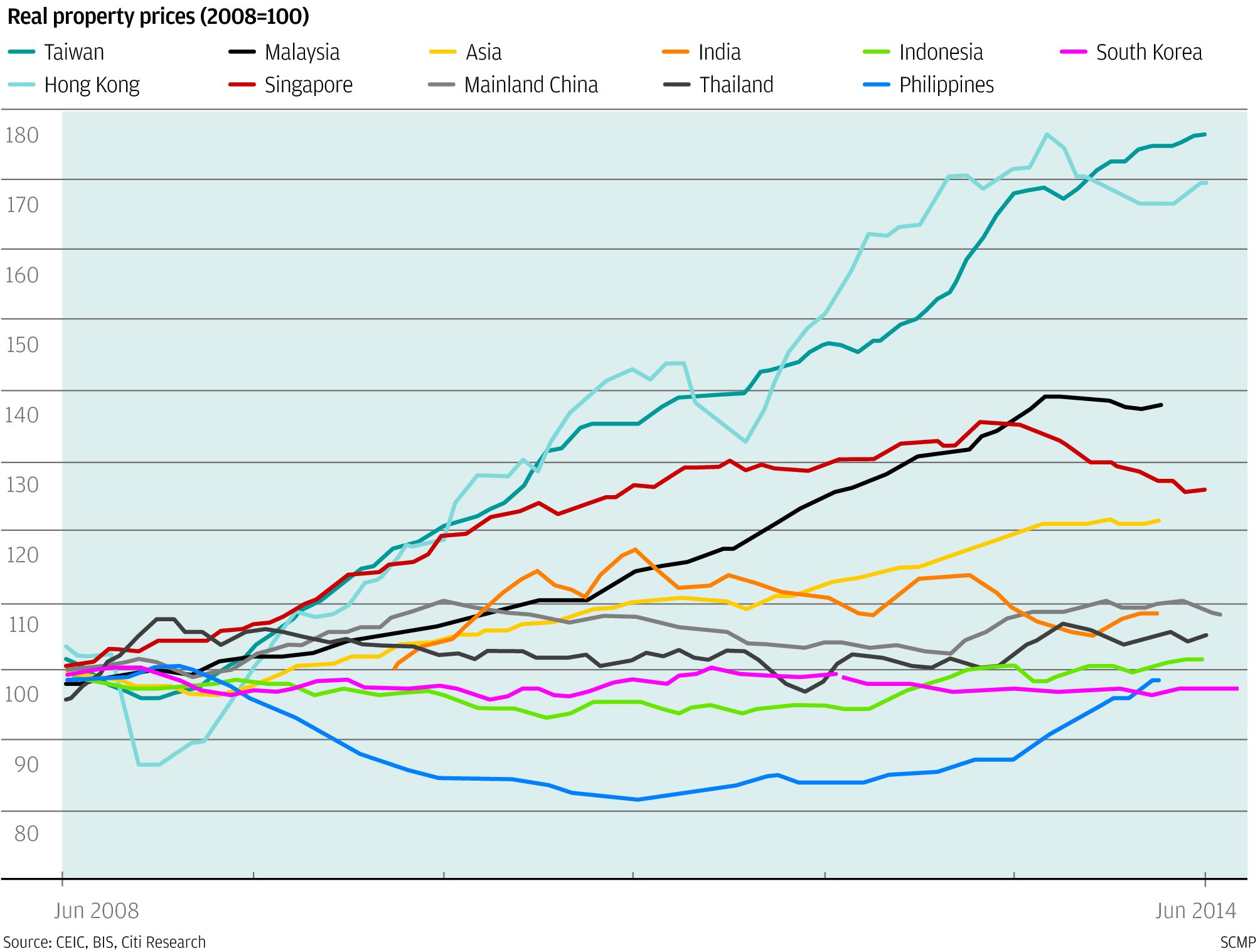

Taiwan, Hong Kong and Malaysia have seen the sharpest rises in property prices in real terms since 2008, though the latter two are down from their peak - in nominal terms, Citi says in a report.

Advertisement

Related Topic

Chart Book