High time to reconsider your yuan investments

Beijing to come under pressure to devalue if the US dollar jumps, which may happen as quantitative easing is increasingly seen as a success

Unnerved by the volatility in financial markets last week, two readers asked whether it was time to get out of their yuan-denominated investments.

At first it might seem strange that an abrupt correction in the Japanese stock market, which fell 7 per cent on Thursday, should prompt people to question the outlook for the yuan, which has climbed 2 per cent against the Hong Kong dollar so far this year and offers a superior yield.

But look more closely at what's been going on in financial markets and it becomes clear our readers are asking an excellent question.

Although commentators have pointed their fingers at half a dozen possible triggers for last week's slump in Japanese stock prices, the underlying reason for the fall was that a correction was long overdue, given it had shot up 67 per cent in just six months.

Behind the scenes, however, the doubling of Japanese government bond yields over the last six weeks indicates a growing belief among investors that the Bank of Japan's money printing efforts will succeed in weakening the yen enough to lift Japan out of deflation.

In other words, people are now accepting that competitive devaluation works.

Similarly, in the United States more investors are waking up to the idea that the Federal Reserve's quantitative easing programme may finally be succeeding, and that as a result it will be wound down at some point in the foreseeable future.

This view was reinforced last week by Fed chairman Ben Bernanke, who told a congressional committee that the Fed could begin to scale down its bond purchases over the next few months.

This apparent vindication of quantitative easing is likely to have two parallel effects.

First, as the US economy strengthens and the Fed winds back its ultra-loose policy settings, capital outflows will diminish and inward investment will pick up.

Second, the US example will encourage central banks elsewhere, notably in Europe and Japan, to keep their own printing presses running in an effort to weaken local currencies and kick-start recovery. The result is likely to be a rise in the value of the US dollar, especially against the currencies of Japan, Switzerland, Britain and commodity-heavy economies like Australia.

With the US dollar already up by 6 per cent since January against a trade-weighted basket of currencies, last week foreign exchange analysts at Morgan Stanley announced the start of a new US dollar bull market.

Their opposite numbers at HSBC declared that "we have entered a US dollar bull environment".

"Taken to the extreme, it means the US dollar may become the most over-valued of currencies," the HSBC analysts added.

If the US dollar does surge in value, the Hong Kong dollar must climb too, thanks to the city's currency peg.

The authorities on the mainland, however, will be quick to reassess their policy settings.

Over the last six months they have allowed the yuan to strengthen against the US currency. Unfortunately that strength has only encouraged more hot money inflows, putting yet more upward pressure on the currency.

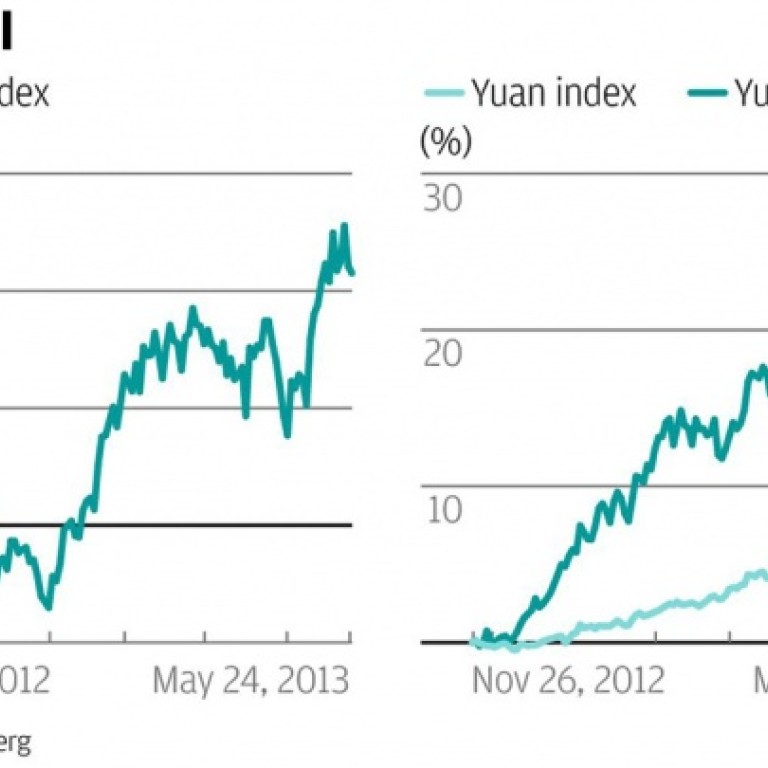

As a result, the yuan has appreciated by 9 per cent against its own trade-weighted basket of currencies, and 25 per cent against the yen.

If the US dollar now continues to appreciate, and other major currencies fall, the authorities in Beijing will grow increasingly concerned about China's loss of trade competitiveness.

As independent research house Capital Economics warned last week, "there is a good chance that policymakers will halt or even reverse the [yuan's] recent gains".

So, yes, it may well be high time for our concerned readers to consider getting out of the yuan.