Hong Kong homebuyers beware: wait for better deals in second half of 2019

- Homes prices could fall by 10 per cent to 25 per cent next year

- Buying window to get best prices will be as little as six months, analysts say

Buyer’s tip: wait until the second half of the new year before purchasing a home in Hong Kong.

While prices have already begun to slide in the world’s least affordable housing market, experts say a mix of events in the first six months of 2019 will weigh down prices further. Savvy buyers should let those play out before taking the plunge, they say.

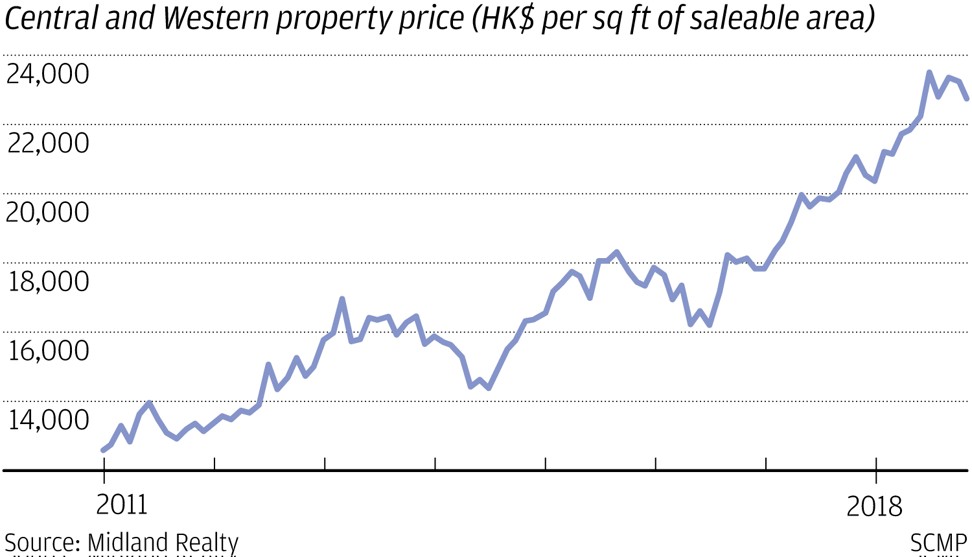

These include a fresh supply of both new private flats and subsidised flats, possible mortgage rate increases, and cuts in asking prices by sellers who want to lock in huge gains from a 28-month property bull market that ended in August and sent prices up by 44 per cent.

