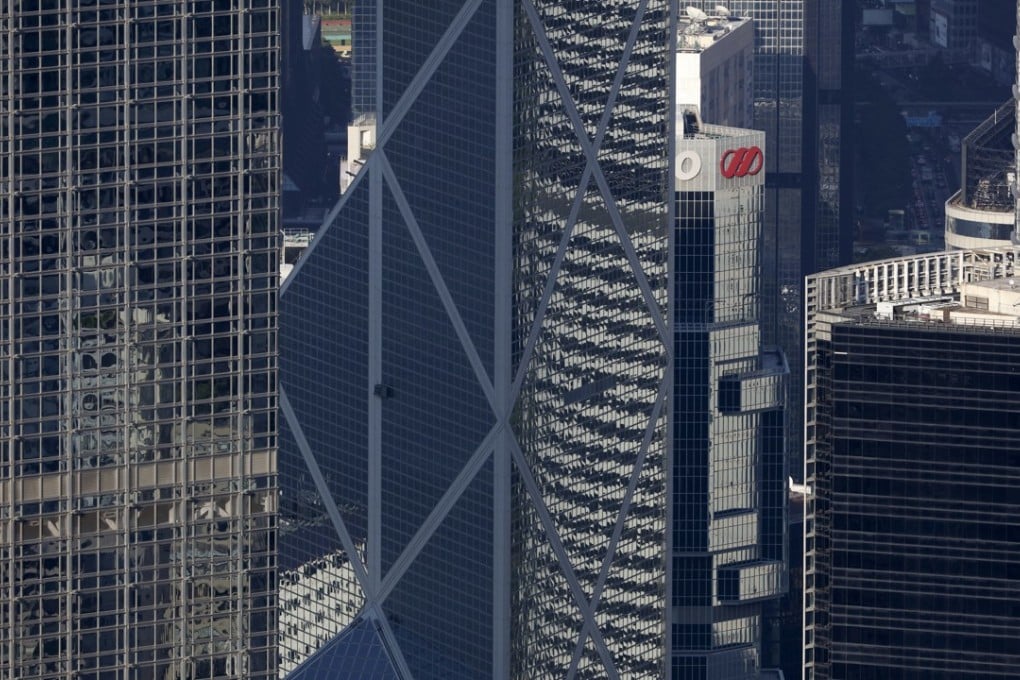

Office rents in Hong Kong on the brink of soaring past all-time high set before 2008 financial crisis

Demand from Chinese companies and limited office space coming on to the market will soon push rents past the historical high of HK$210 per sq ft set in 2008, say market observers

Office rents in Central, the most expensive place to rent office space in the world, is closing in on levels reached before the 2008 financial crisis, with market watchers believing a new high will be reached soon, driven by a paucity of supply and rapid inflow of Chinese companies.

“We’ve seen landlords asking for HK$200 per square feet,” said Ben Dickinson, head of agency leasing at JLL Hong Kong, adding that the last time such a demand was seen was in 2008.

The highest recorded price for office space in Hong Kong was HK$210 per sq ft more than 10 years ago, according to JLL data.

“We will definitely see some units in some prestigious buildings reach deals at over HK$200 per sq ft this year. It will surpass the peak within this year, if not, we will see that in 2019,” he said.

In the first four months of the year, average rents of grade A offices in Central had increased 1.7 per cent to HK$120.7 per sq ft. It is already 3 per cent higher than the last peak seen 10 years ago.

Meanwhile, rents in prime towers in Central are nearing 2008 levels.