South Sea Bubble warning for wealth management investors

CBRC probe into pooled funds either good news or cause for concern institutions will hit problems repaying investors in existing products

In his classic , Charles Mackay detailed some of the investment absurdities of London's South Sea Bubble of 1720.

In one case, the prospectus for an initial public offering described simply "a company for carrying on an undertaking of great advantage, but nobody to know what it is".

It sounds ridiculous to us, but the issuer guaranteed investors they would make annual returns of 100 per cent. His office was promptly besieged by eager punters, and in the course of just six hours, he took subscriptions - and deposits - for £500,000 worth of shares. Today that would be worth HK$668 million.

It's easy to laugh, but many of the mainland savers currently queuing up to buy wealth management products from their banks have no more idea what they are purchasing than those 18th-century Londoners. Just like their forebears, they have been beguiled by offers of high returns.

So depending on your point of view, a report yesterday in the quasi-official that the China Banking Regulator Commission is to launch a major investigation into these products is either good news or deeply worrying.

Specifically, the CBRC is leaning on banks to stop pumping the money they raise selling wealth management products into common pools.

Typically the buyers of the products, which usually have maturities of just a few months, are promised an annualised return of 4.5 or 5 per cent.

That might not sound like much, but with inflation running at 3.2 per cent, it's a lot more attractive than the 2.6 per cent interest rate paid on three-month bank deposits.

Unfortunately, from the buyers' point of view there are big dangers when banks pool their money.

For one thing, savers have little idea what they are really investing in, which means they are unable to make informed decisions about the risks they are running. China Construction Bank, for example, recently offered one product saying only that between 30 and 70 per cent of the proceeds would be invested in debt.

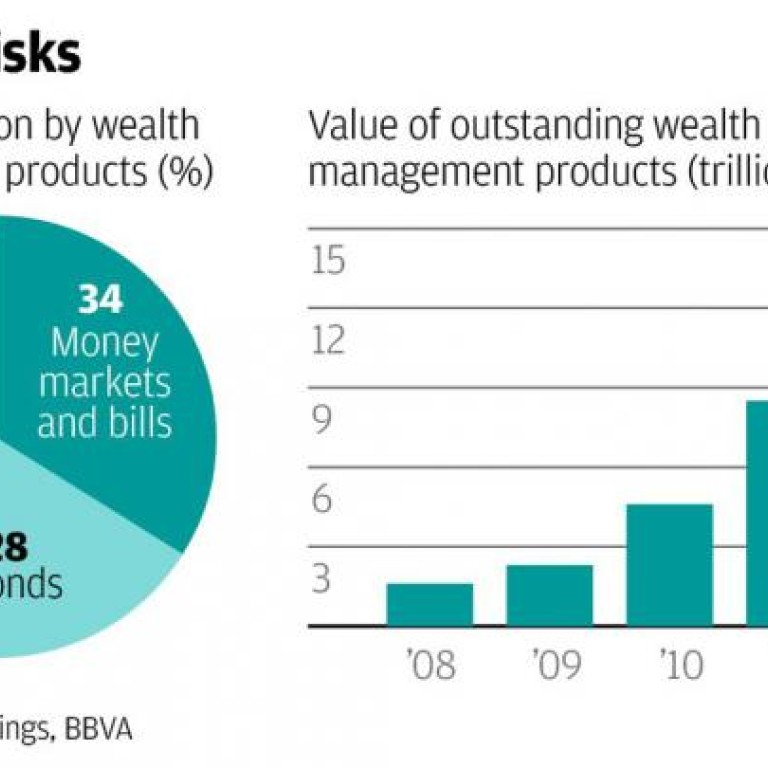

According to a study published last week by Spanish bank BBVA, around a third of wealth management product capital is invested in stocks and bonds, a third in short term money market instruments, and a third in "other" assets (see the first chart).

Other assets typically means investments structured by trust companies, which in turn means loans to local government-backed infrastructure and private companies which can't borrow directly from the banking sector.

The problem is that while the wealth products usually expire within three months, the trust loans are much longer term, typically three to five years. That means the banks have to rely on selling new pooled products in order to pay out investors as the older ones mature.

This is what makes the CBRC probe worrying. If the regulator enforces a ban against financial institutions pooling funds raised by new wealth management products, they will run into problems paying back investors in existing products.

And although many investors are under the impression they are guaranteed the return of their principal plus interest, in reality it is the buyers - not the sellers - who bear all the risk.

As a result, there is a danger an official probe could trigger a collapse in the market. With an estimated 13 trillion yuan (HK$16 trillion) of products, worth 25 per cent of China's gross domestic product, outstanding at the end of 2012 (see the second chart), the effect could be devastating.

It is likely many of those who structured and sold the products won't wait around to find out. As Mackay wrote of the issuer of that South Sea Bubble stock, "he was philosopher enough to be contented with his venture, and set off the same evening for the Continent. He was never heard of again".

Buyers of mainland wealth management products may just see their money vanish in a similar fashion.