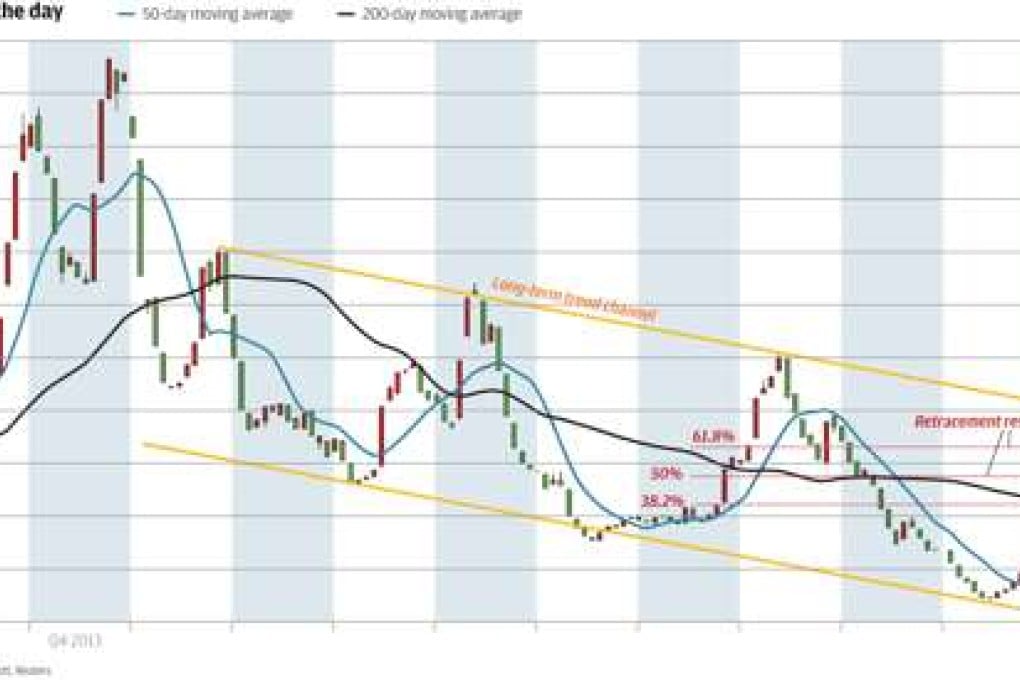

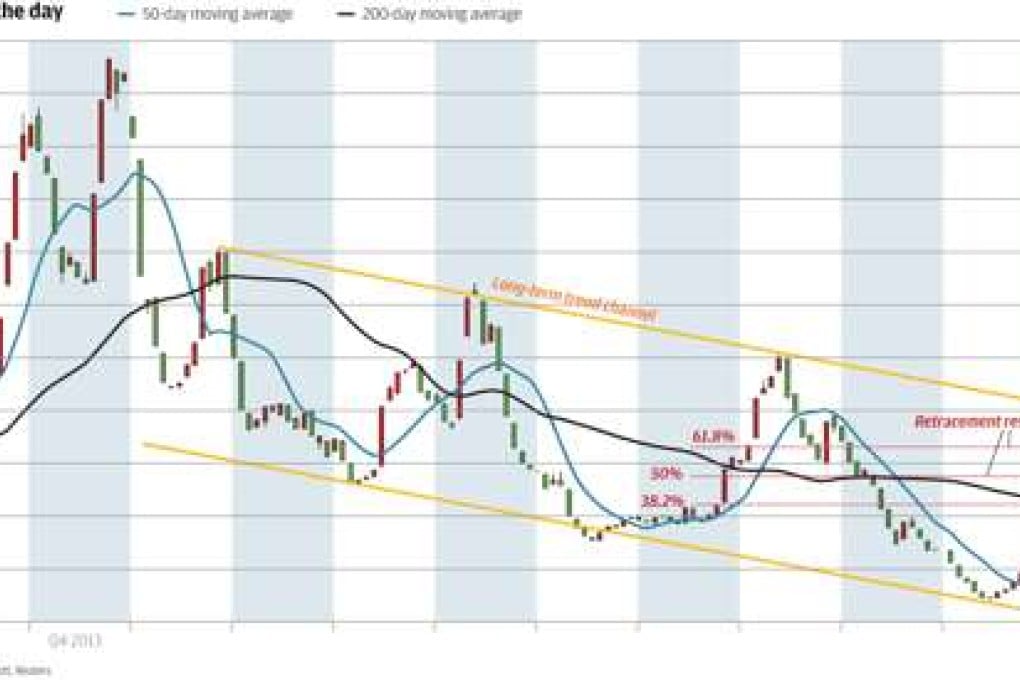

London’s Baltic exchange calculates the benchmark rates for a series of shipping routes using different vessels and various cargoes. From capesize to handysize (the world’s workhorse), its Dry Index is the average daily cost of transporting freight (not oil) over 23 routes. Oversupply saw rates collapse from 2008’s peak to their lowest in 30 years. But look carefully at the chart and you will see that after rallying steadily for 11 consecutive weeks it has retraced half of last year’s losses. Above the 200-day moving average, the 50-day one rallying, over the coming month we expect it to continue on up to the Fibonacci 61 per cent retracement (865) and the top of the channel.