Official manipulation adds 10 per cent to China's GDP

Study gives the lie to the economy-wide inflation rate, argues that housing costs are understated by Beijing's statistical agency

Analysts have always suspected Beijing's statisticians manipulate China's economic data to come up with growth figures that are acceptable to the country's leadership.

Above all, they believe that the National Bureau of Statistics systematically understates China's economy-wide inflation rate.

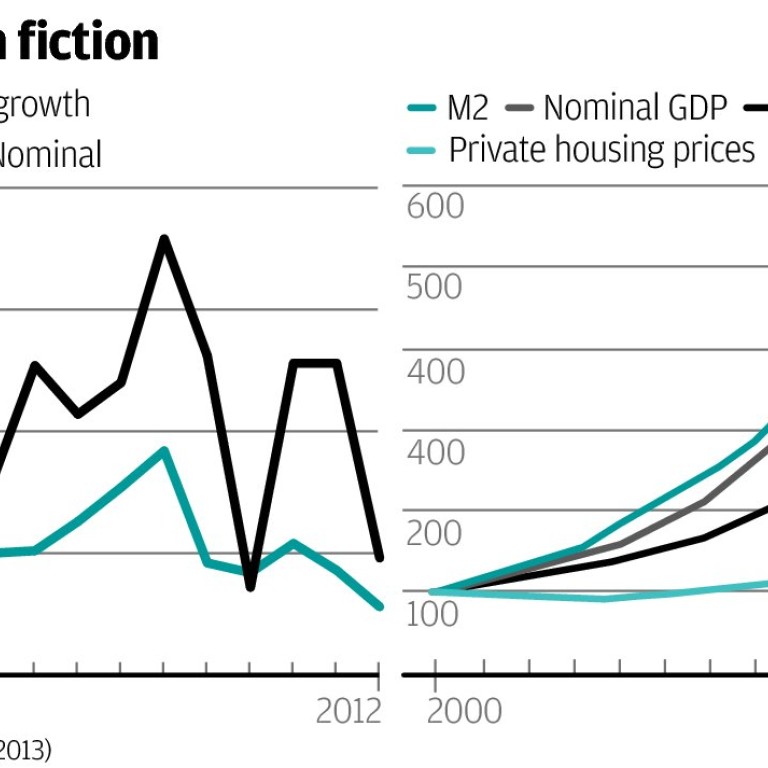

As a result, when Beijing's bean counters correct the raw data for nominal gross domestic product to adjust for inflation, they come up with a figure for China's real growth rate (see the first chart) that is anything but real. Instead it is too high.

Suspicion - even strong suspicion - comes easily. But working out exactly how officials tweak the data, and estimating the size of the resulting discrepancy between appearance and reality, is altogether trickier.

Now a new study by Christopher Balding from the HSBC Business School at Peking University sheds some welcome light on just how the data is manipulated.

Balding argues that housing costs - usually a major item in any country's consumer price index inflation basket - are both understated and underweighted by China's statistical agency.

He points out that, according to the official data, between 2000 and 2011 Chinese house prices rose by just 8 per cent. Urban prices climbed just 6 per cent.

As Balding notes, the modesty of this increase stretches credulity to the limit, especially over a period during which China's nominal GDP quintupled and its money supply expanded sixfold (see the second chart).

"The claim that the housing component of CPI grew by less than 10 per cent between 2000 and 2011 is nothing less than comical," he writes.

Compounding the error, officials assume that 80 per cent of the population live in China's cities, where they say property prices have risen more slowly than in rural areas.

In reality, some 48 per cent of people still live in the countryside.

And then to cap everything, housing barely contributes to the official inflation figures. Between 2000 and 2010, housing costs made up just 13 per cent of China's official consumer inflation basket.

In 2011, the weighting was raised to 17 per cent. But even that looks unjustifiably low. In Hong Kong, for example, housing costs make up 32 per cent of the composite consumer price index. The consequence of this statistical trick is that China's inflation figures are too low, and so the economy's real growth numbers are too high.

In an attempt to estimate the degree of error, Balding has recalculated China's economy-wide inflation figures under a set of different assumptions.

In one scenario, he assumed housing costs rose at least as fast as rents. In another, he based housing costs on third-party data showing that property prices have risen some 60 per cent over the past five years.

And for added verisimilitude, he reweighted housing costs in China's inflation basket to a more realistic 20 to 30 per cent.

His results show that economy-wide price levels today are likely to be about 10 per cent higher than China's implied GDP deflator index indicates. Taking the third-party price data, and assuming a 30 per cent housing cost weighting, the deviation could actually be as high as 16 per cent.

Applying this correction to China's output data, argues Balding, reduces China's real GDP by between 8 per cent and 12 per cent, knocking about 5 trillion yuan (HK$6.3 trillion) off 2012's figure.

"It is disturbing that a statistical body would so obviously manipulate and produce blatantly fraudulent data," Balding writes.

"Given the relative ease with which obvious statistical manipulation was found, it is quite likely that less obvious fraud is present.

"It seems likely that much larger revisions to Chinese real GDP and other economic data are needed to produce more reliable statistics."