HKEX set to launch ‘physically delivered’ gold futures in Hong Kong and London

Chinese Gold and Silver Exchange Society, an organisation of gold traders dating back to 1910, to cooperate on product promotion and storage vaults

Hong Kong Exchanges and Clearing (HKEX) is launching its planned offshore renminbi and US dollar gold futures contracts in Hong Kong on July 10 – the first pair of commodity futures that can be physically delivered in the city.

It’s the third attempt by the local bourse to launch gold futures contracts after two previous plans failed to attract interest. But officials said they are confident this time round the futures will succeed because as will require physical delivery of the precious metal.

Previously settlement was made in cash, and a debit or credit of the precious metal was issued when the contract expired.

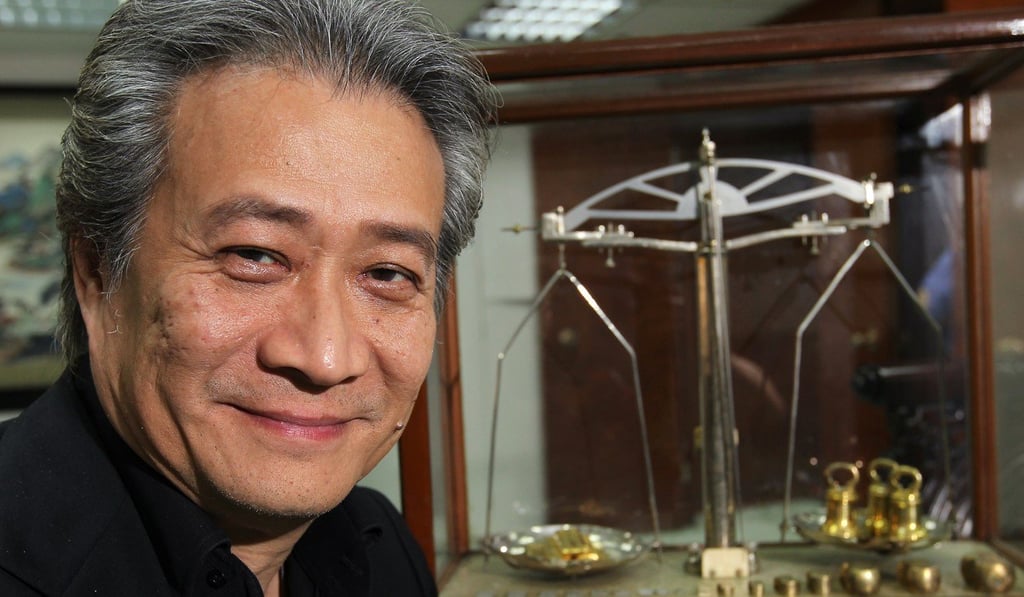

“Hong Kong needs to establish a gold price benchmark which was previously absent even though the city has comprehensive capabilities for gold trading, warehouse and logistics,” said Charles Li, chief executive of HKEX.

“Our gold futures will offer physical market users hedging opportunities and attract financial players, supplementing Hong Kong’s physical trading and helping establish a regional price benchmark.”

HKEX’s London’s subsidiary London Metal Exchange will also launch a gold futures contract the same day. The Hong Kong gold futures can be denominated either in US dollars or yuan, enabling investors to arbitrage between the precious metal and the currencies, and further strengthen Hong Kong as offshore yuan centre, Li added.