Fire and fury of a global trade war could tip markets into major meltdown

Monetary super-stimulus saved the global economy’s bacon over the last decade, but now the outside threat of an all-out global trade battle shunts markets onto full-blown red alert

What do denim jeans, Kentucky bourbon and Harley-Davidsons have in common?

They could be weapons of mass destruction in Europe’s retaliatory strike against US manufactured goods in the event of a global trade war.

No, Mr President, it is not Star Wars but trade wars. Donald Trump opened up a can of worms last week with his threat to impose punitive tariffs on imports of steel and aluminium products. Global markets have been stunned into a state of shock.

There is no econometric model for caprice and whimsy. Economics is supposed to be an objective science subject to random shocks called politics and the weather.

Trump’s assurance last week that “trade wars are good and easy to win” seems more like an unscripted broadside from the The Apprentice rather than a responsible mission statement from a truly global leader.

Trump’s politics have suddenly escalated into a major threat to global economic stability.

It is no surprise policy advisers in the White House are tearing their hair out and wondering what comes next. The damage has been done, the perceived threat of a trade war is out in the open and it is no surprise financial markets are rattled.

Being long and wrong, or short and caught is what [financial markets] are desperate to avoid

Words are easy to say but they have their consequences and global confidence is starting to feel an icy blast of trouble ahead.

Financial markets are rational and they hate uncertainty. Confidence about the future is crucial, irrespective of whether they are going full-steam into a rally or downturn.

Being long and wrong, or short and caught is what they are desperate to avoid. Trump’s sabre-rattling comes just at the wrong time for global equity markets which are running thin on rally-extending stamina.

Monetary super-stimulus saved the global economy’s bacon over the last 10 years, but now the major central banks are on a mission to trim the fat and return to normality, financial market sentiment was already on amber alert about the risks for global recovery. Now the outside threat of an all-out trade war shunts markets onto full-blown red alert.

There will be consequences all around. Trade wars put livelihoods at risk, jobs on the line and affect global well-being. If the crisis escalates, tit-for-tat trade sanctions will be less than a zero-sum game, a no-win situation for all concerned.

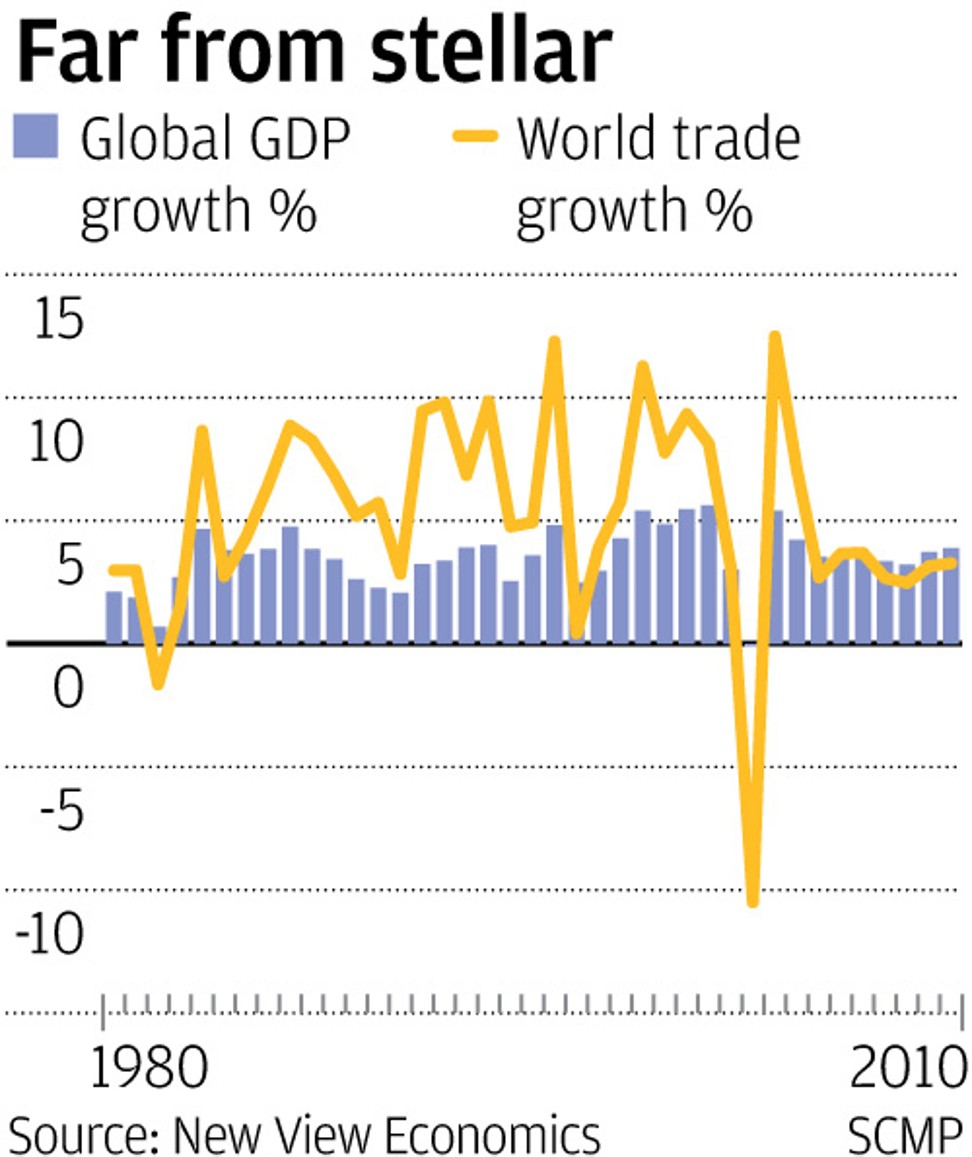

Global recovery ends up slower, world trade growth will lose momentum and there will be little policymakers can do to stop it turning into a deeper rout.

Monetary reserves are all but exhausted and the remits of supranational bodies like the International Monetary Fund, the World Bank and the World Trade Organisation have been emasculated by a highly critical and antagonistic Donald Trump. The days of international policy co-ordination and intervention are numbered.

It would be a case of everyman for himself and a return to beggar-thy-neighbour trade sanctions and escalated currency wars.

World economic recovery could slow to a crawl and world trade growth risks stopping dead in its tracks

The US would be OK as a relatively self-enclosed economy enjoying the economic afterburn from Trump’s recent tax cuts. Export-rich economies like Germany and China would feel ice-cold headwinds to economic activity. The demand for global commodities will slow, affecting growth in the emerging markets.

World economic recovery could slow to a crawl and world trade growth risks stopping dead in its tracks. For financial markets pumped up on cheap money and overextended on hype, the consequences would be grim.

Panic-selling could easily lead into a new financial crash. Markets have been close to a tipping point in recent months and Trump’s threat might have given the final nudge.

How bad could it be? It could be very bad. The global rally has had a fantastic run for its money in the last nine years and needed very careful management in the month’s ahead coming to terms with a radically changing policy environment.

It is not just the shock of the US withdrawing monetary stimulants but the threat of Europe and Japan reeling back the years of exceptional super-stimulus that has added to market concerns.

The risks of a global equity correction have just escalated from a 10-20 per cent sell-off to a 30-40 per cent stock market collapse in the coming weeks. If the finger of blame points anywhere, it points to a US administration obsessed with ‘America First’ priorities.

The fire and fury of a global trade war could tip markets into a meltdown of unimaginable disaster.

David Brown is the chief executive of New View Economics