Market is puzzled over Evergrande's HK$6.8b share buyback spree

Evergrande management has a fair question to answer: How do all these corporate moves reconcile with prudent financial management?

Some mainland soccer fans have questioned billionaire Hui Ka-yan's spending of hundreds of millions of yuan on German, Italian and Brazilian players for his champion team.

But when the country's top leader, Xi Jinping, is a huge soccer fan - posing for pictures with David Beckham and publicly dreaming of China making the World Cup finals - that's probably not worth debating too much.

More puzzling is the HK$6.8 billion Hui's listed firm, Evergrande Real Estate, has used in supporting its share price.

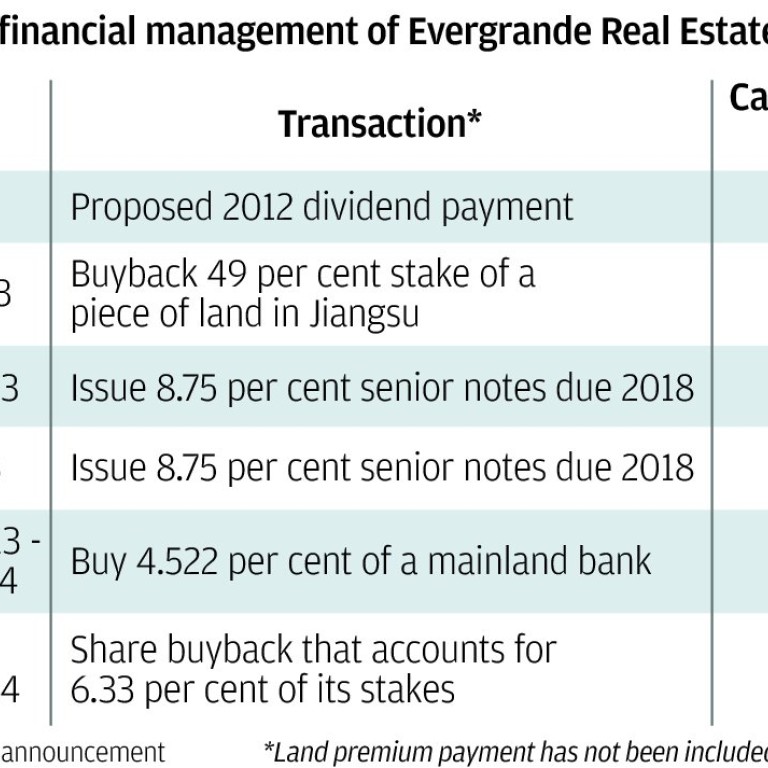

The Guangzhou-based developer has forked out HK$3.8 billion in the past two weeks to buy back about 6.33 per cent of its shares. That is on top of a surprising 2.3 billion yuan (HK$3 billion) special 2012 dividend paid in November.

Let's put that into context.

Dividend payments and share buybacks are for companies with lots of cash and nothing better to do with it. Evergrande is far from that.

It says its net borrowing to equity ratio has dropped from 96 per cent to 58 per cent, but analysts put the ratio at 110 per cent after taking out all the extraordinary adjustments. The industry average is 55 per cent.

While it was sitting on 32.9 billion yuan in cash when it decided to pay the special dividend, it also has a 28 billion yuan loan to repay by June.

As analysts wondered why it had decided to distribute a 2012 dividend more than six months after announcing its 2012 profit - and how the company could afford it - Evergrande announced a significant borrowing.

It issued a US$1.5 billion senior note in November, paying interest of 8.75 per cent.

It would be fair to say that the dividend payment and share buyback, which account for more than half the value of the loan, were largely funded by it.

Is there no better investment opportunity on which to spend the money? The short answer is that many mainland developers' shares are trading below net asset value; yet most have not brought back any shares or paid special dividends.

That makes a lot of sense given Beijing's tight control over credit for the sector.

While rivals are busy stocking up cash to build their land bank, and facing repayment of a significant loan within months, why would Evergrande throw out its hard-earned and interest-bearing money?

For the benefit of its shareholders? Theoretically speaking, a buyback will enhance earnings per share because the repurchased shares will be cancelled. But this doesn't quite apply in the case of Evergrande.

The developer has not "yet" cancelled the 677 million shares, or 4.2 per cent holding, repurchased in January, according to its monthly return on movement in securities filed to the Hong Kong exchange. That leaves propping up its share price as the only benefit of the repurchase.

Evergrande shares dropped to a 27-month low on January 17 but gained 24.7 per cent to HK$3.48 after the 11-day repurchase between January 27 and yesterday.

The buyback, rather than investor confidence, was the main push. Indeed, when the developer brought no shares on February 6, its price fell 5.2 per cent. The buyback accounted for between 60 per cent and 80 per cent of daily turnover, meaning it attracted few followers.

It is therefore not surprising investors are once again questioning whether controlling shareholder Hui has pledged any of his stake in the company for loans. One fund manager described the share buyback as "very strange".

Hui, who holds 65 per cent of Evergrande, has been branching out into the mineral water, movie and beauty businesses, as well as the world of soccer. He pocketed almost HK$2 billion from the dividend payment.

The price support provided by the dividend and share buyback would certainly be good news for anyone who has used Evergrande shares as loan collateral.

Evergrande has repeatedly denied any share pledge by its controlling shareholder. And so has Hui, a self-proclaimed risk-taker who built his empire from scratch with high gearing.

Yet its management does have a fair question to answer. How do all these corporate moves reconcile with prudent financial management?

By the way, the developer has recently secured the consensus of its borrowers to relax the covenants that restricted its borrowing and other financial ratios. Expect more loans to come.