Predicting China’s endgame: Is China merely kicking the can down the road?

China may be able to kick the can down the road further than most countries, but such a strategy could eventually cost it dearly.

In our first instalment of the China-endgame trilogy, we tried to capture the prevailing market expectations on how China may get out of its structural impediments.

We analysed three common ways for unwinding the imbalances facing the economy – an US-style financial crisis, a Japan-type lost decade and a Beijing-preferred soft-landing.

In this and the next updates, we will systematically compare China’s macro characteristics today with those of the US and Japan, before their respective crises to see which one of the three paths is the most pertinent to China.

Here, we start with the US-China comparison.

Many market participants have drawn parallels between China’s growing problems in recent years with those faced by the US in the lead up to the subprime crisis. There are indeed uncanny similarities in the two experiences in:

•Rapid leverage build-up: both countries have experienced significant debt growth. In the US, total debt went from 180 per cent of gross domestic product in 2000 to over 250 per cent by 2009. As the private sector entered deleveraging after the crisis, the baton was passed onto China to lever up. Total debt in the latter rose precipitously to 260 per cent of GDP by end-2016.

•Growing housing bubble: similar to the US, where rapid credit growth had fuelled a gigantic housing bubble, China also experienced strong house price appreciation in recent years. The average property price in China’s tier-one cities has more than doubled since 2009.

•Expanding shadow banking: an important and novel feature in the US crisis was the rapid expansion of its shadow banking system. This helped to amplify the bubble on the upturn of the cycle and exacerbated the slump on the way down. China also saw a fast development in its shadow banking sector which went from virtually non-existent before the crisis to accounting for almost a third of total credit in 2016.

Starting with the housing market: unlike the US, where house price growth was a nationwide phenomenon, China’s boom has been concentrated in a handful of top-tier cities. In fact, the national average price has grown by only 55 per cent over the past eight years, trailing household’s income growth, resulting in an improvement, not deterioration, of housing affordability outside the tier-one cities.

And even if the bubble bursts in the tier-one citiess, these markets account for only 5 per cent of nationwide house sales and residential investment. Without stretched valuations elsewhere to create risks of contagion, a confined asset-bubble burst will be less catastrophic for China than was the case for the US.

Another distinction between the two experiences lies in the interconnectedness of the problems. For the US, its housing market boom was tightly connected to the leverage growth and shadow banking expansion.

In contrast, China’s housing boom and leverage growth are less intertwined. Corporate debt has been the dominant driver of China’s leverage growth since 2009, whereas household debt accounts for only 40 per cent of GDP. Chinese households also face stringent screening on their mortgage borrowing, with down-payments typically north of 20 per cent.

The same goes for the shadow banking system. Trust loans and banker’s bills account for a large portion of China’s shadow credits, which serve the corporate sector, not the housing market.

The system is also less complex, with limited derivative instruments and complex financial engineering. The less pertinent interconnection among the housing market, leverage and shadow banking can reduce cross-contagion of problems, effectively lowering the systemic risk for China.

The final, and the most important, difference lies in the fundamental nature of the two systems. The US is a market-based system, driven by the market’s invisible hand, while the Chinese system is more influenced by the state’s visible hand.

In a market-based system, liquidity can evaporate suddenly in times of intense risk aversion, causing panics and fire-sales of assets that perpetuate a crisis.

Such risks (of a liquidity shortage) can however be reduced significantly in a state-managed system like China’s, with a pragmatic central bank vigilant of liquidity risks and a relatively sealed capital account that keeps liquidity from leaking out.

