Analysis | Four reasons China is opening its bond market to the world

Foreign investors are likely to eventually account for 11 per cent of assets within China’s debt markets over time, implying US$1.5 trillion in capital inflows in coming years

This past Wednesday, the People’s Bank of China and the Hong Kong Monetary Authority announced a joint cooperation to launch “Bond Connect”, with no exact timing given.

Bond Connect is the formalisation of allowing two-way bond investment, trading, custody, and settlement.

The announcement says that the “Northbound Connect” will launch first (with no investment quota), with “Southbound Connect” to follow in due course.

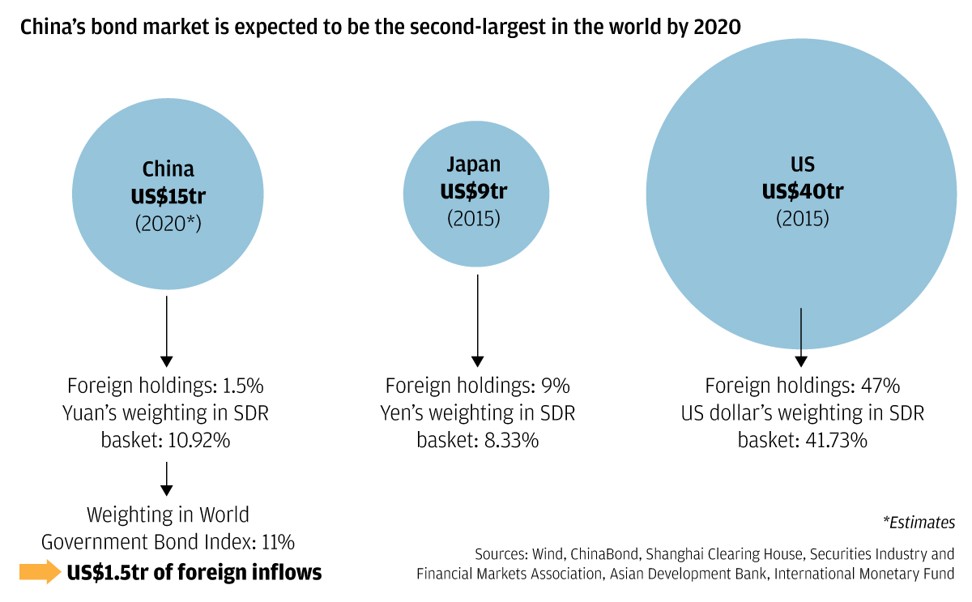

While long flagged by authorities on both sides, this announcement is significant in that currently only 1.5 per cent of the Chinese bond market is held by foreigners, as against a probable benchmark of about 11 per cent. We are not suggesting this reweighting will happen quickly, but rather that the Bond Connect is another step toward developing the necessary infrastructure.

The announcement is a reflection of the continued development and opening of China’s bond market, which is following a progressive path. This includes rapid issuance in domestic bonds (attained); inclusion of Chinese bonds in global indices (occurring); establishing Bond Connect (in process); and institutionalising the bond market, including developing internationally-acceptable credit ratings, credit enhancement, and credit insurance (early stages).

While the joint announcement reads as though Bond Connect is being developed in the best interest and “long-term prosperity and stability of Hong Kong”, we see it accruing far more to the benefit of mainland China.

In our last comment, we wrote that Chinese authorities are designing a number of paths to orchestrate an orderly deflating of their credit excesses. We mentioned the development of the bond market as one of the avenues. We believe the rapid development is deliberately being coordinated by authorities to achieve four key objectives:

Risk Diffusion - diffuse credit risk away from bank balance sheets to reduce concentration/systemic risk, given that banks hold the lion’s share of the massive amount of credit expansion that has occurred.

“Amend and Extend” – banks tend to make short-dated loans given their short-duration funding bases. Bonds allow for longer pay-back periods for borrowers, which better aligns their debt amortisation schedules with their cash flows.

Create Long-duration Assets – we believe China needs to further develop its pension system. But pensions are long-dated liabilities, which therefore require long-duration asset pools in which they can invest. A bond market provides these long-duration asset pools necessary for pension reforms (which we believe are now imminent).

Attract Foreign Capital - Chinese bonds are very under-owned by foreign investors, at least partially reflecting the lack of credible credit ratings and the lack of benchmark global indexes. With Bond Connect in place, and as a more robust credit ratings industry is developed, along with subsequent index inclusions, international investors will begin to have a more investible environment with which to increase weightings toward China. We estimate potential inflows over the next four to five years could approach US$1.5 trillion. This process is underway, and should aid authorities with renminbi foreign exchange management.

The absence of yield differentials reflects the bond bubble that has been created in recent years and which must be corrected

China’s bond issuance has been torrid in recent years. In 2016 alone the issuance of new bonds was equivalent to US$4.9 trillion, and the depth and breadth is developing rapidly -- more products are being issued and with a better mix.

As an example, whereas bond issuance historically had been dominated by Chinese government securities, corporate bonds amount to 36 per cent of all new bond issuance in 2016 as compared to 16 per cent in 2010.

With such a rapid increase in the issuance of bonds, the size of the bond market has increased three-fold since 2010 to US$8.8 trillion at the end of 2016, making it the third-largest in the world.

And the risk diffusion away from bank balance sheets has been effective, with corporate bonds now 21 per cent of total bonds outstanding. This will help to achieve a better mix of risk and yield array, meaning risk adjusted returns will increasingly be better benchmarked across the risk curve, thereby helping institutionalise the market for professional investors.

Having said that, to be sure, this risk curve is still far from perfect. Yield differentials among issuers do not yet adequately reflect differences in balance sheet risk (and nor is it reflected by domestic credit ratings, in our view).

We believe Chinese authorities are acutely aware of this. It is a developmental process on their part, which will continue to improve as the ratings industry becomes more rigorous and internationally accepted. In addition, conditions will improve as markets are more appropriately institutionalised -- including the further participation by professional fixed income asset managers, which Bond Connect will facilitate.

Regarding credit ratings, the establishment of China Securities Credit Investment Corp to expedite internationally acceptable credit ratings is also an integral part of this process.

Importantly, the Chinese bond market is already the third largest in the world, closely behind Japan’s US$9 trillion, and is heading to approximately US$15 trillion by 2020 given the pace of issuance.

Using the 11 per cent weighting of the yuan in the special drawing rights basket of the International Monetary Fund as a proxy for a full-market weighting for Chinese bonds, this implies that US$1.5 trillion of foreign capital inflows would be necessary to achieve a neutral weighting by foreign fixed income investors over the next several years.

In the near term, the correction in the bond markets is likely to continue. In the medium term, Bond Connect, inclusion in global fixed income indices, and the development of credible bond ratings are focal points to provide the infrastructure to encourage these foreign capital inflows.

Andrew Brown is a partner for macro and strategy at ShoreVest Capital Partners