New | Money buys Chinese tenants the cachet of the Central address

Increasing number of Chinese companies in Hong Kong changed traditional tenant portfolio in Central, which was once dominated by MNCs, foreign financial institutions and professional firms

There is one gap that Chinese companies can quickly narrow with their foreign counterparts; all it takes is capital, lots of it.

Over two decades, cash-rich Chinese companies have moved into coveted addresses in Central, becoming the new landlords, tenants, and neighbours to Goldman Sachs, Hong Kong Exchanges & Clearing, BlackRock and the Bank of America-Merrill Lynch.

Since Hong Kong returned to Chinese rule in 1997, one-tenth of Central’s prime office space is now occupied by Chinese companies and financial institutions. In doing so, they have also jacked up prices in the world’s most expensive office market to new heights.

China’s ongoing financial deregulation and Beijing’s call for Chinese companies to “go global” have driven ambitious mainland firms to expand in Hong Kong, where it is often the first port of call for their global financial transactions.

“Most of the companies are coming with the same purpose: outbound financing and investment, for example trading on Hong Kong stocks,” said David Ji, Greater China head of research at property consultancy Knight Frank.

The numbers represent significant increases from an average 19 per cent in 2012, and pushed up the financial district’s monthly rents by another 9.6 per cent in 2016.

Most of the companies are coming with the same purpose: outbound financing and investment, for example trading on Hong Kong stocks

In the latest report by CBRE, Central remains the world’s priciest office market with prime office rent going at HK$264 per square foot (US$365 per square metre) per month. The rate was almost 50 per cent more than the second most expensive – Beijing’s Finance Street.

For most young, aggressive Chinese tenants who are primarily in banking, securities trading and asset management, an office in prime location, on a high floor and with a sea view are important status symbols.

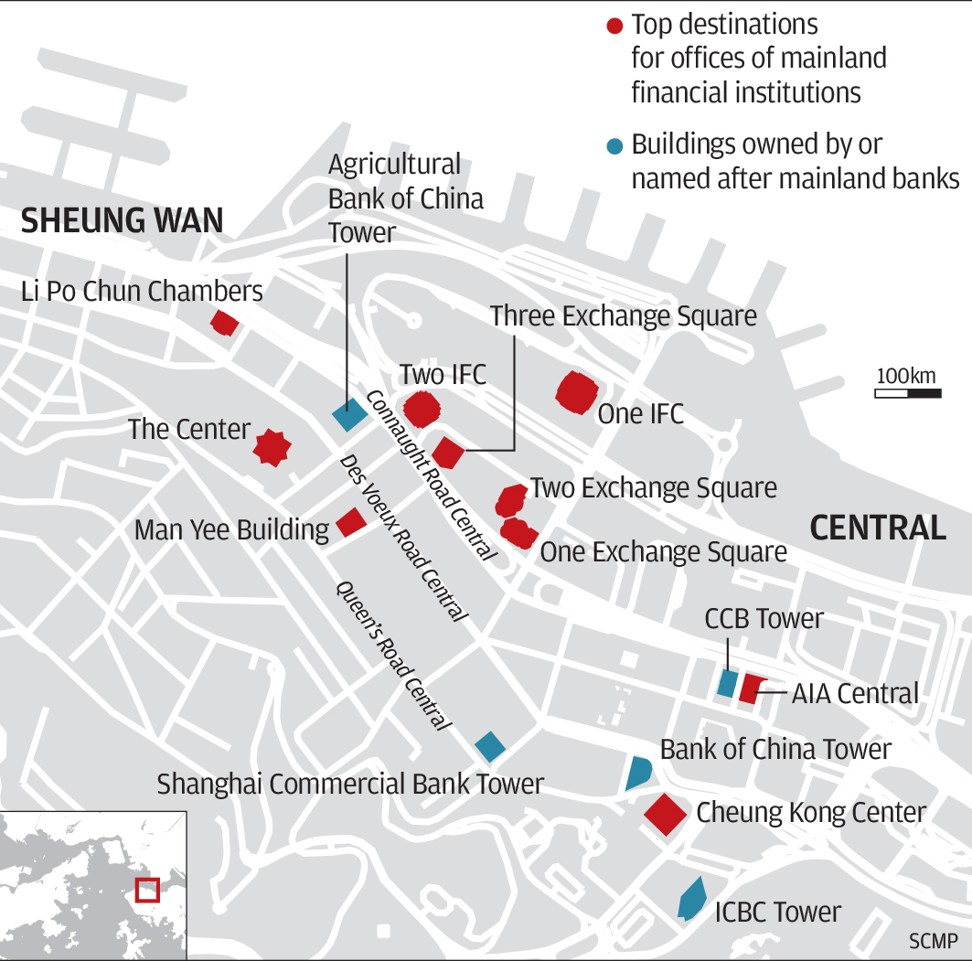

Property consultants say the mainland newcomers and their predecessors have been eyeing landmark grade-A buildings in Central such as the International Finance Centre (IFC), Exchange Square, AIA Central and the Cheung Kong Centre.

Many mainland firms which signed up for an initial space of 5,000 sq ft at the beginning, had expanded their premises by four or five times in two or three years, said Marcos Chan, CBRE Asia-Pacific’s head of research for Hong Kong, Southern China & Taiwan.

HNA Group, the Chinese conglomerate that owns Hainan Airlines and 20 per cent of Hilton Hotels, in October leased two more office lots in the 88-storey Two IFC for HK$27 million per month, tripling its total space in the building to 24,000 sq ft.

More recently, Bank of Communications (Bocom) leased an additional 10,100 sq ft at the Man Yee Building, expanding after its investment banking arm Bocom International Holdings successfully listed in the city. It occupies a total of 44,600 sq ft.

Although Hong Kong developers still own most of Central’s commercial properties, a few forward-looking Chinese banks have bought up entire buildings when the opportunities became available.

China Construction Bank acquired 50 per cent of a 31-storey building where the Ritz-Carlton Hotel in Central used to stand, for HK$1.79 billion, which was then torn down and rebuilt into the CCB Tower. Hong Kong’s Lai Sun Group owns the remaining 50 per cent.

In expanding their footprint in Central, Chinese companies have also pushed out foreign multinationals to the city’s outlying areas.

New York-based asset manager Alliance Bernstein will move from One IFC to Quarry Bay, in the east of Hong Kong island, where rates are half of those in Central.

Law firm Freshfields Bruckhaus Deringer is exiting from Two Exchange Square to One Island East in Quarry Bay in the first quarter of 2018.

“Mainland corporates have leased most of the floor space in Central’s grade A office market so far this year, some have to be put on waiting list for an ideal location,” said Paul Yien, regional director of Hong Kong markets at JLL.

CBRE estimates that new demand for 1.8 million sq ft in the next few years will come from mainland banks and finance companies that have yet to establish their presence in Hong Kong.

The vacancy rate for grade A offices in the financial district was a mere 0.7 per cent as at the end of March, while the rate for the entire area was 1.5 per cent.

Mainland corporates have leased most of the floor space in Central’s Grade A office market so far this year, some have to be put on waiting list for an ideal location

“I don’t think Central’s status will be replaced anytime soon. Neither West Kowloon nor Hong Kong Island East can compete with it,” said Ji.

CBRE’s Chan said the office supply in Central is the lowest among the CBDs in Hong Kong, and there would not be any new buildings to come on stream until 2022

“We forecast Central’s rent will grow 10 to 15 per cent this year,” he said.