Lai See | HSBC suffers the Taibbi treatment in Rolling Stone

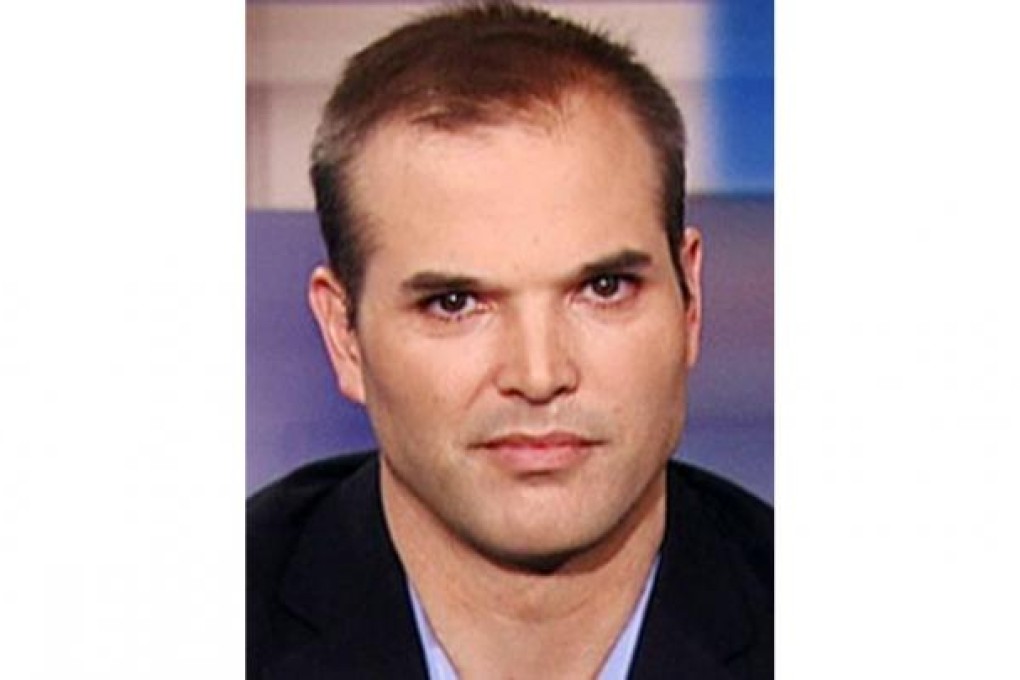

Matt Taibbi, the man who famously described Goldman Sachs as "a great vampire squid wrapped around the face of humanity", has turned his attention to HSBC in the latest edition of Rolling Stone magazine. Reflecting on the bank's recent encounter with the US Department of Justice over money laundering he wonders aloud why "despite a decade of stupefying abuse" it received a US$1.9 billion fine and no individuals were fined or went to jail. Much of his detail has already been recounted but Taibbi's inimitable style and moral indignation give his writing a force not found in many others' work.

For more than half a decade, he writes, the bank "helped wash millions of dollars for organisations linked to al-Qaeda and Hezbollah, and for Russian gangsters; and helped countries like Iran, Sudan and North Korea evade sanctions; and, in between helping murderers and terrorists and rogue states, aided countless common tax cheats in hiding their cash. "They violated every goddamn law in the book," says Jack Blum, a lawyer and former Senate investigator who headed a major bribery investigation against Lockheed in the 1970s that led to the passage of the Foreign Corrupt Practices Act. "They took every imaginable form of illegal and illicit business."

Taibbi mocks the justice department and HSBC as being "too big to go to jail". Why was this? "Had the US authorities decided to press criminal charges," said assistant attorney general Lanny Breuer at a press conference to announce the settlement, "HSBC would almost certainly have lost its banking licence in the US, the future of the institution would have been under threat and the entire banking system would have been destabilised."

Taibbi goes on to describe the bank's almost suicidal disregard of a stream of warnings from the US about its lax approach to money laundering, and a damning account of the bank's so-called expanded anti-money-laundering programme at New Castle, Delaware. There was no training, people hardly did any work, knew little if anything about money laundering and the bosses didn't seem to care.

It seems hard to believe this is our own warm, cuddly, socially concerned HSBC that is part of the fabric of Hong Kong. CEO Stuart Gulliver said in a statement after the bank's fine was announced in December: "The HSBC of today is a fundamentally different organisation from the one that made those mistakes." Hmmm - they always say that don't they?