Hong Kong home prices fall 2.4 per cent in October, marking a third consecutive monthly drop at a quickening pace

-

Hong Kong lived-in home prices saw their largest fall in three months, with a 2.4 per cent decline in October

-

That means home prices have fallen 3.6 per cent in total after peaking in July

Hong Kong lived-in home prices saw their largest fall in three months, with a 2.4 per cent decline in October

That means home prices have fallen 3.6 per cent in total after peaking in July

Home prices in Hong Kong slid for a third month – and picked up the pace.

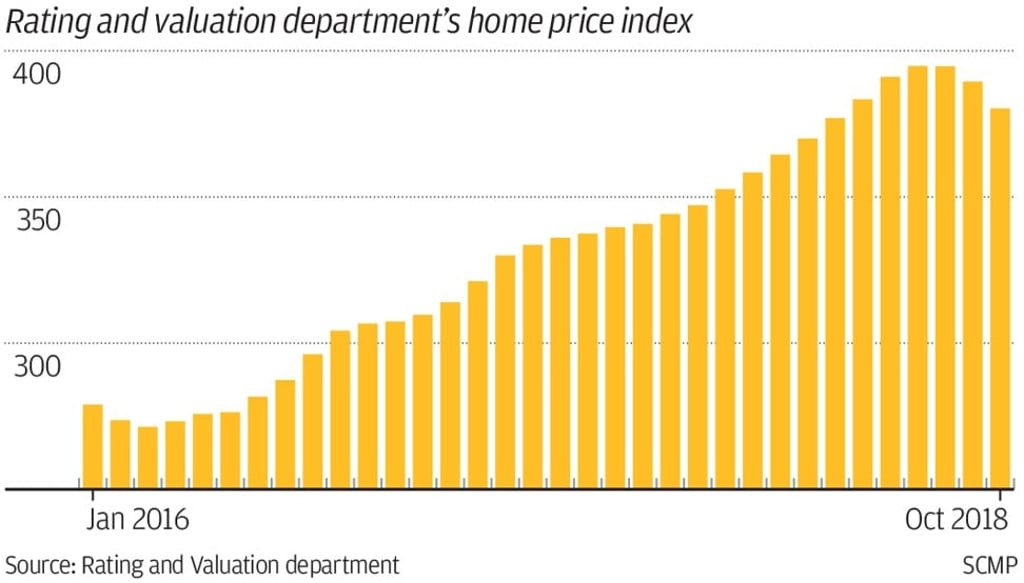

Hong Kong lived-in home prices dropped 2.4 per cent in October. That means home prices have fallen 3.6 per cent in total after peaking in July after a 28-month rally that began in April 2016.

The price index of used homes dropped to 380.3 in October from 389.5 in the previous month, a much bigger decline than the 1.3 per cent recorded in September, and the 0.03 per cent in August, according to data released by the government’s Rating and Valuation Department on Friday.

Analysts often say that three makes a trend, so the latest data are significant for property watchers, developers, owners, buyers and renters.

“It is dropping faster than we expected,” said Derek Chan, head of research at Ricacorp Properties. “If an owner does not cut their asking price, it will be very difficult at this moment to sell his apartment. We see some have cut their offered prices by as much as 20 per cent.”