Opinion | Sluggishness and high prices not only reasons for SOE losses

While state firms play the blame game, a look at their financial statements reveals the role of growing bills for staff and benefits

The managements of various state-owned enterprises have been blaming a sluggish global economy and falling prices for their multibillion-yuan losses and profit nosedives in the past two weeks.

A look into the financial statements of various non-financial companies in the past 13 years, however, shows that the problem is elsewhere.

It is inefficiency - as illustrated by the growing number of staff and rising costs - that has made the companies vulnerable to economic hardship. It is the same illness that Beijing has tried to cure by international listings of companies over the past two decades.

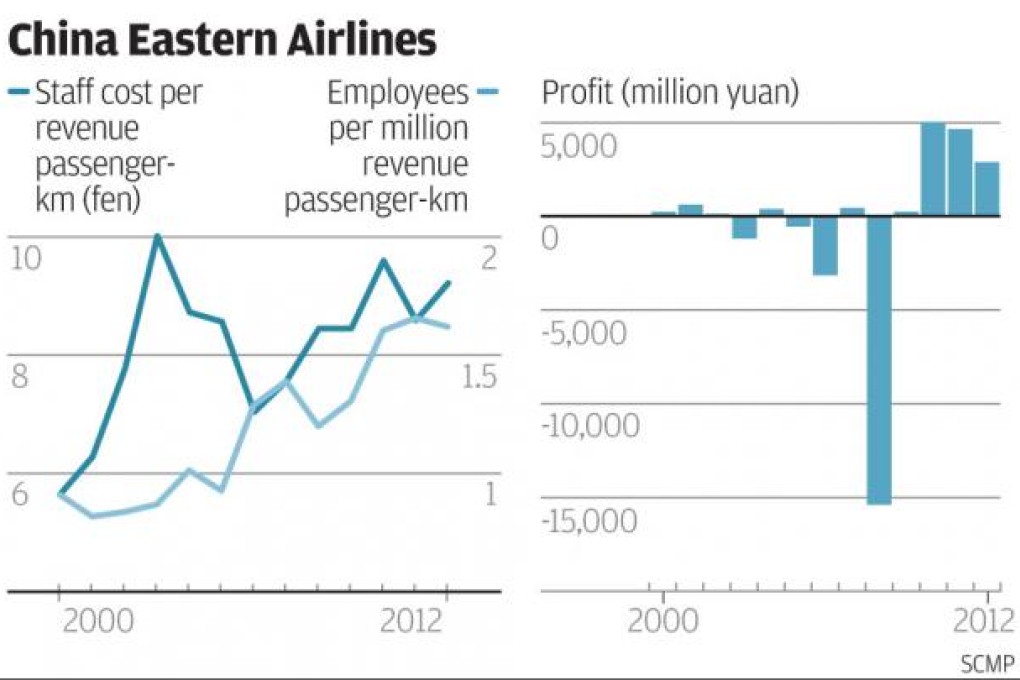

Let's look at China Eastern Airlines. It was listed in February 1997 - the first of its kind - to launch the country's reform of its aviation industry.

Yet, it was also the first to ask for a government bailout after the financial crisis. Between 2008 and 2012, it received a total of 103 billion yuan in capital injections from the government - the largest ever - to repay debt.

Last year, China Eastern saw its profit drop 37.7 per cent to 2.8 billion yuan (HK$3.46 billion). The management blamed it on the slow economy, rising fuel prices and high finance costs.