Allowing free capital flows is fast going out of fashion

The world is increasingly moving away from economic orthodoxy and accepting that capital controls are necessary to contain hot money

Hopes are high that when Premier Li Keqiang launches Shanghai's new free-trade zone this weekend, he will announce a major opening up of the mainland's financial system.

But if Li is indeed planning a big relaxation of Beijing's strict controls on cross-border capital flows, he will be swimming against the tide of international economic thought.

For decades economic orthodoxy dictated that emerging economies should open up their financial systems.

Any backsliding was roundly condemned, as in 1998 when in the depths of the Asian currency crisis Malaysia banned free capital flows to stabilise its currency, the ringgit.

Recently, however, orthodox opinion has reversed.

In the future, capital controls could prove not just useful, but essential, for some markets

Consider the Damascene conversion of Stanley Fischer. Between 1994 and 2001, as first deputy managing director of the International Monetary Fund, Fischer was closely associated with the Fund's hardline opposition to capital controls.

But as governor of the Bank of Israel between 2005 and this June, he found himself taking a different view of the merits of unrestricted capital flows.

As the US Federal Reserve eased policy in response to the 2007 credit crunch, capital flooded into international markets, pushing the shekel up by 25 per cent in a matter of months. With such rapid appreciation threatening to push Israel into recession, Fischer cast around for a way to slow the inflows.

Deterring flows with taxes or regulations wasn't feasible at short notice. "In practice we relied mostly on intervention," he says.

The experience was educational. "Short-term capital flows are frequently more of a hindrance than a help," he admits. "There is a case for trying to moderate their influence."

Fischer isn't the only one to revise his views. In 2010, the Asian Development Bank said members should consider imposing capital controls to stop inflows of hot money fuelling asset bubbles and inflation.

"Market intervention may help," she told central bankers last month, adding that in the past "capital flow management measures have been useful".

In the future, capital controls could prove not just useful, but essential, for some markets.

Although most Asian economies are in a much stronger position today than ahead of the Asian currency crisis, CLSA strategist Russell Napier notes that some Eastern European markets are looking dangerously exposed.

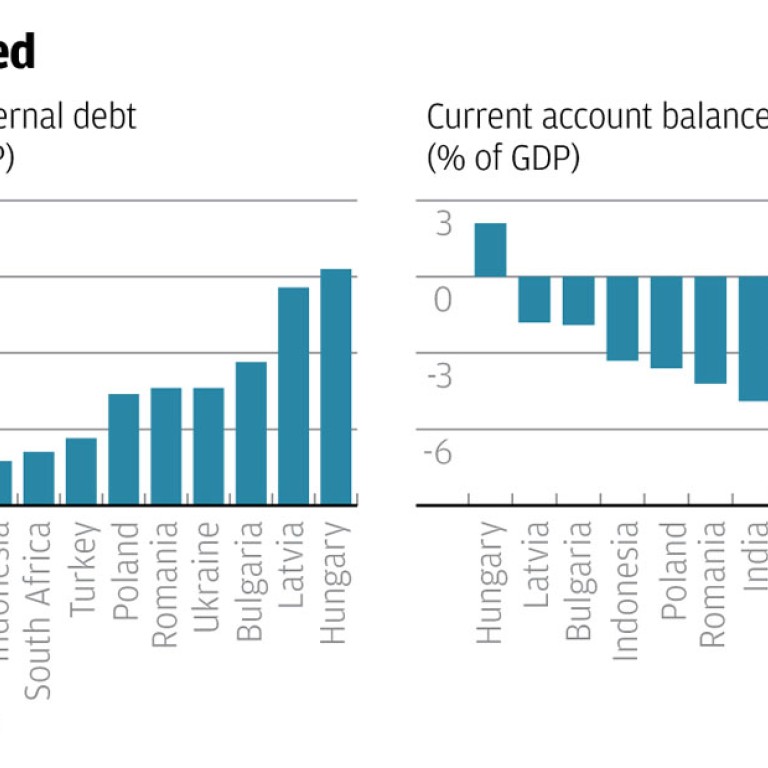

Many are running gross external debts well above the danger level of 30 per cent of gross domestic product, while economies including Hungary and Bulgaria have foreign debt ratios comparable with Thailand or Indonesia in 1997.

Worse, much of their foreign-owned local currency debt is held by open-ended funds. Losses triggered by rising yields as expectations of tapering take hold could prompt a wave of redemptions, Napier warns.

With East European markets largely illiquid, any redemptions could spread contagion to relatively healthy markets in Asia as fund managers sell whatever assets they can to meet investors' cash calls, he says.

Faced with a rapidly spreading crisis, governments would be quick to impose controls on capital outflows. "The free movement of capital is too disruptive," he says. "It will have to be stopped."

Napier's crisis call is unusually bearish. But his belief that developing economies will impose capital controls to manage outflows is increasingly mainstream.

China, of course, already has such controls. Given the international trend, Li Keqiang may well conclude this is no time to dismantle them.