China’s capital controls send tremors through Australia’s property market

On a recent Sunday morning in the sun-drenched Australian city of Brisbane, about 50 ‘property tourists’ boarded a bus tour with a difference.

The group - all local Aussies looking to purchase their first homes - were shuttled to five new apartment projects where brochures promised they could “capitalise on international deposit defaults” and snap up properties at sharp discounts.

The homes were mostly being sold by Chinese investors unable to make settlement on their investments as Beijing cracks down on money flowing out of China and restrictions on Australian banks lending to foreign investors bite, the company behind the tour said.

“Getting money out of China is very hard now. That is a big factor for these discounts,” said Property Direct founder David Beard, who sold some two-bedroom units on the bus tour at 15-20 per cent lower than list prices.

“Property sales have fallen because of that, and it has got progressively harder to get bank loans in Australia.”

While nationwide hard data on such sales are not available, UBS estimates one in five apartment buyers in Brisbane, Australia’s third-largest city, are failing to settle.

Several analysts said they expected a similar response in the larger markets of Sydney and Melbourne if house prices soften further.

Official data is already signalling a slowdown.

Housing starts, which peaked at 116,000 in 2015, are now down to around 96,000. Completions are running faster at close to 110,000, a significant portion of which is expected to come up for settlement in 2018, industry experts warned.

Already, home values in Sydney have started to fall, down 0.7 per cent in November, a third straight monthly decline.

Even so, a 74 per cent rise in the city’s house prices since 2012 means many investors who paid a 10 per cent deposit to buy off the plan are still well in the money, providing a strong incentive for them to settle if possible.

Chinese buyers account for nearly a quarter of all new-built purchases in Sydney and about 15 per cent in Melbourne, according to a Credit Suisse analysis of government taxation records between January to June 2017.

But analysts think that proportion could fall as Chinese investors struggle to move money out of the mainland after Beijing this year imposed a curb on “irrational investment overseas” and clamped down on individuals transferring funds internationally.

Regulations only allow Chinese nationals a foreign exchange quota of US$50,000 a year and since July, the nation’s banks have been required to report any overseas transfers by individuals of US$10,000 or more.

While the rules were often flouted in the past, doing so now has become increasingly difficult, some money transfer agents told Reuters.

“It is almost impossible to send the full (settlement) amount from mainland China,” said Felix Su, financial adviser at foreign exchange firm KVB Kunlun.

That double whammy has made it more difficult or expensive to raise money locally, forcing investors to forfeit their deposits or try to on-sell their properties.

Chinese developer Poly Real Estate Group Co’s Australian subsidiary is switching its focus to local buyers as investors from China find sealing deals harder.

“There’s a lot lower risk with domestic buyers,” who can also more easily tap domestic credit markets, Jay Carter, New South Wales state sales and marketing director at Poly Australia told Reuters.

At the same time, agents say new interest from China has plunged since several Australian states hiked taxes on international property purchasers.

“A lot of investors are thinking about other countries where there are less barriers to entry,” said Ian Chen, founder and Chief Executive Officer of China-focused Jalin Realty, who has seen his China sales roughly halve since July.

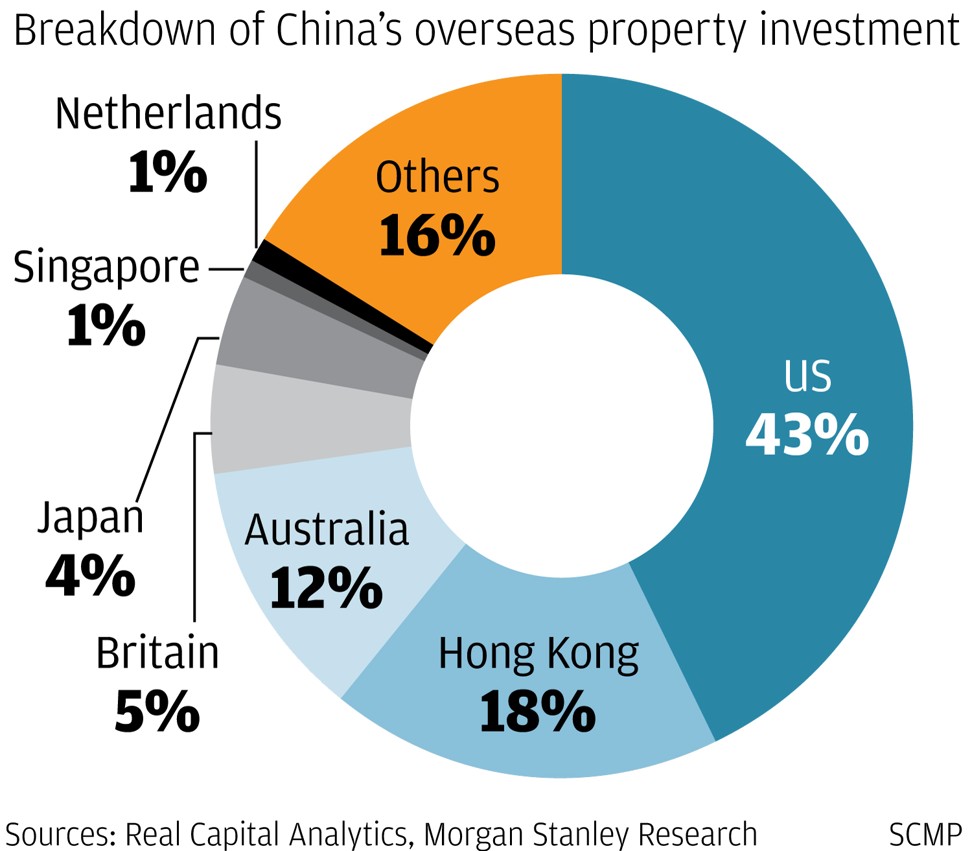

While the impact of China’s capital crackdown is less obvious in other markets popular with Chinese investors such as Canada, the United States and London, demand has cooled more generally, according to agents.

In the UK, for example, property buying enquiries have likely fallen 10-15 per cent in 2017 compared to a year ago and many buyers have reduced their budgets, said Carrie Law, chief executive of China’s largest international property website, Juwai.com.

“We have also seen less-expensive but otherwise desirable countries, like Thailand and Malaysia, shoot up in the rankings of top countries for Chinese buyers,” Law said.