SFC enforcement actions jump 55 per cent in 2016

The Securities and Futures Commission has stepped up enforcement action against individual bankers and directors, with data showing a 55 per cent rise in 2016.

The securities regulator imposed fines or other penalties on 85 senior executives or brokers, fund managers, and financial advisers or listed companies, compared to 55 actions in 2015, according to a study by law firm Freshfields Bruckhaus Deringer based on public information.

Bucking the trend, actions against companies fell 24 per cent on year, with just 25 companies facing censure, compared to 33 in 2015.

Total fines assessed in 2016 amounted to HK$67.9 million (US$8.74 million), down 4.2 per cent from 2015.

“This increased enforcement focus on individuals is consistent with what we’ve been hearing from the Hong Kong regulators. The regulators have been clear that unless the leadership of corporates and financial institutions steers with the right ‘tone from the top’, individual directors and executives may be held responsible for their involvement in problems that arise,” said Georgia Dawson, a disputes partner at Freshfields.

On Friday the SFC fined Merrill Lynch HK$15 million for control failures. In announcing the disciplinary action, the SFC said Merrill Lynch has “involved their senior management in the liaison with the SFC about the regulatory concerns at an early stage”.

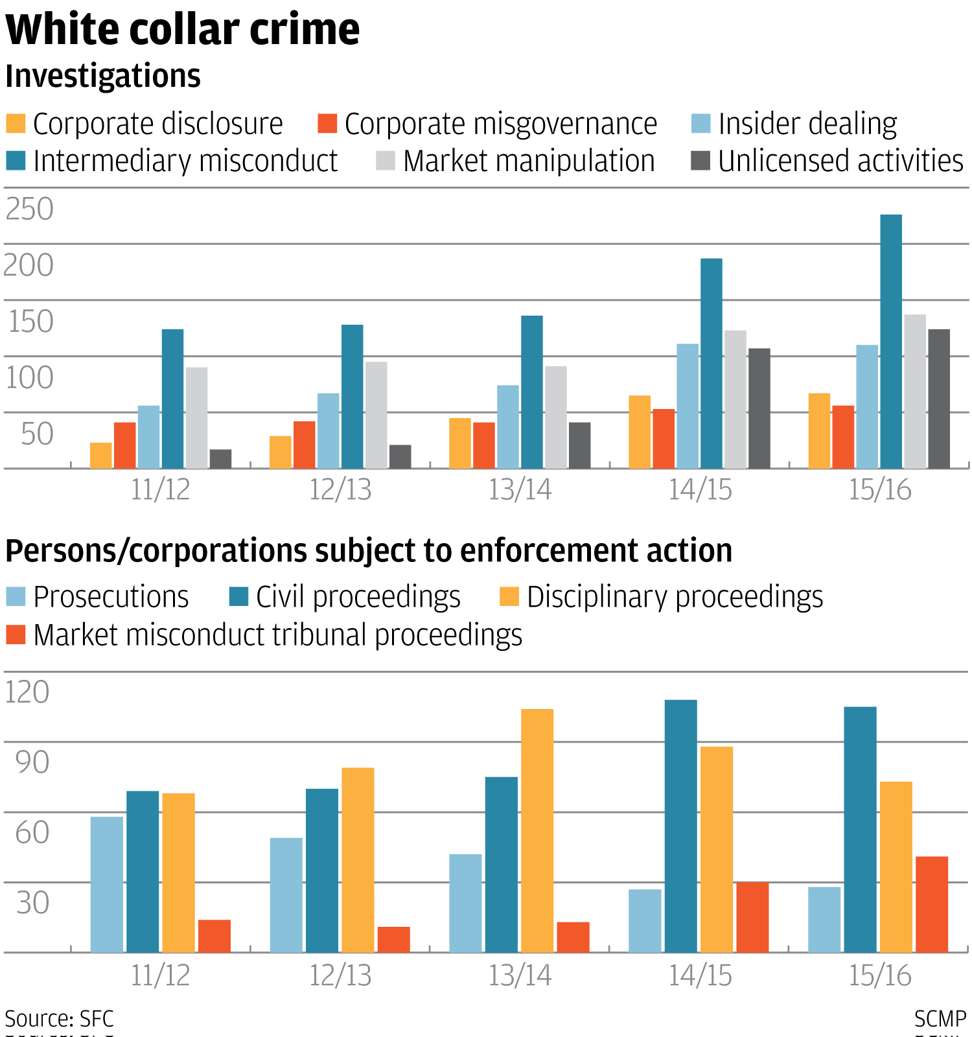

The data also shows that the SFC has conducted more investigations to crack down on malpractice in recent years. The watchdog has conducted 226 investigations relating to misconduct among brokers, bankers and fund managers in the financial year ended in March 2016, up 82 per cent compared to 124 investigations in 2011.

A total of 105 licensees received enforcement action from the SFC in the financial year to the end of March 2016, up 52 per cent from 2011.

Looking ahead, the SFC is expected to widen its footprint, as its executive director of enforcement Thomas Atkinson said in October that the watchdog has set up a special team to check on the conduct of listed sponsors and volatile Growth Enterprise Market companies.

The SFC is also set to introduce a new rule known as “Managers-in-Charge” from April 18, requiring more accountability among senior managers of SFC licensed brokers, fund houses and investment banks. They may face higher risks of disciplinary action if they fail in their duties to ensure compliance in areas involving risk management, finance, accounting and information technology.

A harder enforcement stance by the SFC may explain the drop in new listings in Hong Kong during the first quarter. The city lost out to New York, Shanghai and Shenzhen to rank as the fourth largest IPO market globally.

But keeping market quality and investor protection at the top of the regulatory agenda is important for the healthy development of the Hong Kong market. We want Atkinson and his team to continue to do their jobs well.