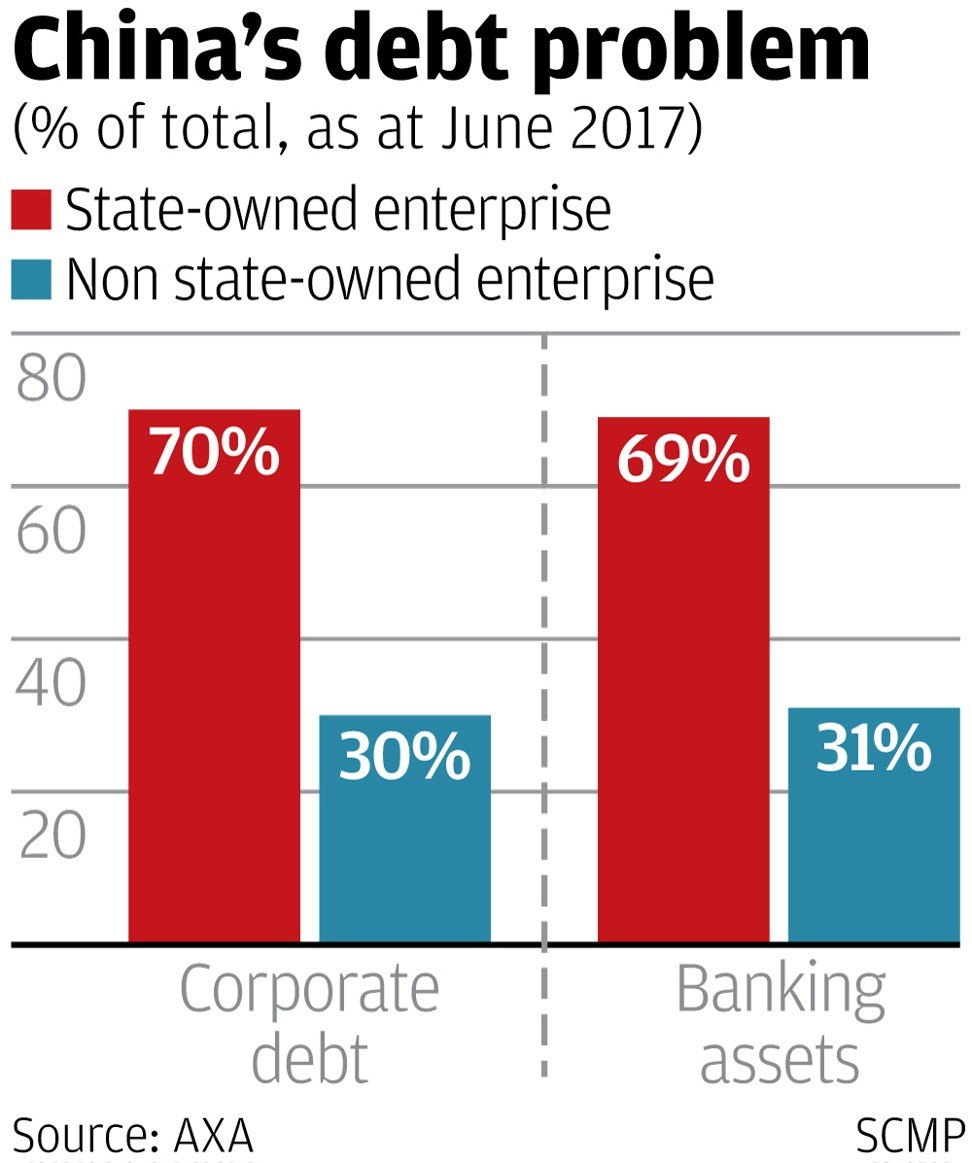

One example of this extensive state control is in the supply and demand of credit. The chart below shows that a vast majority of China’s corporate debt is owned by the state-owned enterprises, while those who supply the credit are mostly state-owned banks.

The Chinese government is effectively behind both the supply and demand of credit, and eventually owns the nation’s debt problem. Such an impeccable control of the system has enabled the authorities to inject and guide liquidity during tense times, avoiding a sudden-stop of liquidity that typically precedes crises in a market-based system.

This is the most important reason, in our view, why a classic financial crisis is unlikely in China barring major policy mistakes.

However, merely suppressing a crisis without ever resolving the underlying issues cannot be sustainable for any systems. China may be able to kick the can down the road further than most countries, but such a strategy could eventually cost it dearly.

One country’s experience that serves as a warning for China is Japan, with its two-decade-long of economic struggle. Will China’s can-kicking tactic eventually take its down to the path of Japan into a prolonged economic stagnation?

Stay tuned for our final instalment of the China endgame series.

Aidan Yao is the senior emerging Asia economist of AXA Investment Managers