Advertisement

Advertisement

Opinion

Macroscope

by David Brown

Macroscope

by David Brown

Trade war with the US shows China needs a new market-driven model for monetary policy

David Brown says while a more decisive interest rate cut would be beneficial now, what China’s central bank really needs is more transparency in monetary policy and less government dictation

It is time for China to show more monetary mettle. Striking the right balance on interest rates between China’s highly industrialised economy while meeting the rest of the nation’s needs is like mission impossible. Depending on your vantage point, interest rates are either too high or too low, leaving the Goldilocks ideal hard to fix. Around the world, central bankers share a similar dilemma with the same problem. World growth is slowing and more policy stimulus is needed.

The People’s Bank of China has its work cut out, especially since the economy is at greater risk this year of missing the government’s growth target of around 6.5 per cent. And, given the way the US-China trade war seems to be damaging China’s domestic economy, Beijing might be lucky to see growth much above 5 per cent next year. To avoid a deeper crisis, China must ease monetary policy with an interest rate cut as quickly as possible.

Forget what the Fed is doing, ratcheting US rates to more “normal” levels, the signs are that the world could be heading into another major meltdown and steps must be taken soon to help insulate China’s economy from the fallout. The collapse in global share values around the world in the past few weeks is not simply a correction, but symptomatic of a deeper loss of confidence due to growing concerns about the damage to world trade and its threat to global economic activity.

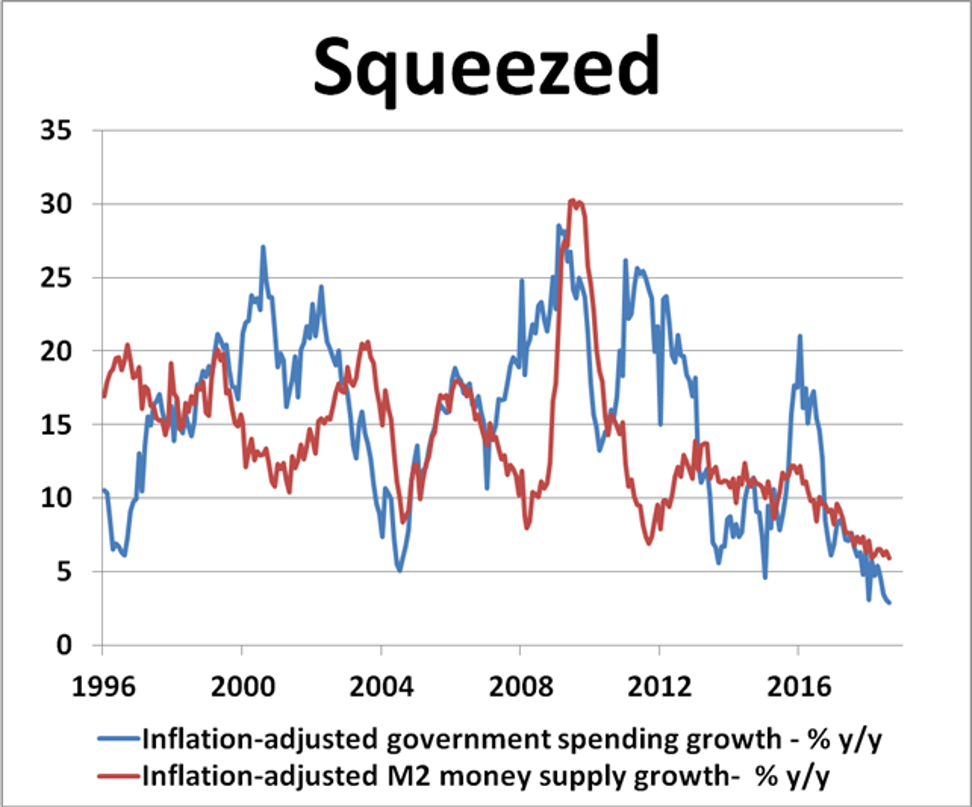

America may be fine thanks to the impact of US President Donald Trump’s explosive fiscal stimulus programme but question marks remain over China, given its sensitivity to export multiplier effects as world trade flows suffer. In a world where multilateralism is under attack and “America first” policies are taking their toll, Beijing needs to take unilateral action of its own. The signs are that China’s fiscal and monetary initiatives both need serious revision as a sharp squeeze seems under way.

China’s underlying domestic credit expansion and government spending growth are both slowing down at a time when the economy is crying out for more. This is piling added pressure on the PBOC to take the strain. The central bank is heading in the right direction, having recently cut the banks’ reserve requirement by 1 percentage point to inject more cash into the banking system and ease lending conditions. Another interest rate cut worth half a percentage point would not go amiss, either.

In the longer term, a new monetary model is needed to improve China’s interest-rate-policy setting, one which is truly governed by market forces and less by government diktat. PBOC policy should be less opaque, more transparent and much more simplified. Open and frank public debate is needed both within and outside the PBOC and monetary policy allowed to function with genuine independence to secure full confidence with consumers, business and investors at home and abroad.

The US Fed offers a clear set of defined parameters for governing interest rates, not perfect, but good enough to generate rational expectations on where US rates should be heading under business cycle conditions. Right now, the Fed is providing the market very clear signals that robust economic growth, full employment and a moderate inflation risk are enough to warrant that short-term interest rates should continue heading higher until “normality” is reached.

The origins and impact of the US-China trade war

At what point US interest rates become normal or “neutral” is the US$4 trillion question right now as the Fed continues its quest to roll back its massive balance sheet expansion following the 2008 crash. Thanks to the Fed’s continuing communication, markets are fairly well briefed for interest rates returning to neutrality somewhere between 3 and 4 per cent in the medium term.

China’s central bank should be working just as hard on building expectations, except with interest rates set to go lower. China’s growth and employment prospects look vulnerable, inflation risks appear benign and the markets need better guidance. The PBOC needs to fill the void with greater clarity.

China needs a new monetary model, where the PBOC’s independence and rate-setting process is genuinely liberalised and fully guaranteed. The time for change is long overdue.

David Brown is chief executive of New View Economics

This article appeared in the South China Morning Post print edition as: Trade war shows China needs a new monetary policy model

Post