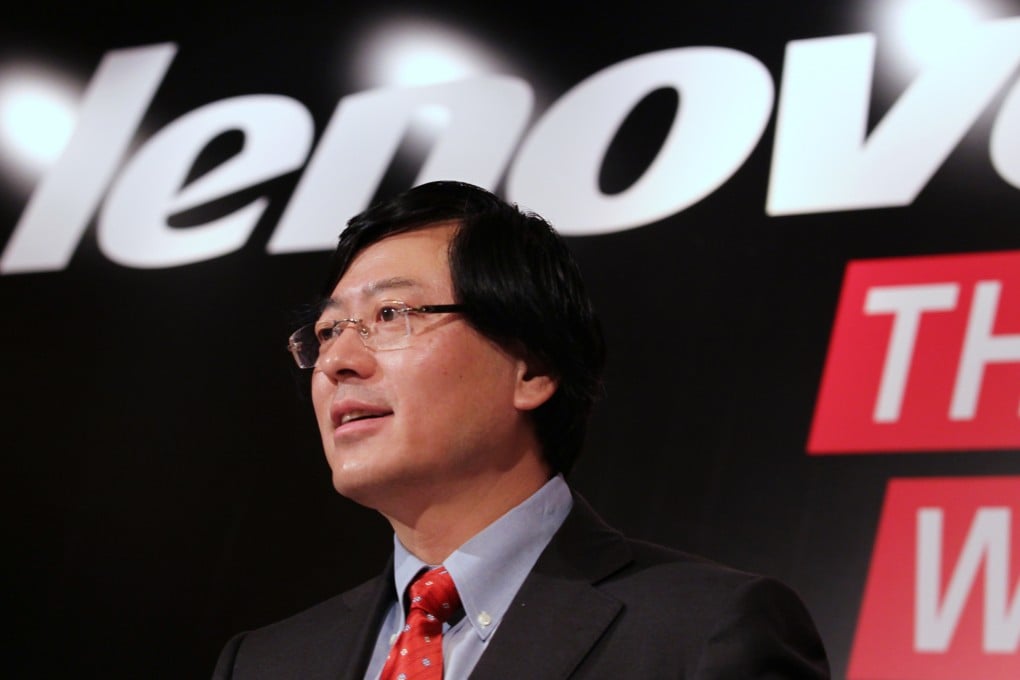

Opinion | Lenovo, Tencent directors lead rush to unload shares

Fantasia ramps up buy-back despite rally in stock price, while overall buying remains strong

Selling by directors surged last week, with 18 firms reporting 75 disposals worth HK$478 million, up from the previous week's nine companies that reported 43 disposals valued at HK$96 million.

Buy-back activity remained high, with nine companies posting 32 repurchases worth HK$432 million, consistent with the previous week's eight companies and 35 repurchases, but the value soared from HK$148 million.

The surge in buy-back value was led by Fantasia, which picked up 220 million shares worth HK$336 million from November 18 to 22 at an average of HK$1.50 each.

The trades were significantly more than the 93.7 million shares worth HK$135 million that the property developer bought back from October 28 to November 15.

Even more surprisingly, the company ramped up its buy-back activity despite a 25 per cent gain in the share price since October 28 from HK$1.25 to a high of HK$1.56 last week.