Monitor | Five years later, what has the mini-bond scandal taught us?

While rules for sale of complex products have been tightened, the same forces are at work that saw investors ramp up risks for better returns

It took a few days for Hong Kong to realise that the September 2008 implosion of Lehman Brothers had created a very specific local problem.

Tens of thousands of ordinary Hong Kong savers had spent some HK$20 billion on "mini-bonds" issued by the bust investment bank. With its collapse, the value of their investments fell to zero.

Much of the following three years was taken up with bitter accusations of mis-selling and inadequate regulation.

Yet five years after Lehman's bankruptcy, with new and tighter investor protections now in place, it is questionable how much investors, bankers and regulators have really learned from the whole fiasco.

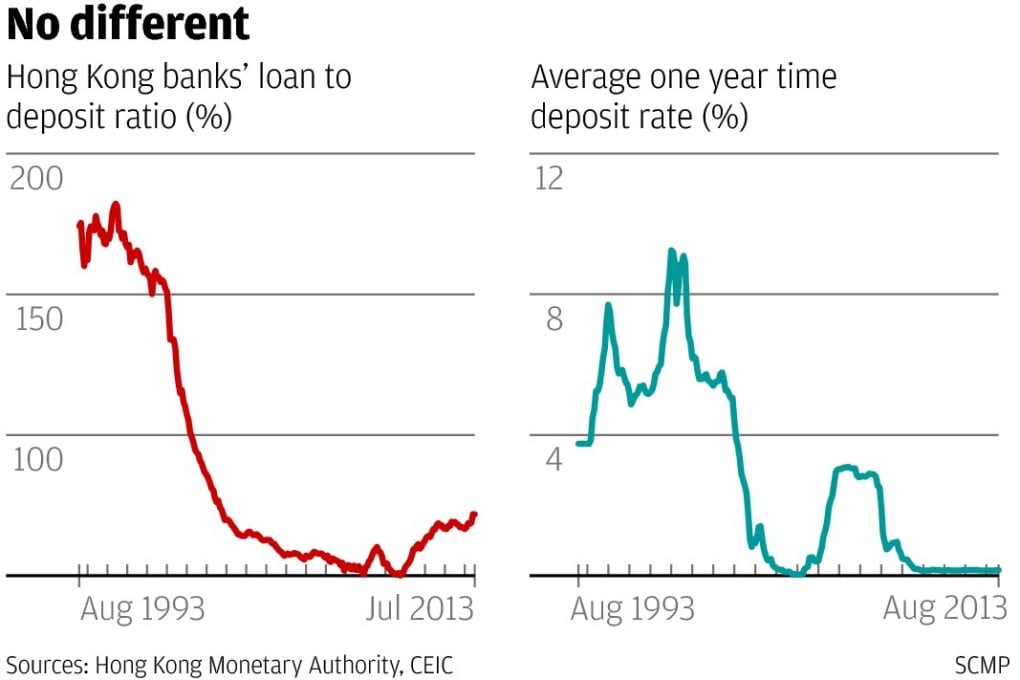

With deposit rates low, banks and their customers are as willing as before to run extra risks

In case you've forgotten, or if you were lucky enough never to know in the first place, Lehman's mini-bonds weren't bonds at all. The name was intended to inspire confidence, but in reality they were credit-linked notes assembled using complex derivatives.