Jake's View | A hard time feeling the struggle amid boom times

Despite official cries of a slowdown, a quick calculation of the top three components of gross domestic product paint a very different picture

When the Hong Kong economy struggles along at a growth rate of barely one per cent, as the latest quarterly economic report says it is now doing, there is a distinctively pinched feel to things.

I have a hard time feeling it at the moment. Traffic clogs the roads as rarely before, shoppers clog the shops, property prices are at record peaks, expatriate parents are screaming about the lack of school places, and all around I see the usual signs of boom time.

Where is this slowdown?

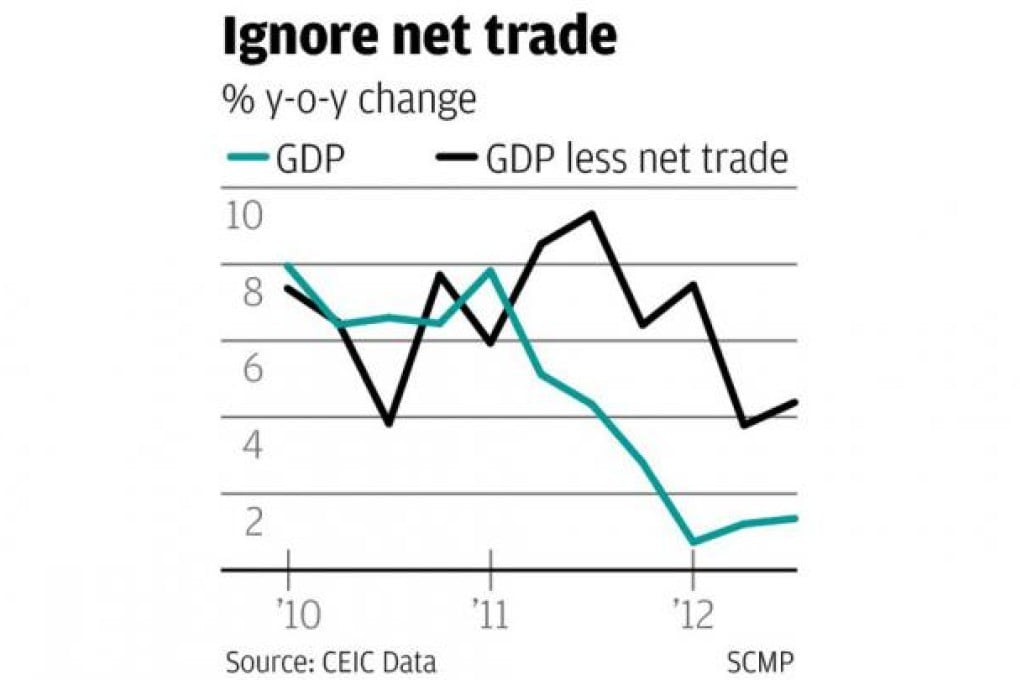

I suspect it exists in the statistics alone, and I can easily find a higher growth rate than the 1.3 per cent officially registered in the third quarter. Just add up the three largest components of gross domestic product (private consumption, public consumption and fixed capital formation). Together they account for about 97 per cent of GDP, and their combined growth rate in the third quarter was 4.3 per cent. As the chart shows, this figure has been consistently higher than the official growth rate since early last year.

The weak part of the total equation is net exports of goods and services, along with the related changes in inventories.

The fundamental reason that these trade figures pull down the official growth rate is that we insist on treating Hong Kong's foreign trade the same as any big country's, when what we actually have is anomaly piled on anomaly, and guesswork to make sense of them all.