Opinion | Pearl may be found in Oi Wah Pawnshop flotation if it turns into a shell

The stock market flotation of the Oi Wah Pawnshop chain may make little sense for shareholders except if it becomes a shell company

A pawn shop is going for a listing. That's interesting. Its shares have been over-subscribed 1,000 times. That is even more interesting.

Well, wait till you read the prospectus of Oi Wah Pawnshop Credit Holdings.

You see a teeny tiny business raising a teeny tiny sum for a teeny tiny expansion. You see a big why.

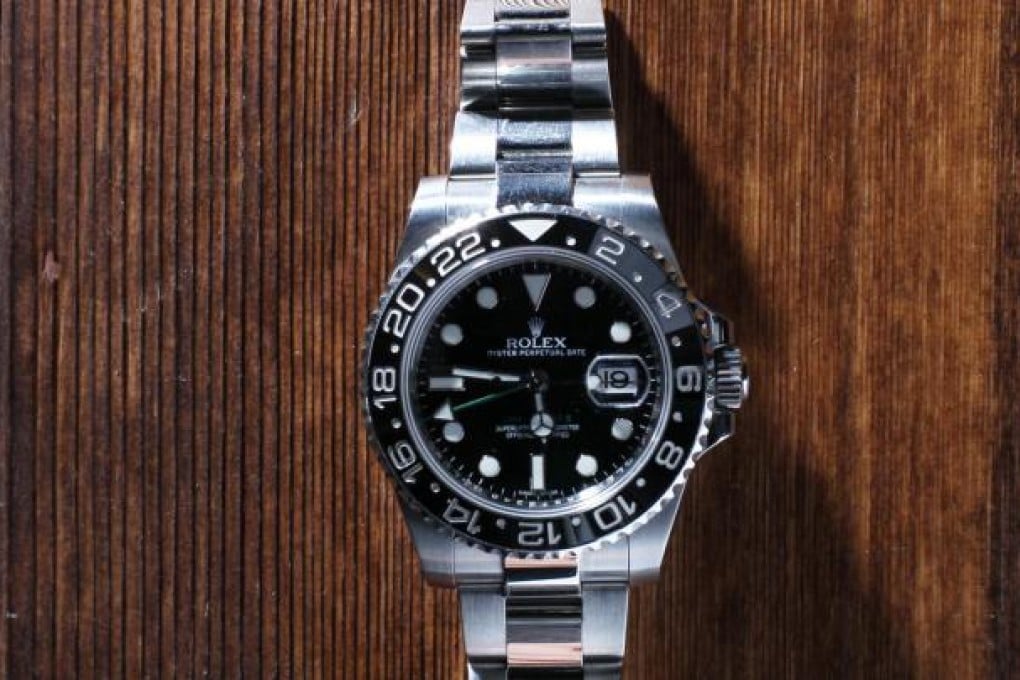

For the lucky ones who have never traded with a pawn shop, a brief explanation is necessary. Behind the little green doors is a guy who has just lost his shirt in a soccer bet. He pawned his Rolex watch for HK$$100,000 - the maximum allowed by law - to make another bet.

If he is lucky and wins, he would pay Oi Wah HK$103,500, the original loan plus the 3.5 per cent interest rate allowed by law, within a month to retrieve his Rolex. If not, the pawnshop will pocket the watch.

It is a juicy business, if tiny. Oi Wah, the largest in the industry, recorded HK$66.3 million in revenue and HK$33 million profit in the financial year 2012. That translates into a daily income of HK$15,136 for each of its 12 shops!