Monitor | Watsons float little reason for Hutch investors to celebrate

Proceeds from a possible AS Watson listing would be more likely to end up in Europe than in Hutchison Whampoa shareholders' hands

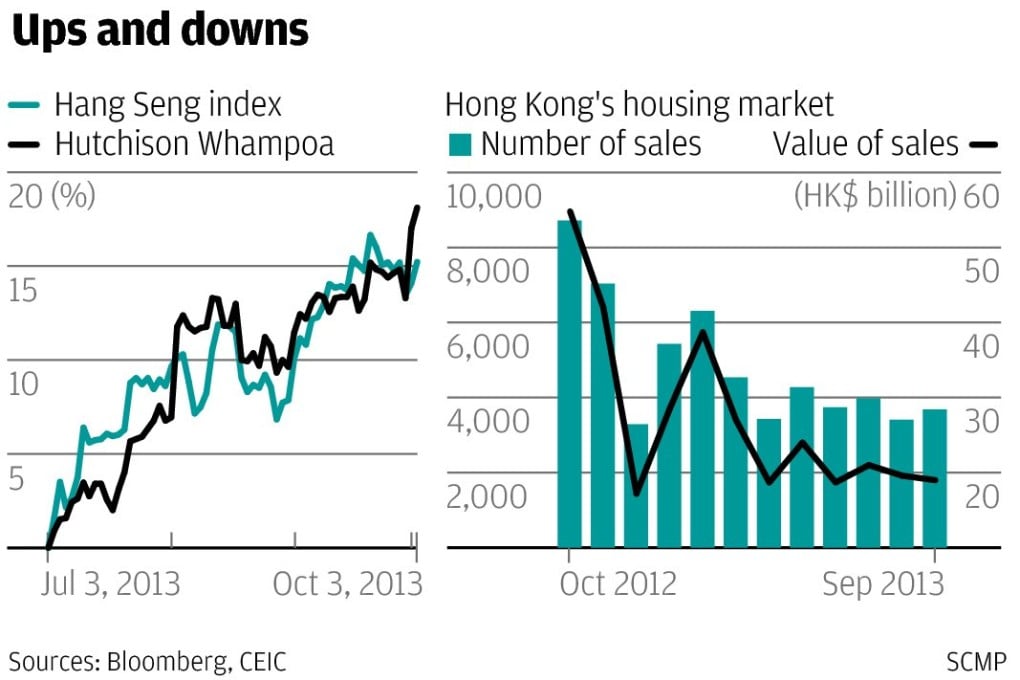

Shares in ports-to-telecommunications conglomerate Hutchison Whampoa have jumped 4.25 per cent in the last two days on the rumour that controlling shareholder Li Ka-shing is planning to float the company's retail business.

The positive reaction is no surprise. Like Asia's other family-run conglomerates, Hutch as a whole has long traded at a deep discount to the value of the sum of its parts.

Even after the upward pop of the last couple of days, the company's shares are still trading at a discount to their net asset value of some 30 per cent.

Now, with the prospect of an initial public offering for Hutch's retail subsidiary AS Watson, investors hope they might realise their long-cherished wish that a series of spin-offs will finally allow them to realise the full value of their shareholdings.

They are likely to be disappointed. Whether floating Watson could help Hutch to narrow its discount to net asset value would depend on what Li and his lieutenants decide to do with the proceeds.