Hong Kong’s Central remains the world’s most expensive office address for the third straight year

Hong Kong’s Central district was the world’s most expensive office address for the third consecutive year, as an influx of mainland Chinese financial firms overwhelmed the city’s supply of grade A space and drove vacancy to a three-year low.

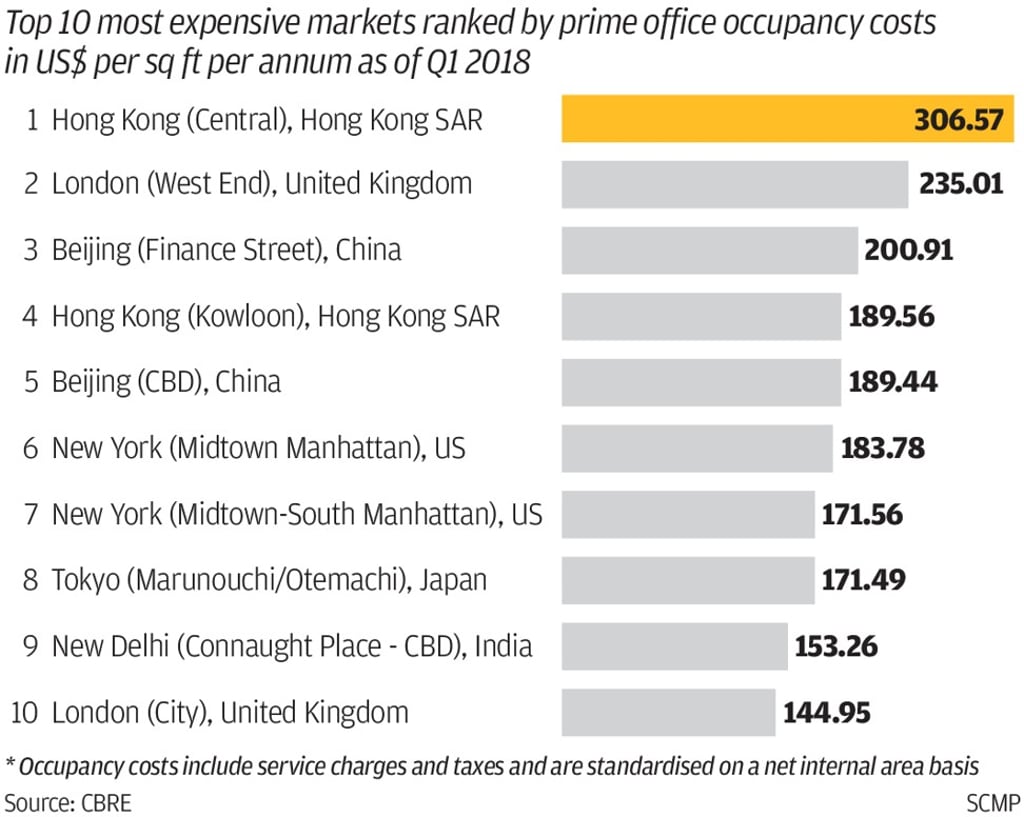

The average annual rent in Central rose to US$307 per square foot, 30 per cent more than the US$235 per sq ft in London’s West End in second place, and almost 53 per cent higher than the US$201 per sq ft at Beijing’s Financial Street in third place, according to a report by CBRE.

“The supply [of office] in Central continues to be low, thus smashing the record is just a matter of time,” said James Mak, district sales director at property broker Midland Commercial.

Office space in world’s most costly area is set to cross all-time high

It’s a good time to be an office landlord, as vacancy in Central dropped to 1.1 per cent, the lowest since the third quarter of 2015, according to CBRE. The lease among the city’s grade A1 buildings such as the International Finance Centre (IFC) and Cheung Kong Center have risen by 1.7 per cent to HK$176.7 per sq ft, less than 5 per cent from a 2008 record , according to data by JLL.

“Banking and finance continued to be the key drivers of demand, particularly by mainland Chinese companies,” said CBRE Hong Kong’s executive director Alan Lok.

Mainland companies including HNA - the parent of the country’s fourth-largest airline and one of the biggest overseas asset buyers - are determined to make a statement when they set up shop in Asia’s financial hub.