US-China trade war could put a huge damper on Chinese demand for high-end American clocks

- A distributor of luxury American clocks sold on the mainland says the outlook has soured as the impact of China’s new 10 per cent tariff takes effect

Mechanical clocks have become the latest victim of the ongoing trade war between Washington and Beijing.

A Chinese distributor of high-end mechanical clocks made in the US said recently the sales outlook for the goods on the Chinese mainland appears challenging as the impact of a 10 per cent tariff begins to take effect.

Meanwhile, the outlook for high-end European clocks appears brighter, as these products are set to enjoy a drop in Chinese import duties.

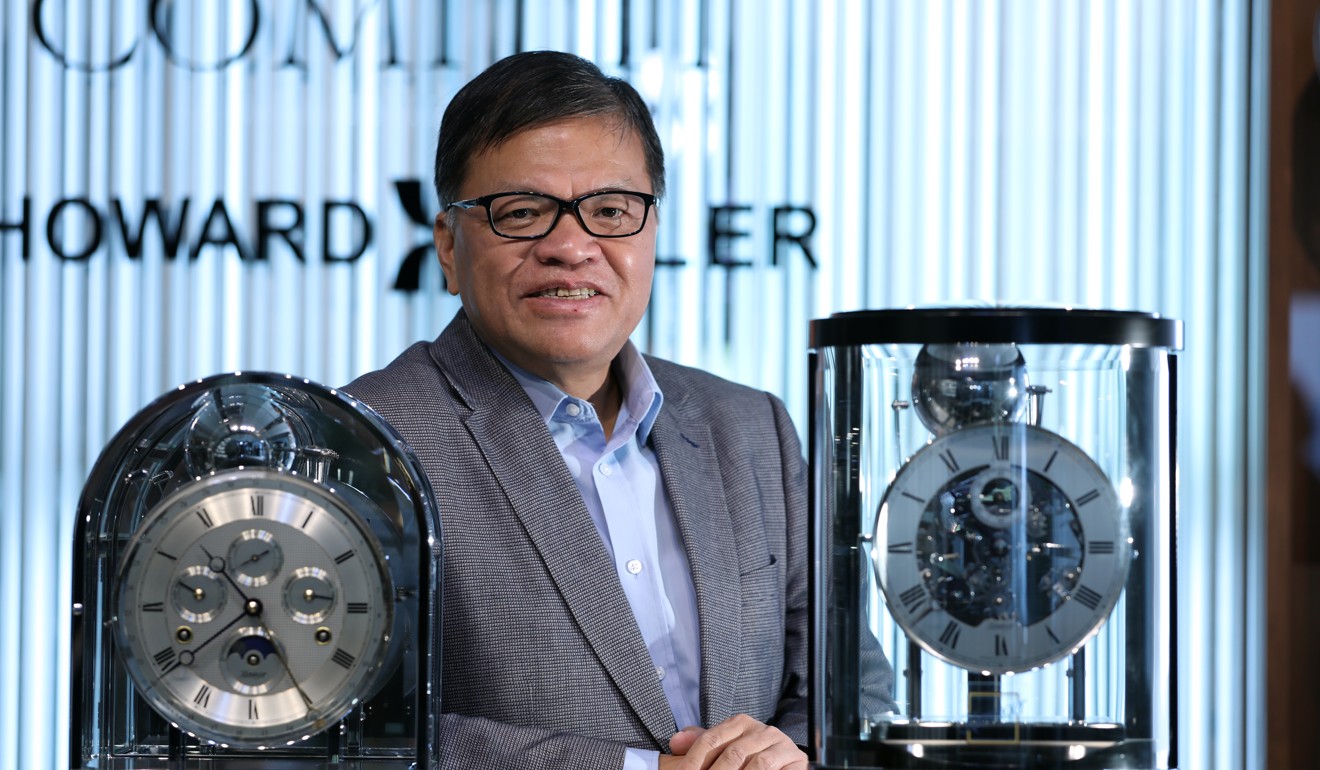

“At the beginning of the year, I was very confident, but this year is a bit funny,” said Ip Chun-keung, owner of Qingya Clocks. “The retail sector in China is not performing as well as we want it to be. And the trade war makes it seem like two elephants are fighting and we are in the middle of it.”

Qingya Clocks is the exclusive partner of the Howard Miller Group, an American company which owns the Howard Miller brand and the German brand Kieninger.

“Since August, I need to pay 10 per cent more,” Ip said, referring to the mainland import duties.

Owing to the lower sales, Ip said he revised his expansion plan for Qingya Clocks stores in China this year. They only added eight shops, down from earlier plans to add 10 stores, bringing their retail network to 48.

Qingya Clocks has seen its economic fortune impacted by the trade dispute between the world’s two largest economies.

In July, the US began imposing a 25 per cent tariff on US$50 billion worth of Chinese products, a decision that provoked a retaliatory levy from China on the same amount of American goods.

The dispute escalated in September when the US imposed a 10 per cent tariffs on US$200 billion of Chinese imports, while China responded with tariffs on US$60 billion worth of American goods.

A survey at the recent Watch and Clock Fair by the Hong Kong Trade Development Council found that buyers and exhibitors were more cautious about sales in 2019, citing the trade rift between the US and China.

Growth in retail sales in China has softened to the high single-digits in April from a consistent rate of nearly double-digit growth in previous years. Between November 2015 and November 2017 retail growth trended between 10 per cent and 11. 2 per cent

In October, retail sales grew 8.6 per cent on year, the slowest since May, data from China's National Bureau of Statistics showed.

Ip said that sales of Howard Miller clocks, which retail for 40,000 yuan (US$5,765), had been lacklustre in recent months as the higher tariffs from US products began to bite.

“It's the mid-level and low-end items that are not doing as well,” Ip said.

Sales of Kieninger clocks have been largely spared from the fallout of the trade war. Its parts are made and assembled in Europe, where tariffs are set to fall from 15 per cent to 10 per cent.

“The duties on some European products are [being reduced] from 15 per cent to 10 per cent, but for the American products, they are increasing from 15 per cent to 25 per cent,” Ip said.

Gerhard Schneider, sales manager at Kieninger, said that while the sales of their complete clocks remain relatively upbeat, their business of supplying movements to other clock manufacturers had taken a hit.

“The Kieninger brand is doing OK. It's not booming, but it's stable,” Schneider said. “We're not making low-end clocks, we're only supplying lower end movements to some manufacturers. The mid-level and lower end, they're not doing very well this year.”

Kieninger’s timepieces retail for about 150,000 yuan.

Market research company Euromonitor International estimated that Chinese consumers spent US$39.3 billion for household furnishings, silverware, and clocks in 2017, reflecting 7 per cent growth on year.

For 2019, Ip said his company plans to add 10 more shops on the mainland, and an additional 3 million yuan to fund development of a related online venture.

He estimated that the online business would contribute 20 per cent of sales for 2019.

Ip said most buyers of heritage style mechanical clocks were middle-aged Chinese men, although he was hoping to target the products at younger consumers in China.

Adam Xu, partner at OC&C Strategy Consultants, however expressed doubts whether online would be a successful strategy for a shop selling luxury items such as Qingya Clocks.

“There is an appetite for house furnishing items in China, but I haven't noticed that young Chinese having an interest in big mechanical clocks,” Xu said. “And for luxury products, buyers usually want to see, touch and inspect the product first before spending huge amount of money for an item.”