Update | Li Ka-shing’s ‘transforming’ CK Property spends US$895m on share buy-backs as interim profits rise 14 per cent

Li Ka-shing’s CK Property toasts 8pc revenue rise to US$3.81 billion for the six months to June 30.

Cheung Kong Property Holdings, controlled by Hong Kong tycoon Li Ka-shing, has reported a 14 per cent increase in core profits for the first half year, driven by strong property sales and gains from its newly acquired businesses in the energy and infrastructure sectors.

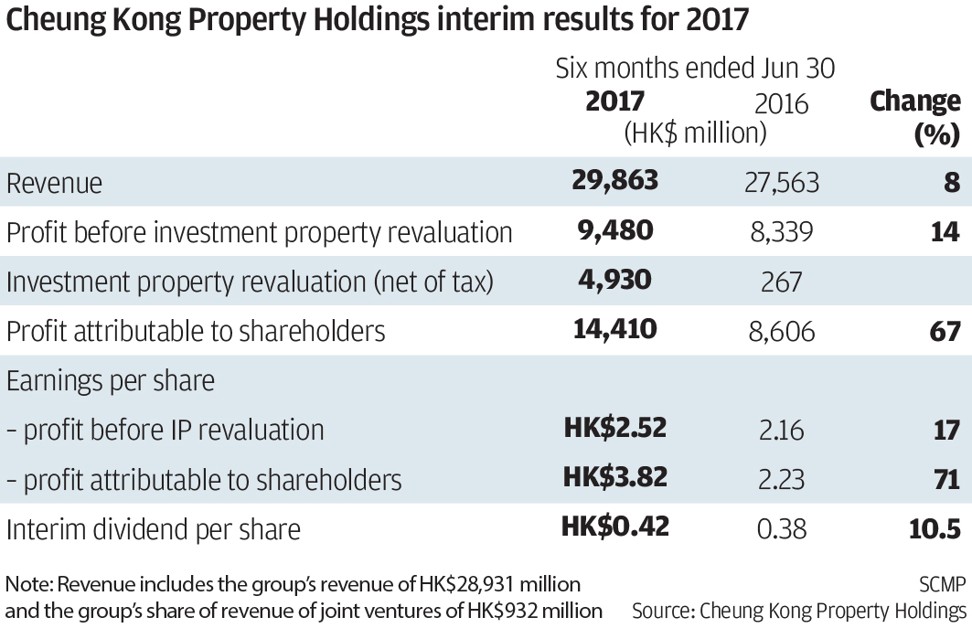

Underlying profit, excluding revaluation gains on investment properties, amounted to HK$9.48 billion (US$1.21 billion), or HK$2.52 earnings per share, which beat market consensus expectation of HK$2.42 per share, by 12 per cent, according to analysts polled by Bloomberg.

The group has utilised a total of HK$7 billion (US$895 million) in share buy-backs in the first half to reflect the underlying value of the company, and signify its confidence in its long term growth prospects

Hong Kong’s second-largest developer by market captialisation, CK Property said revenue rose 8 per cent to HK$29.8 billion (US$3.81 billion) for the six months to June 30.

“The group has utilised HK$7 billion (US$895 million) in share buy-backs in the first half to reflect the underlying value of the company, which signifies its confidence in its long term growth prospects,” chairman Li Ka-shing said in the company statement.

In response to the company share buy-backs and dividend payout during the analyst post result meeting on Thursday, vice chairman Victor Li Tzar-kuio reiterated “it is the decision of chairman and not my responsibility”.

Edmond Ip, director of CK Property said Victor Li may be “chairman next year”, raising speculation again that Li senior, who turn 90 next year, will step down then. But a spokesman for CK Property said Ip was just kidding.

In June, Li Ka-shing named his eldest son Victor Li as his successor in principle, but the group underlined Li had “no concrete timetable” to retire from the global conglomerate.

Ahead of the results announcement, shares in CK Property soared to a two-year high of HK$65.05 before closing at HK$65 on Thursday, down 0.077 per cent. They have risen 37 per cent in the last 12 months.

“It shows the company believes buying its company shares provides better returns than buying land for development,” said Alfred Lau, a property analyst at Bocom International.

The firm’s core profit was also boosted by a combined HK$764 million profit from its newly acquired aircraft leasing business, and DUET Group, a energy utilities operation in Australia. The aircraft business plans to buy another 43 aircraft for about HK$15.6 billion, it said.

CK Property, with bank balances and deposit of HK$82.7 billion and a debt-to-capital ratio of just 0.8 per cent, is branching out into non-property investments as development margins have been significantly squeezed by high land prices and soaring construction costs.

It has made four non-property investments worth a combined HK$108 billion either through partnerships with CK Infrastructure or Power Asset Holdings, since December last year.

Those investments have been in aircraft leasing, building equipment in Canada, and electricity and natural gas projects in Australia.

“CK Property is in the process of transforming,” said Nichole Wong, regional head of property research at CLSA.

“It has been offloading properties without any major land acquisition recently,” she said.

Excluding agricultural land and completed properties, its land bank is 124 million sq ft, of which six million sq ft is in Hong Kong.

It also owns 17 million square feet of investment properties, including Cheung Kong Center, Hutchison House and China Building, in the city’s Central business district, as well as a hotel and serviced-suite portfolio of more than 15,000 rooms.

Net profit rose 67 per cent to HK$14.41 billion, or HK$3.82 earnings per share, up 71 per cent from a year ago, due to a larger revaluation gains on investment properties. An interim dividend of 42 HK cents per share was declared, 10.5 per cent higher than a year ago.

“With a firm commitment to establishing a strong recurring income base, the group will press ahead with its globalisation and diversification initiatives to achieve long-term value growth through synergies of different functionalities by building on its sound financial strengths and strong management capabilities in business expansion,” said Li in the statement.

Last month, the company proposed to change its English name to CK Asset Holdings to better reflect its strategy “to achieve long-term sustainable business growth and value creation” through investments that include property, infrastructure, and aircraft leasing.

The change, subject to the approval of shareholders, was also aimed at aligning CKPH’s name with other listed companies within the CK group, the company said in an exchange filing last month.

Justin Chiu, executive director of CK Property said earlier that the company had achieved sales revenue of HK$36 billion from the sale of 2,500 units so far this year.