Chinese companies account for half of top 10 biggest venture capital financing deals in 2017

Last year saw record deal activity backed by venture capital (VC) in China, with half of the top 10 largest deals globally by Chinese telecoms and internet companies.

Topping the list was Didi Chuxing’s US$5.5 billion financing in April, which emerged as the largest VC-backed deal in the past decade.

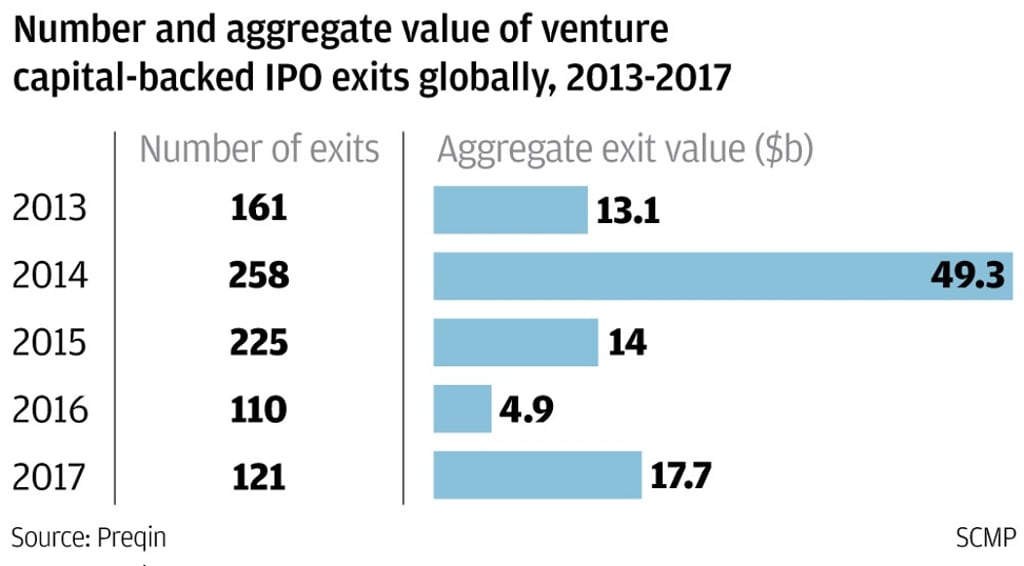

Preqin, a data service provider for the alternative assets industry, expects an uptick in venture capital investors seeking initial public offerings (IPOs) in 2018.

“Spotify [is expected] to become publicly traded in 2018, and other venture capital-backed companies may follow suit. A number of VC-backed companies have now grown to valuations that would make them unlikely candidates for trade sales to corporates … as such, becoming publicly listed is the most likely exit strategy for these companies,” said Felice Egidio, head of venture capital products at Preqin.

Earlier this month, the Swedish music-streaming service filed for a listing on the New York Stock Exchange. Details of the listing are limited, although the company is reportedly seeking a direct listing on the exchange without an initial public offering to raise additional capital.