Ambitious Sunac buys its way to the top of China’s property league

The developer’s purchase of most of Wanda’s tourism assets increases its land bank by 70 per cent as it eyes expansion

Sunac China’s US$9.3 billion acquisition of hotels and tourism projects from Dalian Wanda Group will increase the fast-expanding developer’s land bank by about 70 per cent, according to details released on Tuesday.

The purchase of most of tycoon Wang Jianlin’s hotel and tourism assets adds 50 million square metres to the ambitious builder’s existing land reserves of 73 million sq m, bringing its total land bank area to 123 million sq m.

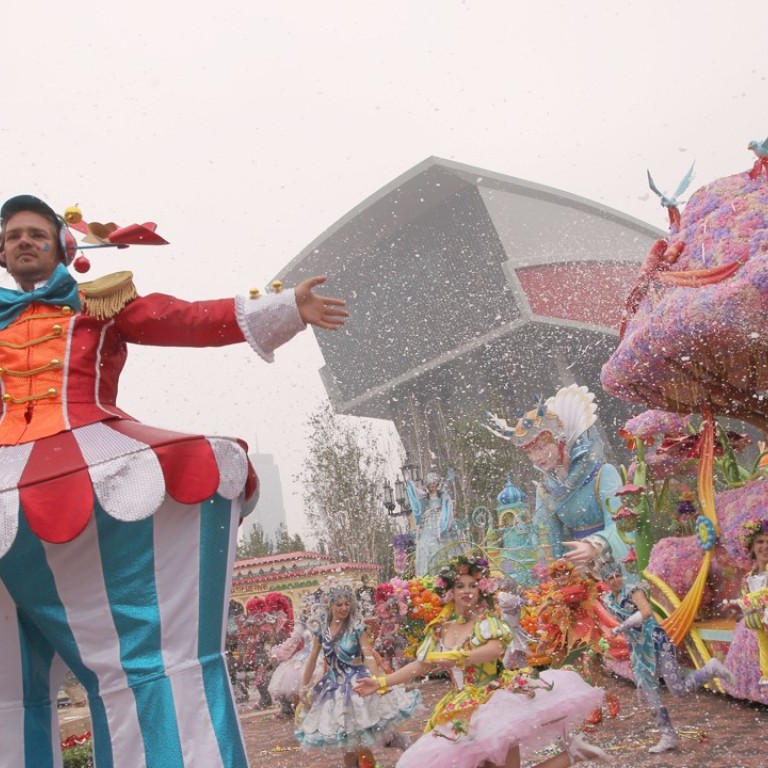

Sunac, currently the seventh-largest Chinese homebuilder, founded by Shanxi tycoon Sun Hongbin, saw its share price jump 14 per cent to close at HK$16.82 in Hong Kong after it resumed trading on Tuesday. On Monday the acquisitive developer agreed to buy 76 hotels and 91 per cent equity in 13 theme parks and projects classified as culture and tourism from Wang’s Wanda Group as the conglomerate was in need of cash to repay debts.

Morgan Stanley estimates the newly added land bank can contribute a total of 770 billion yuan to contracted sales over next 15 years, or 51 billion yuan each year compared to Sunac’s 2017 sales forecast of 250 billion yuan.

Sun will certainly be hoping his purchase – the biggest single property transaction in China’s history – helps him achieve his ambition of making Sunac one of the country’s largest developers.

The 13 tourism projects “have clear location advantages with reasonable land prices”, with 84 per cent of the total area “available for sales,” Sunac said in a statement on Tuesday. The 76 Wanda hotels are located in central areas of various cities, and have good “operational status”, it added.

The asset package brings Sunac a total saleable gross floor area of 49.7 million sq m, along with 9.2 million sq m of tourism assets and 22,920 hotel rooms, the company said.

Sunac has enough cash to support the Wanda deal as it has stepped back from public land auctions in the past few months

Sunac has emerged as one of the most acquisitive Chinese developers in the past few years. It became known for its takeover attempts of rival Greentown China and Kaisa Group back in 2014 and 2015.

Although both eye-catching deals failed, Sun’s ambition to grow into China’s top developer has never waned.

“The expansion of Sunac in the past years has largely relied on aggressive acquisition,” said Carol Wu, a China property analyst at DBS Vickers. “It experienced some failures, but the company learned from them.”

Sunac’s property holdings have expanded rapidly, from six cities in 2011 to 44 last year.

The deal with Wanda marks 54-year-old Sun’s biggest bet, building on a buying spree totalling roughly 110 billion yuan (US$16 billion) in the past six months as Sunac seeks out better ways to deploy its capital amid China’s increasingly challenging property market.

The 10 acquisitions included a high-profile 15 billion yuan capital injection into cash-strapped Chinese technology giant LeEco, and a number of smaller peers spanning from Chongqing and Tianjin to Qingdao.

Sun said the company would use its own funds for the Wanda deal, and that it had more than 90 billion yuan in cash as of the end of June, thanks to strong contracted sales in the first half, Caixin reported on Monday.

Sunac said in its statement on Tuesday that Wanda would procure for it a loan of 29.6 billion yuan for three years, which would reduce the payment pressure on Sunac.

“Sunac has enough cash to support the Wanda deal as it has stepped back from public land auctions in the past few months,” Wu said.

“In fact, we have already stopped purchasing new sites since last November,” Sun said. “It’s too dangerous.”

The Tianjin-based developer recorded 111.8 billion yuan in contracted sales in the first six months of 2017, an 89 per cent rise from the same period a year earlier.

Meanwhile, its total borrowings surged 37 per cent to 129 billion yuan by the end of April from 92 billion at the start of the year.

Still, Wu said, the deal with Wanda could turn out to be bad as Sunac had been focusing on residential development and maintaining a fast-turnover strategy. Whether the company can succeed in operating hotels remains to be seen.

S&P assessed Sunac’s financial discipline as “negative” on Tuesday, citing increasing pressure on the developer’s already high financial leverage and the burden on its future cash flow.