Monitor | The indebted consumer's guide to growth in China

Growth rate of increase in loans key to fuelling country's economic pace but the credit-driven model is clearly not sustainable

Earlier this week, Monitor described the divergence between Chinese credit creation and economic growth as "puzzling".

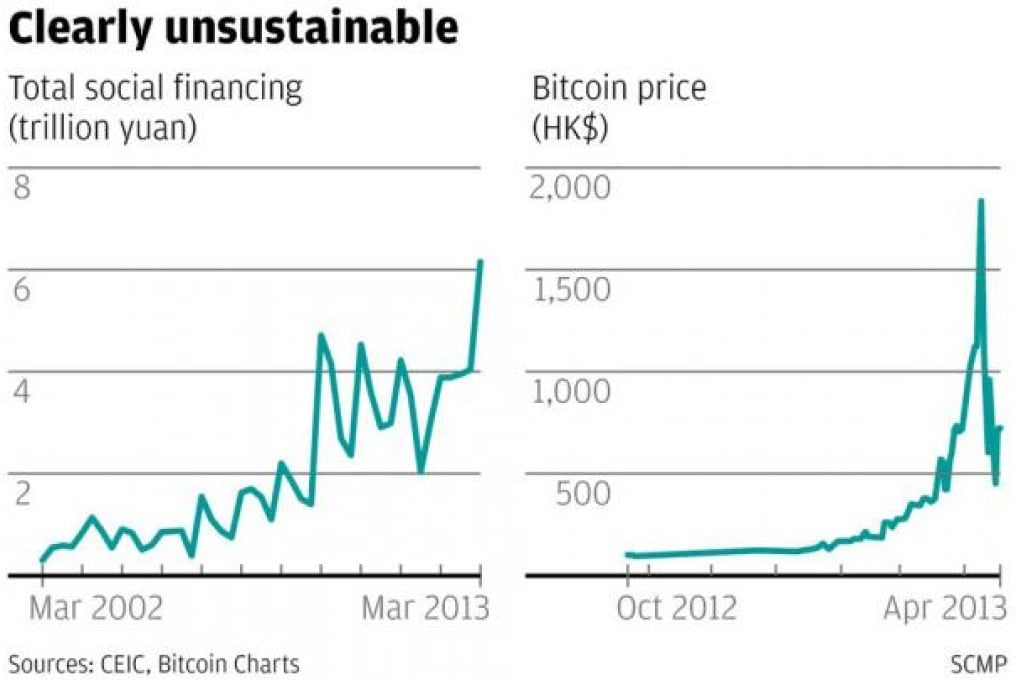

In recent months, China's financial system, including its shadow banking market, has been making new loans at a blistering pace. In the first three months of this year, total social financing - Beijing's broadest measure of credit creation - expanded by a record 6 trillion yuan (HK$7.5 trillion).

Yet economic growth has remained lacklustre. In the first quarter, China's gross domestic product grew at a year-on-year rate of just 7.7 per cent; a feeble performance by China's turbo-charged standards.

Normally, you would expect some time lag between credit creation and a pickup in economic activity, but as Goldman Sachs economist Andrew Tilton pointed out in a research note last week, the link between credit and growth is more subtle than simple cause and effect.

For one thing, it is not the amount of outstanding credit that affects economic growth, nor even the rate at which credit is growing. According to Tilton, it is the rate at which credit growth itself is growing which drives growth in China.