Analysis | Xiongan landowners lead market swoon over China’s dream city

Some companies’ exposure to the new area is not as large or direct as the optimists suggest, analysts warn

More than 40 Shanghai, Shenzhen and Hong Kong-listed companies have surged in the past three days, riding the wave of euphoria created by President Xi Jinping’s ambitious plan to build Xiongan New Area (雄安新區) – billed by many as the next Shenzhen.

Amid the frenzy, however, analysts have warned that some companies’ exposure to the new area is not as large as the more optimistic investors seem to think. Indeed, the first wave of the rally may have already passed.

“The initial enthusiasm can support at most three straight trading days,” said Liu Feifan, an analyst with Guotai Junan Securities. “The most likely scenario is intermittent Xiongan-spurred rallies. Any subsequent news about Xiongan could boost related stocks for a while, before they cool again.”

The initial enthusiasm can support at most three straight trading days

That means investors will need to adopt a delicate, well-calculated strategy in which timing is everything, particularly in the mainland’s volatile, speculation-driven market.

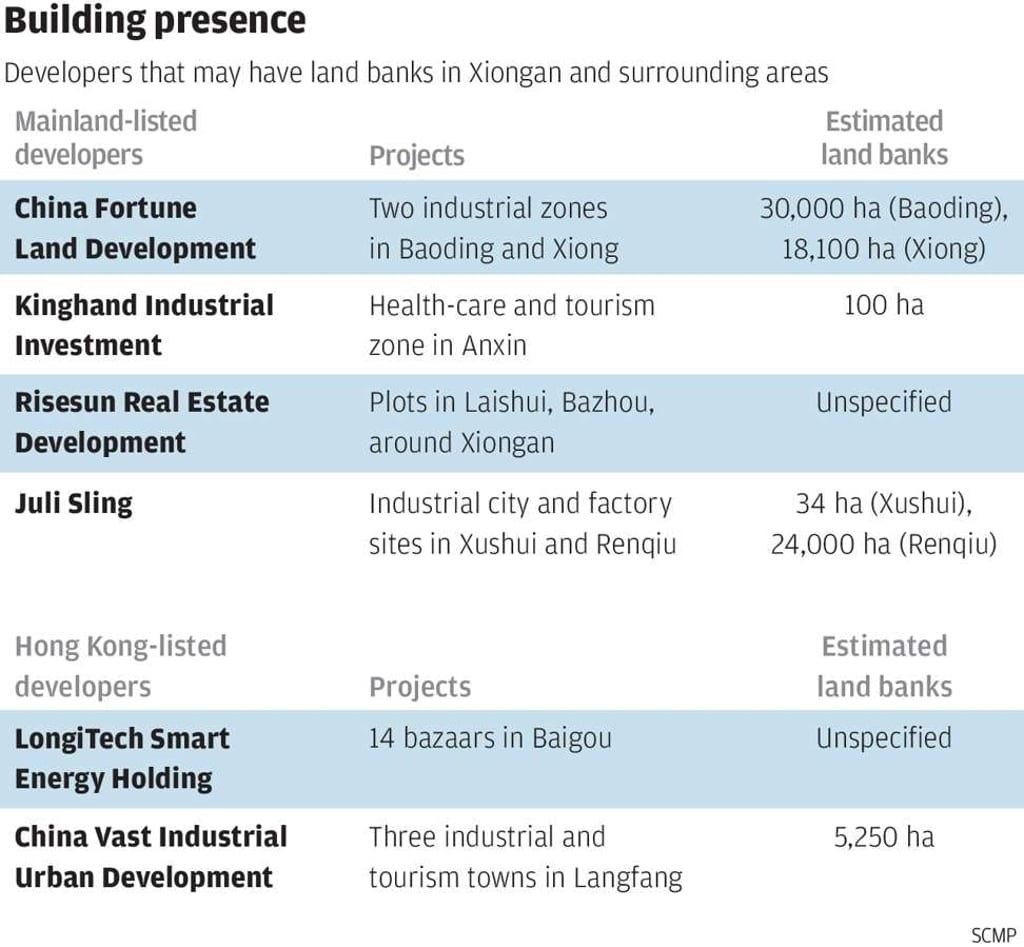

Investors were quick to spot the real estate stocks with land banks in Xiongan: China Fortune Land Development (CFLD) and Kinghand Industrial Investment, both of which rose by their daily limit for three consecutive days.

Then there are RiseSun Real Estate Development, Juli Sling and Langfang Development that don’t have direct exposure to the new area, but have projects in nearby cities. They have also surged by the daily permissible limit for three straight trading sessions. They soared 10 per cent immediately after the market opened on each day, leaving retail investors complaining that they barely got a chance to buy the stocks.

No Chinese builders listed in Hong Kong have land banks in Xiongan, but primary land development company LongiTech and China Vast Industrial Urban Development have projects nearby. Primary land development involves relocating existing residents, building roads, and connecting to water, electricity and other utilities before selling the plots to developers. Such companies split their land sale and tax revenue with local governments.