Chinese magnate Sun Hongbin says his 15 billion yuan LeEco bailout brought tears to his eyes

Sunac, whose gearing had almost doubled to 394 per cent, said it’s aiming to pare debt down to 90 per cent by the end of 2018, and to 70 per cent a year later.

Sun Hongbin is nothing if not indefatigable. The real estate magnate, exonerated from a four-year jail sentence for embezzlement, sprang back to build Sunac China over a decade into one of the country’s most aggressive asset buyers and biggest property developers.

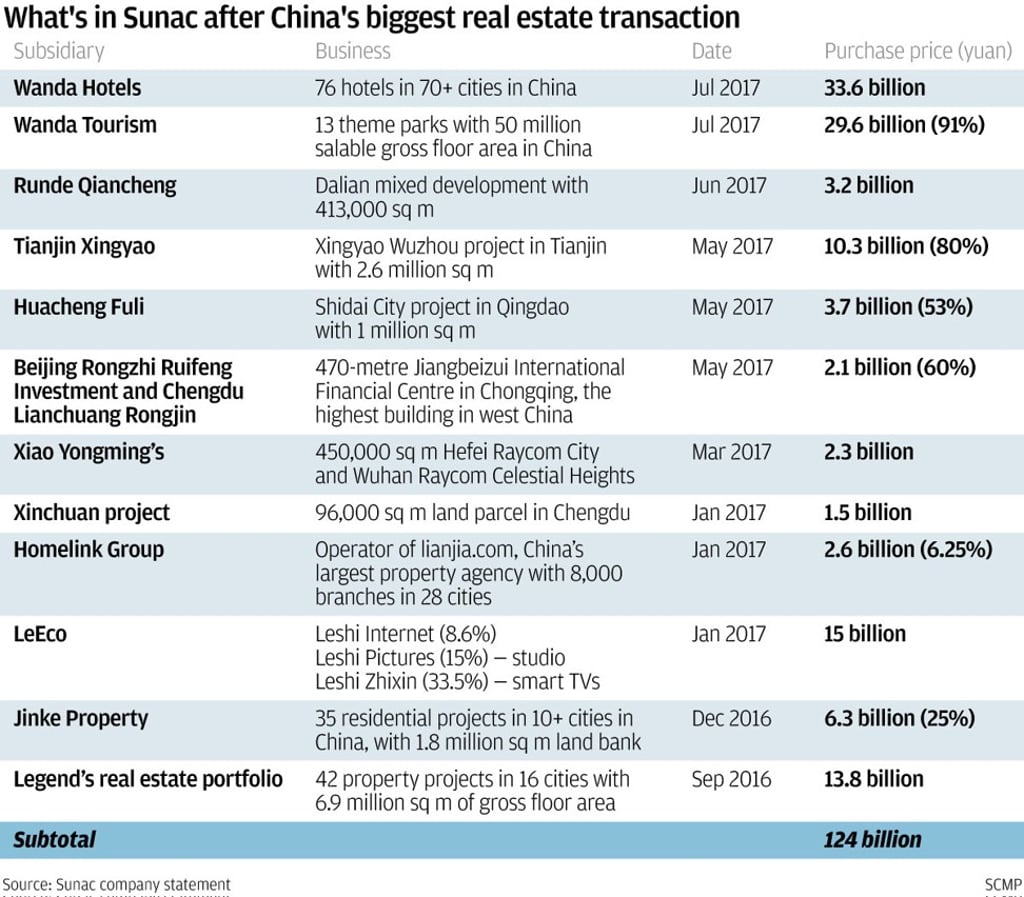

Sunac bought more than a dozen theme parks from tycoon Wang Jianlin’s Dalian Wanda Group in July for 43.8 billion yuan, part of the largest real estate transaction in the country’s corporate history.

But if there’s anything that causes Sun to pause, or bring a tear to his eyes, it’s his decision in January to pour 15 billion yuan (US$2.28 billion) to bail out fellow Shanxi entrepreneur Jia Yueting and his LeEco group of companies, which has run up huge debts running a business that stretched from video streaming to movies to making an electric car.

“I’ve never had any regrets my entire life, until I invested in LeEco,” Sun said during a Hong Kong press conference announcing Sunac’s interim results. “If I can’t turn LeEco back to normal,that would be a regret.”

Jia, who was burning through cash building a US$1 billion car plant in the desert of Nevada, dragged his feet in stemming the financial bleeding, Sun said. That forced Sunac to write off 1.1 billion yuan of its investments, pushing the developer’s investment in LeEco into a 1.5 billion yuan loss in the first half.

“The problem is Jia was indecisive,” Sun said during the Hong Kong press conference, holding back tears. “He should have sold troubled businesses earlier.”