Given high local government debt, low interest rates and a moribund property market, stimulus would be ineffective and wasteful. Beijing should reach instead for deregulation and supply-side solutions to fix the structural downturn.

Local governments’ reliance on a hot property market to sell land and cheap, available credit have been blamed for the bubble, but other factors have been at play. Even a property tax as low as 0.5 to 1 per cent could have helped prevent the bubble that is disrupting China’s economy from forming.

A deflationary force to its trading partners for a long time, China has kept inflation in check largely because of its pool of cheap labour. But urbanisation is slowing, population growth is collapsing and addressing rampant inequalities is on the government’s agenda.

Hit with multiple challenges including double-digit inflation, Turkey’s decision to protect domestic production over its exchange rates may be its most sensible choice. If the adverse impact of a lira slide can be mitigated with government support, so much the better.

Many officials believe China has dodged a bullet, given other nations’ experience with microfinance, which has failed to reduce poverty or increase incomes. Rather, they see a real solution in big industrial enterprises and big services platforms, and in supporting state-owned banks over microlenders.

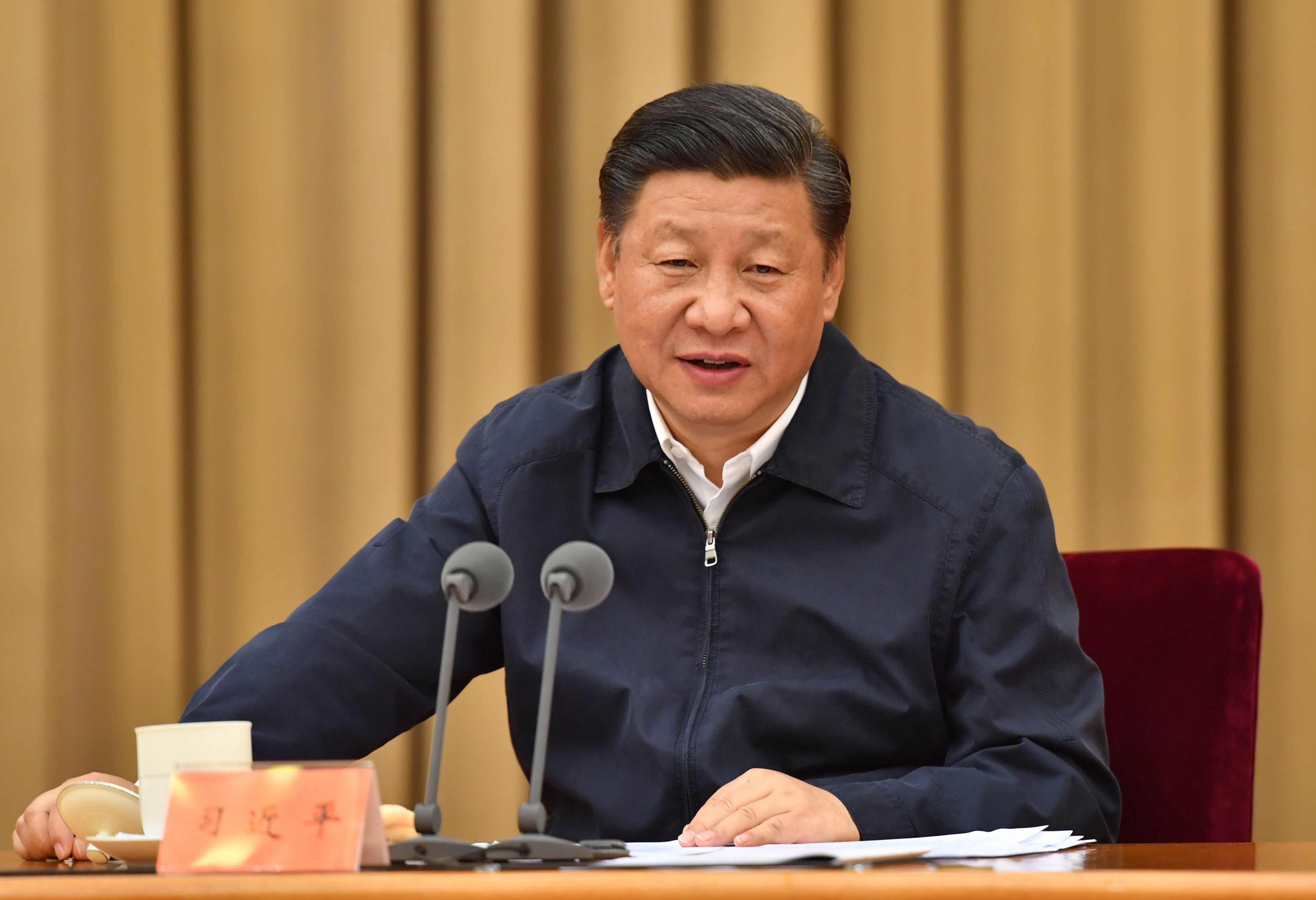

Wall Street investors surprised by Beijing’s regulatory changes have only themselves to blame for ignoring the signs. China is no democracy, but its policymaking process is transparent and follows a clear pattern, and its policies largely benefit the people.

The recently announced lower interest rate ceiling on non-bank credit will force lenders to vet borrowers more carefully. In the longer term, a debt amnesty could provide a clean slate upon which China could construct Western-style credit infrastructure.

Online lenders and other more traditional nonbank players are sinking further into trouble as a weakening Chinese economy takes its toll. Given the weak legal infrastructure, expect the fallout to hurt banks and destroy many nonbank financial institutions.

While senior officials stress the need to repay debt, the government has made it harder to creditors for recoup loans. Conflicting messages from the government and judiciary have emboldened irresponsible borrowers.

Despite the country’s many economic challenges, cushions of support exist to prevent a crash. Officials have the tools to act if a more aggressive rescue is needed.

Beijing has turned decisively towards more state control of the economy in the last decade, and public support for tighter regulations means capitalism may be in trouble.

As many of China’s online lenders fold, a key question is whether they should continue to exist alongside banks subject to interest rate controls.

All signs point to an economic slowdown in China, but warnings of a credit crisis are too simplistic

China's shadow banking is opaque, huge and fast-growing. In the past year, it has managed to cause two interbank crises, a few small-scale bank runs and several high-profile defaults and near-defaults of bonds.

It is too early to say if China has achieved economic success, even after 36 years of consistently high growth.

Despite the familiar refrain from analysts these last few years, China's real estate and credit bubbles have not burst. While I, too, am worried, I have not been brave enough to venture a prediction until now: I think the bubble will gradually deflate over a decade or two, rather than burst dramatically.

Within just six months, Yu E Bao, the partnership between the mainland's Alibaba and fund house Tianhong Asset Management, raised 250 billion yuan (HK$318 billion) from millions of little guys to invest in money market funds and treasury bonds.

China’s economic growth slowed in the final three months of last year to 7.7 per cent, the weakest quarter since 2009, but still way too fast to allow for the restructuring that the country urgently needs.

In an essay published in the Financial Times eight years ago, I said China's private sector was in the shadow of the state.

Every investor likes to think that he or she is a contrarian. The truth is that they are anything but.

Twice a year I travel to Jingmen in central China to visit my parents and siblings. Last week, I was there on a new mission: to review the work of my sisters as shadow bankers.