Private capital must fill US$2.5 trillion gap in funding for social enterprises in Asia, says UNDP region chief

We need the participation of big institutional investors, pension funds and high net worth individuals, says Assistant Secretary General Xu Haoliang

Asia needs more private investment in projects that bring social and environmental benefits, plugging a US$2.5 trillion gap not filled by state funding, so the United Nations’ development goals can be met, according to a senior official at the global organisation.

According to Assistant Secretary General Xu Haoliang, the United Nations Development Programme is working with financial intermediaries and private investors in places such as Bangladesh, India, Cambodia and Hong Kong to push forward efforts that channel more private money into so-called impact investment projects.

“We need financial intermediary participation, but this is not enough. More importantly, we need people who control the money, including big institutional investors, pension funds and high net worth individuals,” he told the South China Morning Post in an interview.

Xu is also the director of UNDP’s Asia-Pacific bureau, which acts as a partner in impact measurement and management, without providing its own funds for projects.

In September, it partnered with Impress Capital, the wealth-management arm of Dhaka-based conglomerate Impress Group, to launch the Build Bangladesh-UNDP SDGs Impact Fund to finance social housing construction.

We see impact investing as pursuing both financial return and positive social impact, and without financial concessions

Impress Capital was responsible for assessing the viability of proposals, advising investors on progress and ensuring the successful delivery of projects.

According to Cape Gemini’s latest “World Wealth Report”, about 16.5 million high net worth individuals – those with US$1 million or more in investible assets – globally had a combined wealth of US$63.5 trillion in 2016, a third of which belonged to individuals in Asia-Pacific.

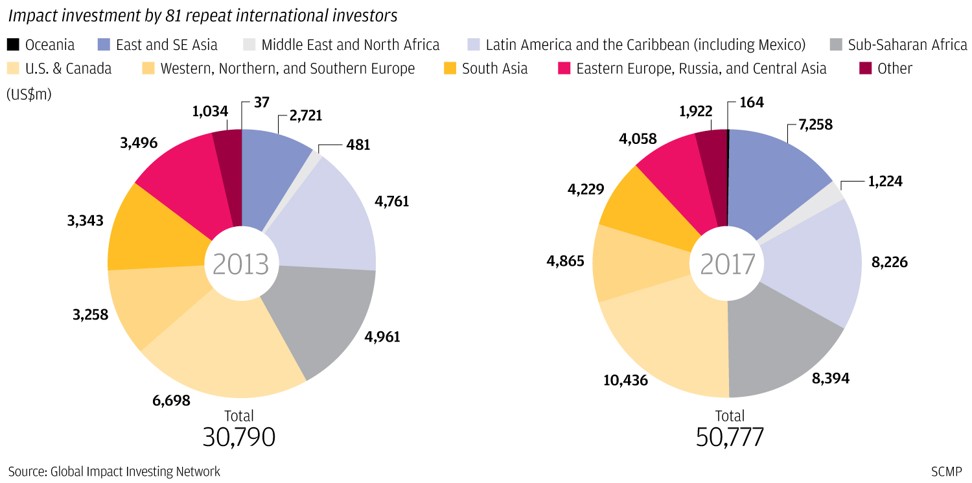

However, an annual impact investor survey by Global Impact Investing Network found that among five-year repeat international investor respondents, their combined allocation on impact investments in East and Southeast Asia was only US$7.3 billion last year. It was, however, up from US$2.7 billion in 2013, representing average annual growth of 28 per cent.

The global issuance of social bonds jumped by 285 per cent last year to US$9.2 billion from 2016, while that of sustainability bonds rose by 76 per cent to US$9 billion, according to an HSBC report which said these had grown “on the coattails” of the success of green bonds that bring environmental benefits.

It defined social bonds as those that benefit disadvantaged people, through projects such as social housing, public transport and apprenticeships, and sustainability bonds as those that fund green and social projects.

The UN General Assembly in 2015 came up with 17 Sustainable Development Goals to be addressed by 2030, which it estimated would require about US$4 trillion a year to realise, well above the US$1.4 trillion currently being invested annually in related projects.

The SDGs cover objectives such as extreme poverty eradication, health and education improvement, inequality reduction and actions to enhance environmental sustainability.

Steven Ying, managing partner at High Impact Capital Advisors, which has advised on transactions and executed its own impact investments worth about US$100 million, said doing social good and making a financial return were complementary and not contradictory.

“For us, we see impact investing as pursuing both financial return and positive social impact, and without financial concessions,” he said.

His company seeks out disruptive technologies that can solve social problems, often through drastic cost reductions that make previously unaffordable products and services available to certain groups of consumers.

One such technology was deployed to enable mobile finance in rural villages. High Impact is one of the investors in CFPA Microfinance, one of China’s largest microfinance lenders, which helps mostly rural women who cannot borrow from banks to finance new business ventures in some of the poorest areas of the country.

Ant Financial, another of CFPA’s investors, deployed its mobile finance solutions and worked with 100 companies to help farming households finance their procurement needs by offering online payment, credit and insurance services. Ant Financial is a subsidiary of Alibaba Group Holding, which owns the South China Morning Post.

Hobert Wai, who has spent years researching and marketing diseases diagnostic equipment in California, and is now a partner at Black Tiger Capital, a US-based investment company specialising in health care technology start-ups, is an impact investor in the health care sector.

“I am not a philanthropist, but I want to invest in companies that could potentially bring about a real impact in global health care besides returns,” he said, adding his firm was particularly interested in companies that deployed artificial intelligence in medical diagnostics.

“An example is leukaemia, which has various sub types, and different experts often give different diagnosis,” he said. “Artificial intelligence is better at detecting the finer details and can instil objectivity for better diagnosis.”

In remote villages in Africa and China, where affordability is an issue because of long-distance travel to clinics, data transfer between village clinics and city diagnostics experts through cloud computing can help save medical costs and improve medical outcomes, he said.

As a co-founder of Jade, which aims to use start-up experience from Silicon Valley to help groom Hong Kong and “Greater Bay Area” start-ups, Black Tiger also seeks opportunities to do such impact investing in this region.