Monitor | The HK$1 trillion reason to keep Hong Kong's US dollar peg

Logic of switching to a yuan anchor doesn't stand up when that currency isn't freely convertible and its offshore liquidity is shallow

Predictably, the 30th anniversary of Hong Kong's exchange rate peg has prompted calls for the city to ditch its link to the US dollar, and switch to a peg to the yuan.

Alas, the people making these calls have failed to think things through. To abandon the US dollar link would be to court financial disaster.

Critics say the peg may have made sense in 1983, when Hong Kong's economy was still based on manufacturing for export.

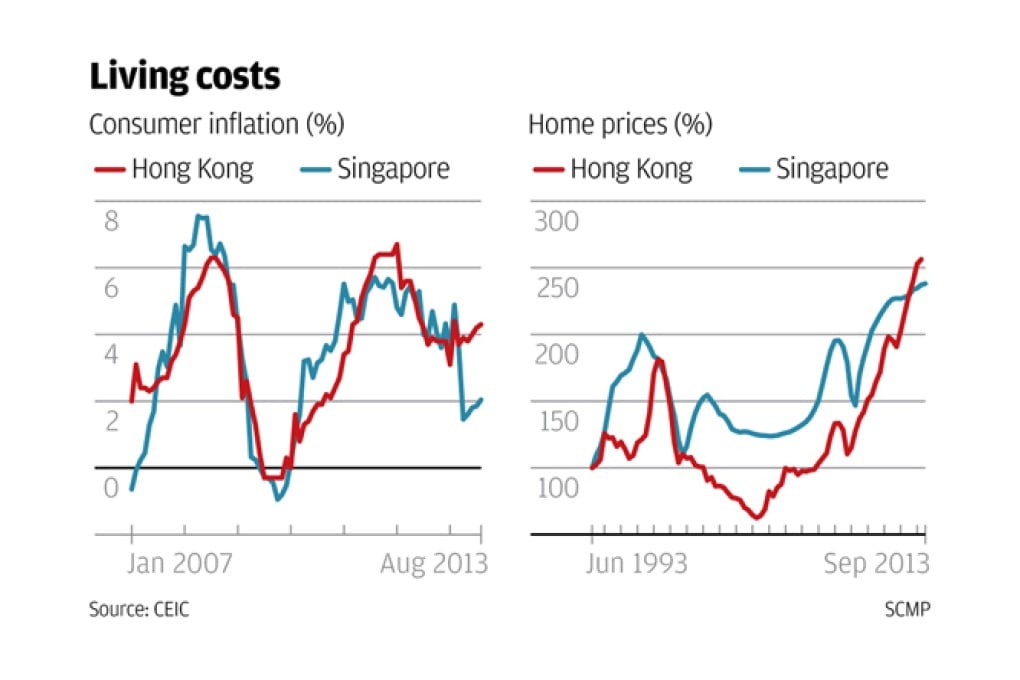

But today they blame the link to a weakened US currency for consumer inflation and sky-high property prices, as low interest rates and heavy liquidity inflows have pushed the cost of a typical flat up to more than 13 years of median household income.

With US financial credibility undermined by incessant political squabbling, Hong Kong's economy tied ever more closely to mainland China and the yuan growing rapidly in international importance, it is high time the city switched from a US dollar to a yuan peg, they argue. It sounds, at first, like a reasonable suggestion. But the arguments for getting rid of the peg don't stand up to scrutiny.