Monitor | Less toxic than before, but Cinda still isn't a great buy

Amid suspicion over bad-debt warehouse Cinda’s balance sheet, it seems to have been repaying its bonds, presumably with help from Beijing

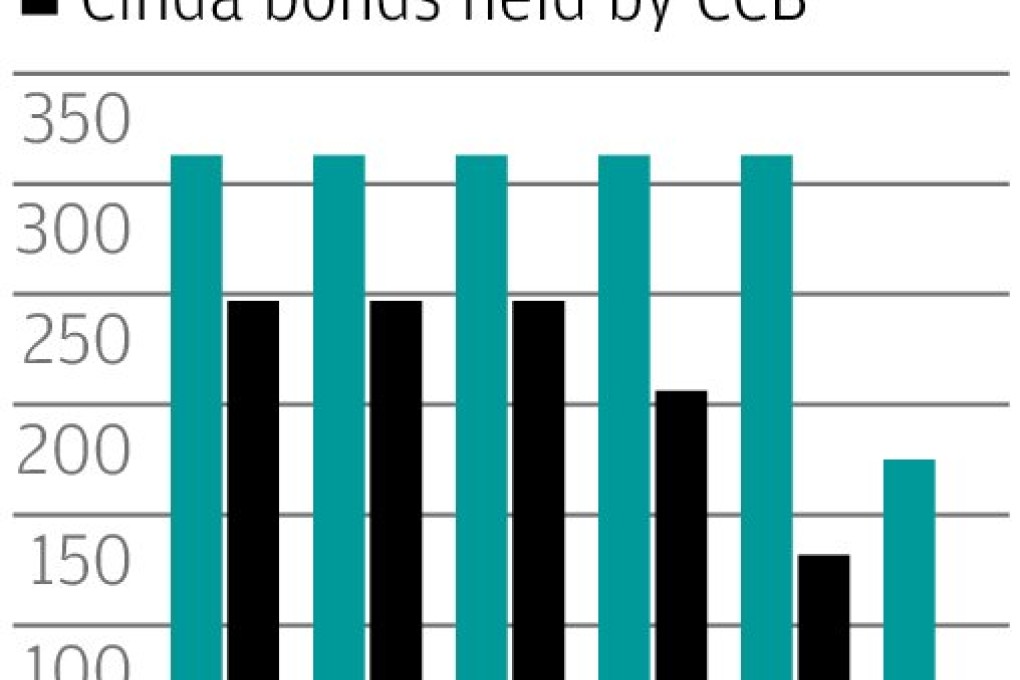

I am grateful to the reader who wrote in response to yesterday's Monitor, drawing my attention to the note concerning "debt securities classified as receivables" on page 133 of China Construction Bank's 2012 annual report.

In case you missed it, yesterday's column looked at the HK$15 billion initial public offering being lined up for China Cinda Asset Management.

One of the four bad debt warehouses set up by the mainland authorities 14 years ago to shift trillions of yuan in non-performing loans off the balance sheets of state banks, Cinda has been restructured over the past few years.

When the deal hits Hong Kong's market in the coming months, the company will be sold to investors, not as a dump for toxic financial waste, but as a profitable universal financial services group with a robust balance sheet.

It looks as if the Finance Ministry must be wiping out Cinda’s liabilities ahead of its listing

Monitor, however, doubted how clean Cinda's balance sheet really is. Although its worst assets were spun off into a separate fund in 2010 in return for Finance Ministry IOUs, yesterday's column questioned the value of these IOUs.