Tech industry’s best talent demand market’s flashiest offices

Hi-tech firms rented a sixth of the 4.9 million square metres of Grade-A office space leased out in Asia-Pacific last year

Tech firms are fast becoming the most willing to fork out for prime offices sites in some of Asia’s biggest city centres, according to the region’s top property agents, some in a simple effort to lure the best talent to work for them.

While some tech companies in London have already started clustering themselves around what’s now being dubbed “Silicon Roundabout”, which is close to the traditional financial district, The City – similar groupings are being formed in some of Asia’s equivalents.

David Ji, Knight Frank Greater China region’s head of research, says what were more traditionally financial districts and central business districts, are becoming tech hubs as “it appears that technology companies are becoming the [only] ones able to afford the expensive rents”.

The latest data from JLL shows tech firms rented a sixth of the 4.9 million square metres of grade A office space leased throughout in Asia-Pacific last year, with hardware designers, e-commerce, and fintech companies the biggest lessors.

To be classed grade A, office floor areas must cover at least 4,000 sq ft, have central air-conditioning, and be decorated and fitted to top standards.

In Beijing, experts say a quarter of prime office space is currently occupied by telecommunication, media, and technology (TMT) firms, and it is 18 per cent in Shanghai, data compiled by Cushman&Wakefield shows.

Tech firms also dominate a fifth of business park space in those two cities, and the percentages are similar in Guangzhou, Shenzhen, Manila, New Delhi, and Chennai, says JLL research.

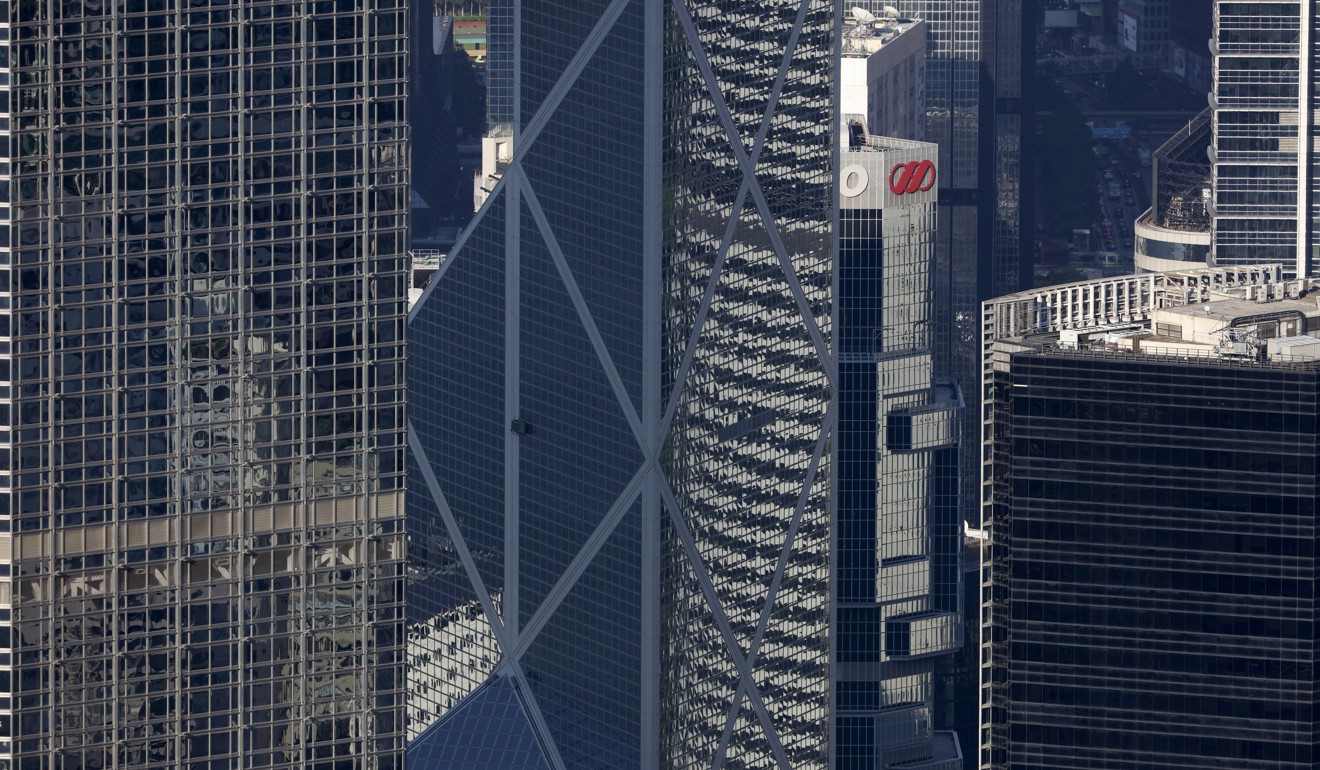

Hong Kong, particularly, has seen a rapid influx of fintechs to some of its most-prized central business districts, said Benny Cheung, director of advisory and transaction services for office of CBRE Hong Kong.

Last week, one US-based fintech leased over 13,000 sq ft of grade A office space at Nine Queen’s Road Central, costing it around HK$80 (US10) per sq ft per month, said Cheung, who refused to name the clients, hinting only that it was moving from another nearby site in Central, and is a data, information and analytical services provider. Its new Hong Kong office will house 60 to 70 staff, up from its previous 40.

“These types of location are also becoming important because those fintech firms have the banks and hedge funds they deal with as their major clients, nearby,” said Cheung. “They might need to meet people from those banks on a daily basis.”

Christopher Clausen, JLL’s associate director of regional research, said managing to attract the best staff in the major cities is growing in importance, and where their office is located often sways a potential staffer in your favour.

Firms have also become a lot more aware of what financial help they might be able to get access to, in the form of tax breaks, for instance.

“Upgrading premises can help firms gain an edge in the war for talent, giving then that little extra budget to attract and then retain top talent,” said Clausen.

Buildings with solid power supply and backup is also crucial to firms with large volumes of data stored on-site, as well as flexible floor layouts that can accommodate swift changes to staff organisations,

adds Clausen.

John Siu, managing director of Cushman&Wakefield Hong Kong, says that’s certainly changed from the past, when companies such as IBM and Oracle dominated, with younger tech firms now anxious to provide their often millennial-aged employees with just the right environment in which to shine.

“Tech companies mostly enjoy millennials, and they demand places to work where transport is convenient, and which have trendy, modern surroundings,” said Siu.

Clusters have already started forming, too, in Hong Kong’s Causeway Bay, where the Hong Kong branches of Google and China’s top e-commerce firm Alibaba already have offices, and Tsim Sha Tsui, now home to the city’s offices of the world’s largest telecommunications equipment supplier, Huawei.

[Alibaba owns the South China Morning Post]