Monitor | Investors need to get real about China's slowdown

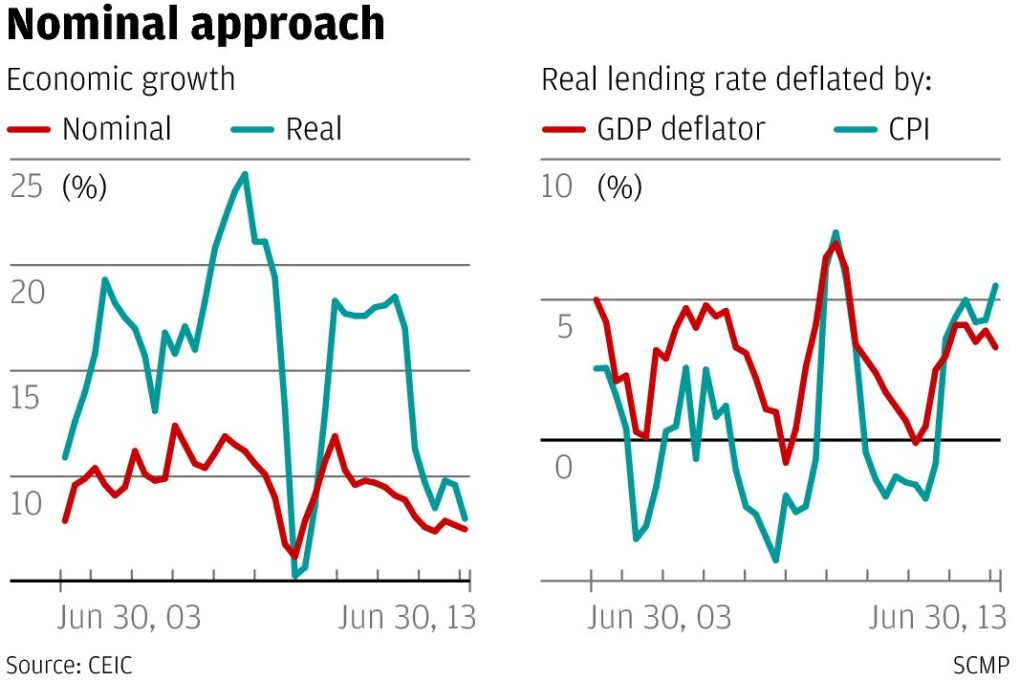

A steep fall in nominal growth will erode profits at companies at a time when sales growth is declining and tighten liquidity for corporate sector

Over the past few weeks, as the trickle of data from the mainland has turned slightly more positive, investor sentiment towards the world's second-biggest economy has perked up.

With industrial production picking up, liquidity easing and activity in the property market recovering, optimism is growing among analysts that the mainland's economy has bottomed out and is poised for a rebound.

With mainland stocks now looking cheap relative to other markets, a few brave fund managers are even talking about a handsome buying opportunity.

They may be just a little too courageous. It is true that at first glance the mainland's economic slowdown appears relatively modest. After all, growth only dipped to 7.5 per cent in the second quarter, down from a 10-year average of 9.6 per cent.

Because of the build-up of excess capacity, companies have enjoyed little pricing power

A drop of just over two percentage points hardly looks like the end of the world. But the apparent shallowness of the slowdown is misleading.