Financial markets sinking into rampant risk and ruin

The current stock market rally, nearly a decade-old, is bloated on the proceeds of global monetary super-stimulus

Ever wished for a return to the good old days when life was simple, living was easy and there was reasonable confidence about better times ahead?

Not quite mum’s home-made apple pie, Nat King Cole getting his kicks on Route 66 and the family huddled around terrestrial TV to catch up on The Mary Tyler Moore Show.

But a return to a world based on stability and some semblance of life improving. It seems a bygone age.

Fast forward to the new millennium and the world seems to be floundering into a new age of risk, uncertainty and fear for the future.

Job certainty is a thing of the past and the gig economy and zero contract hours are now the new norms for too many workers around the world, increasingly disenfranchised from the companies they work for and relegated to mere worker bees in the creation of unimaginable riches for the globe’s billionaire elite.

Retail therapy used to be based on what your savings could afford and money saved was generally kept safe under lock and key with trusted financial institutions. Now, consumers are blitzed by high-visibility ad campaigns, spending beyond their dreams and means, pumped up on free and easy access to cheap credit. Debt is the new ‘good’.

Investors lured into high-risk, get-rich schemes like cryptocurrencies and spread-betting are so commonplace, society hardly even seems to bat an eyelid.

The world economy might have vacated casualty and ended back in the recovery room, but progress is nothing to write home about considering all the weight of stimulus thrown at it by global policymakers in recent years

Financial markets have slipped into a parallel universe of excess and short memories.

Forget about the Great Crash of 1929, the post-Herstatt crisis in the early-1970s, the Hammersmith and Fulham debacle in the 1980s, the 2000 Dotcom bubble, the shock of Lehman’s collapse and the Financial Crash of 2008. The names and events seem increasingly lost in the mists of time.

For months the world has been wringing its hands, fretting about the sustainability of the current stock market rally, nearly a decade-old and bloated on the proceeds of global monetary super-stimulus.

Just recently, it has had a first taste of possible disaster with the market in a short-lived free-fall. But the bulls are still living to fight another day, putting the negative price action down to a minor correction and a technical one at that.

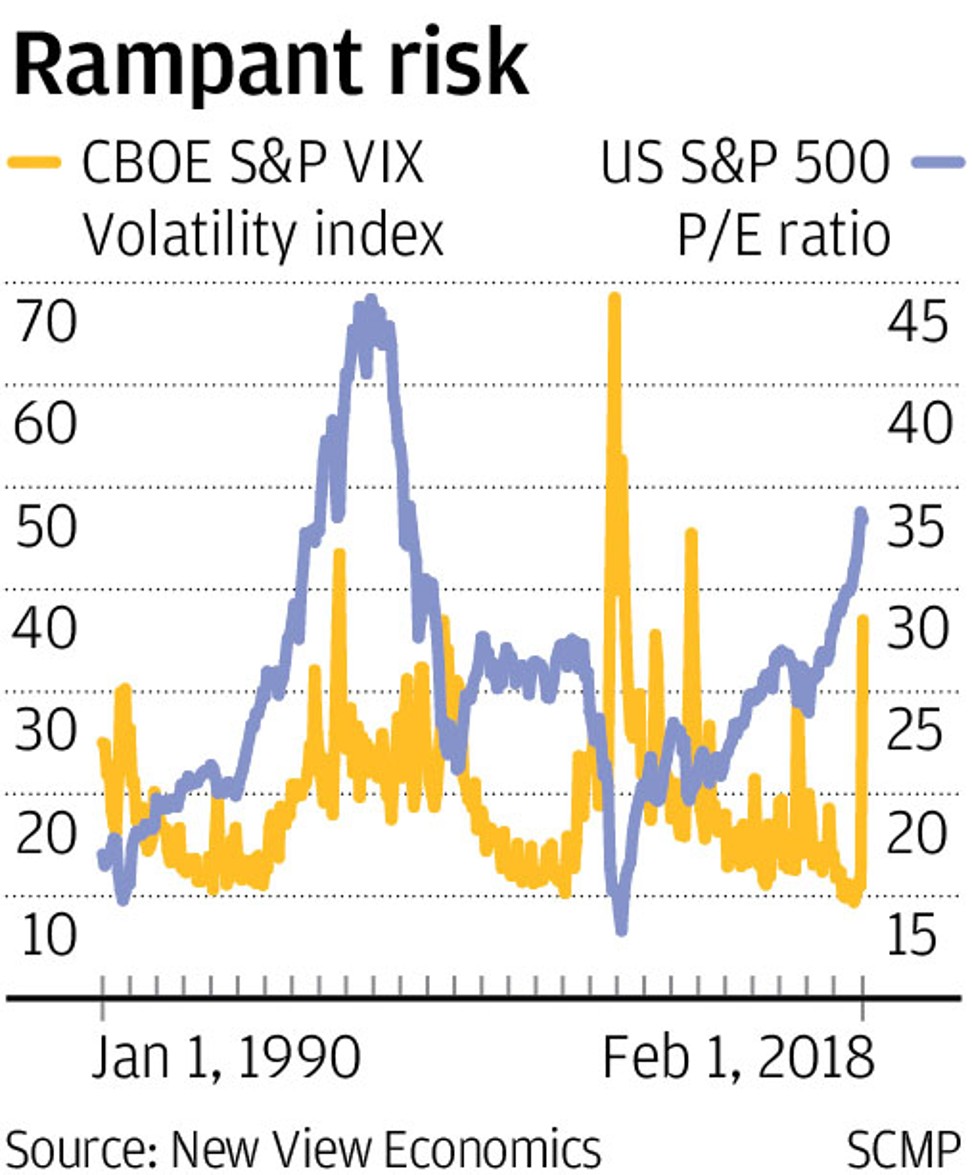

Blaming the rout on market-covering of equity volatility shorts suggests the sell-off is being passed off as a hitch rather than a collapse in faith about the underlying economic fundamentals. The reaction of the CBOE Vix index surging to a recent intra-day high of 50 after months of languishing in the doldrums is testament to stock market volatility bouncing back with a vengeance.

The world economy might have vacated casualty and ended back in the recovery room, but progress is nothing to write home about considering all the weight of stimulus thrown at it by global policymakers in recent years. In fact, annual global GDP growth running around 3.5 per cent looks rather modest, especially juxtaposed against the lofty high price-earnings ratios governing US equity valuations right now.

If the stock market rally is based on investor exuberance, mega-leverage and hype then we are digging ourselves into a deeper hole than we could ever have imagined.

But it extends much further beyond that, into a house of cards constructed out of moral hazard, complex derivative products and extreme financial engineering. The world could be in for another shock before too long.

There is still time to stop the rot. Global policymakers and regulators were asleep at the wheel over the subprime and collateralised debt debacle in the run-up to the 2008 crash. Extra supervision, vigilance and regulation are definite musts now to keep the extremes of financial risk-taking in check. Tougher controls over hedge funds, investment banks and tax avoidance must be enforced.

The financial community should be made to pay for its own mistakes rather than taxpayers and central banks footing the bill for excessive behaviour.

The 2008 crash took a huge toll on the global confidence and badly affected so many lives the world can ill-afford to repeat.

The bailout kitty stands at rock bottom and policymakers have run out of options for dealing with the next catastrophe. Perpetrators must bear the full brunt of heavy penalties and be allowed to fail.

The age of innocence is over. The world is speeding down the road, loaded with rampant risk and heading for ruin unless the brakes are applied soon.

David Brown is chief executive of New View Economics