Hong Kong’s stock index is the world’s best performer to date, but is the party over?

Analysts say a correction looms as the Fed is expected to begin unwinding its balance sheet, which could lead to tighter liquidity and higher interest rates

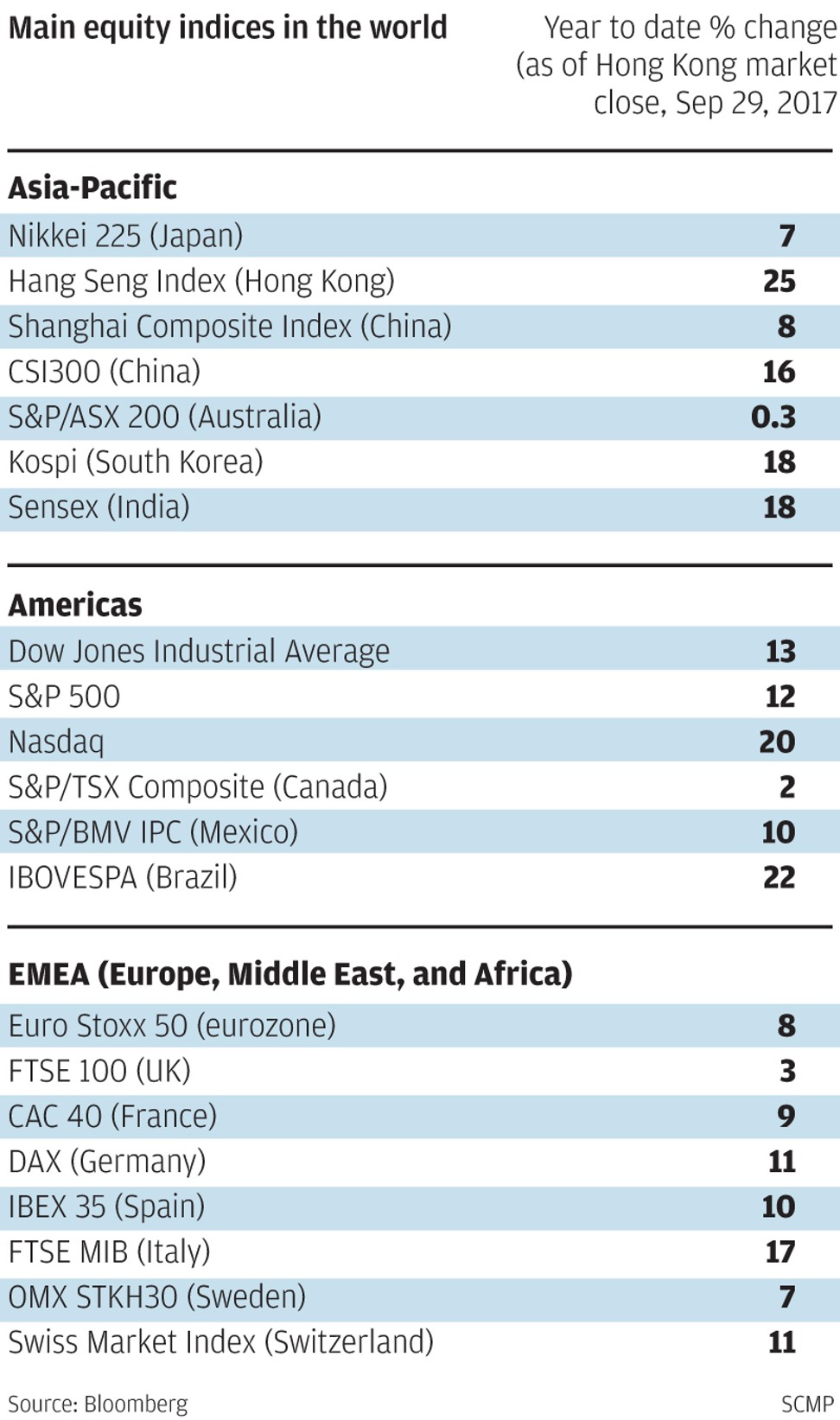

Hong Kong stocks jumped 25 per cent in the first three quarters of this year, thanks to Tencent’s 78 per cent increase that accounted for nearly 30 per cent of the gains in the Hang Seng Index, making it the top performer among the world’s major stock indices.

However, analysts warn that the market could be heading for a correction in the fourth quarter, as the Federal Reserve’s monetary policy tightening has yet to be fully priced in the market and a rapid rise in US bond yields could accelerate capital outflows from emerging markets.

Hong Kong’s benchmark Hang Seng Index (HSI) closed at 27,554.3 on Friday, the last trading day of September. It had risen 5,553.74 points, or 25 per cent in the first three quarters, outperforming its main counterparts in Asia-Pacific, the US, Europe and other markets, according to data compiled by Bloomberg at the close of trade in Hong Kong on Friday.

The biggest booster to the index’s gain was Tencent, which has soared 78 per cent to date this year on the back of strong financial results, especially from its soaring mobile game revenue. The counter contributed 1,572 points, or 28 per cent, to the HSI’s gains.

“The biggest concern is the Federal Reserve’s reversal of the quantitative easing programme, which could result in tighter market liquidity and higher interest rates, and cause capital outflows from emerging markets.”

But investors have to be careful about the last quarter, as the Hang Seng Index has gathered a large amount of gains, and is inclined to have a correction

The Fed decided in its September meeting that it will start to unwind the US$4.5 trillion balance sheet in October, a profound change in US monetary policy that will have implications on the global bond market, risk assets and economic conditions. It also signalled another rate increase later this year.

Traditionally, investors were nervous about October, as some of the largest historical market crashes had occurred in October, including Black Monday, Tuesday and Thursday, Yip said.

He said the Hang Seng Index had risen for eight consecutive months through August, before staging a retreat in September, which was a sign that “the index level may have reached too high a level”.

Some international investment funds may have locked in profits, and would tend to adopt a more conservative approach for the rest of the year, he added.

He expected the index to have a correction at the beginning of the fourth quarter, namely October, with a likelihood to fall below the 27,000 level.

Others such as Louie Shun, chief executive of Sincere Securities agreed, adding that some risks factors had not been priced into the market.

“The Fed’s unwinding of the balance sheet will draw the liquidity out of the market and cause global investment funds to de-leverage, ” Shun said.

In Hong Kong, banks’ interest rates could rise as liquidity tightens, which will have a negative impact on property prices and real estate developers.

“I would not be surprised if the Hang Seng Index drops below the 25,000 level [in the fourth quarter],” Shun said.

I would not be surprised if the Hang Seng Index drops below the 25,000 level [in the fourth quarter]

Technology and property counters that have shone in the first three quarters, could see a pull back in share prices and were unlikely to outperform the benchmark index, he added.

On the mainland, the benchmark Shanghai Composite Index closed Friday at 3,348.94. It had gained eight per cent for the first three quarters.

The CSI 300 index of large-cap companies listed in Shanghai and Shenzhen jumped 16 per cent during the same period. Leading performers were “new economy” sectors, including technology and consumer companies.

In June, MSCI announced that it will add mainland Chinese shares into its benchmark emerging market index, a move widely regarded to speed up the inflow of foreign funds into China’s stock markets.

Government statistics showed on Friday that overseas fund inflows into mainland securities reached US$20.6 billion in the first half, more than four times the amount for the same period last year.

However, Shun cautioned that China’s capital outflows could worsen in the fourth quarter, if the Fed’s policy tightening causes a rapid rise in long-term bond yields.

Geopolitical risks from North Korea could also heighten uncertainties and accelerate capital flight from risk assets, he added.