Asian convertible bonds expected to continue to outperform equities and vanilla bonds as rates rise

Strong issuance of convertible bonds – particularly by Chinese companies – will extend into new year, say bankers and investors

Riding on record high share prices in Hong Kong and the United States, Chinese listed companies have this year reaped cheap financing through convertible bonds, an equity-linked hybrid instrument that gives investors fixed-income returns and the prospect of profiting from a rise in the issuer’s equity.

In a few cases, issuers such as social media giant Weibo and consumer electronics maker Haier Group were able to issue at 1.25 per cent and zero-coupon bonds, respectively, attractive pricing terms not achieved by most Asian issuers since the global financial crisis. The zero-coupon bonds enabled Haier to lock in financing of US$1 billion for as long as five years without paying any coupon during the bonds’ tenor.

More notably, the two deals – completed around end-October to November – underlined investors’ strong appetite for convertible instruments. As the US Federal Reserve is expected to continue raising rates in 2018, bankers and investors alike expect stronger convertible bond issuance and performance than plain vanilla bonds. The Fed has raised the federal funds rate three times this year to a target range of 1.25 per cent to 1.5 per cent.

“As interest rates have started rising, we see some companies starting to look at convertible bonds as an alternative to straight vanilla bonds due to the former’s compelling cost advantage. With convertibles, the call option embedded in the bond gives additional value to investors, cushioning them from the full impact of rising interest rates compared with vanilla bonds,” said Eva Zhong, head of convertible bonds origination for Asia-Pacific at Credit Suisse. Generally, as benchmark interest rates rise, bond pricing in terms of yield to maturity is likely to track closely.

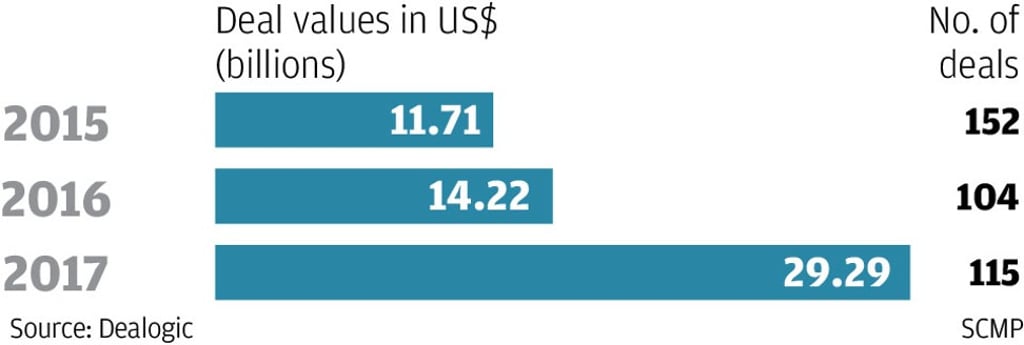

As of December 21, convertible bonds issuance reached US$29.29 billion in Asia excluding Japan across 115 deals, data from Dealogic shows. The issuance value was higher compared with 2016 and 2015, but deal counts in 2017 have lagged behind the 152 recorded in 2015.