Fears cutting percentage of private housing stock could halt market cool-down

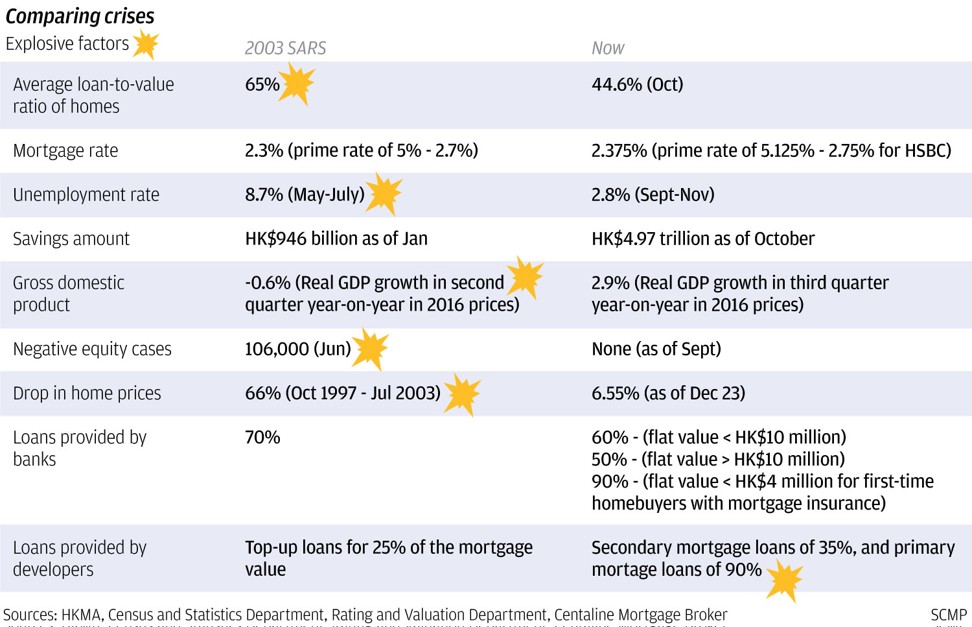

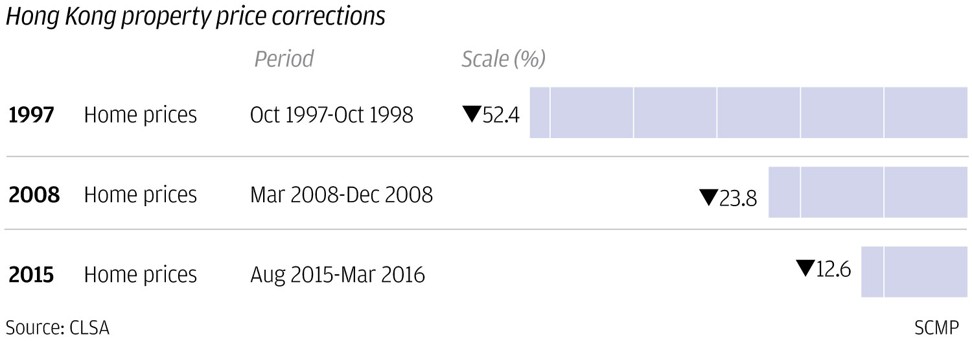

Analysts are predicting home prices could fall by 10 per cent to 25 per cent in Hong Kong next year. That would be a much softer and shorter downturn than the one-two punch delivered by the 1997 Asian financial crisis and the 2003 Sars epidemic, when prices plummeted 66 per cent between October 1997 and July 2003.

If the analysts are right, that means the buying window to get the lowest prices will be short – as little as six months before prices begin to recover.

“In the next six to seven months, a narrow window will open for first-time homebuyers and those regarding a Hong Kong flat as a long-term investment. It is all about timing,” said Letizia Garcia Casalino, head of residential services at Colliers International.

“The question mark is whether buyers can gain as much as in the previous cycle,” Casalino added.

Looming big vacancy tax is prodding city’s developers to sell empty flats

Terence Wong, a 30-year-old bank employee, is among those hoping to benefit from the expected drop in prices. Married in May, Wong and his wife looked at flats for months but found prices “just insanely high”. Now he feels lucky not to have bought.

“I am willing to wait until the second half of the year to hopefully to see another 5 to 10 per cent drop. But I won’t wait too long as there will never be perfect timing,” Wong said.

Hongkongers who have watched for signs to buy when the market was hitting bottom have been richly rewarded in the past. An investor who bought in July 2003 as the battered housing market started to turn back up would have seen a whopping 552 per cent gain as of now.

Builders woo cautious buyers with special mortgage rates, discounts

In comparison, in that 15-year period the Hang Seng Index has gone up 167 per cent, while gold has gone up 258 per cent.

Warning signs flashing

The warning sign that the property bull run was over in Hong Kong flashed in August, with the first data showing a slight decline in the median price of lived-in homes. Home prices have dropped by 6.55 per cent in the past 13 weeks, according to Centaline.

In November, booked sales were down nearly 60 per cent from July to 2,635, according to data from Colliers International. That was the lowest monthly transaction level since March 2016.

How Hong Kong let the air out of property bubble without popping it

Another sign of a changing market: some owners have slashed their asking prices by up to 20 per cent in residential suburbs such as Tsuen Wan and Pok Fu Lam to attract buyers.

“Unless owners slash prices more than the normal expectation – 15 per cent at least – prospective buyers won’t consider sealing a deal,” Ricacorp Properties’ research head Derek Chan said.

The snowballing negative sentiment got an extra push from uncertainty around the US-China trade war as well as drops in the city’s stock market.

Many prospective buyers stepped back, adopting a wait-and-see attitude. Developers began finding it harder to sell new flats at launches. And red flags started being raised that micro flats – some smaller than a Hong Kong parking space – would take the biggest hit in a downtrending market, with owners facing as much as 30 per cent losses.

Hong Kong’s love of shoebox abodes has ended as quickly as it began

Then the Hong Kong government said on December 21 that it will increase the amount of subsidised public housing available for purchase. While the timing is not yet clear, the government said it wants to add 15,000 subsidised flats to its earlier plan, which would bring the total number of new subsidised flats up to 95,000 over the next decade. Those flats will be highly sought after, adding to the “wait-and-see” behaviour by buyers who think they are income eligible for flats discounted by as much as 50 per cent.

Applications set to open for first batch of half-priced subsidised flats

In the private market, developers are pumping out more supply, trying to not get stuck with unsold new units before an expected steep empty-flat tax is slapped on them. In comparison to early summer, when the market was still red hot, recent launches have largely been unsuccessful. One exception was a launch by Sino Land, which offered new flats at a 14 per cent discount to stimulate sales in mid-December, making it the only project to sell out quickly with its low-price strategy.

Hong Kong developer bucks falling trend as buyers snap up all flats

Pricing pressure will continue to be felt in new launches, experts say. Ones expected to come into the market in the next few months include The Regent in Tai Po by China Overseas Land & Investment, Lohas Park Phase VIII in Tseung Kwan O by CK Asset Holdings, and Central Horizon in Tai Po by Billion Development and Project Management. They will add a total of 4,450 flats to the market.

How bad will it get?

Market observers suggest that the current correction will be more akin to the most recent housing sting in 2015 when the US Federal Reserve raised its benchmark interest rate for the first time in nearly a decade. Over the next eight months ending in March 2016, median prices of lived-in homes in Hong Kong fell 12.6 per cent. It was bruising – but not horrible.

“We will need two elements to say ‘yes’ [to whether it is a good timing to buy]. First, when the forecasted 15 per cent price drop is completed. And second, an indication of improving economic outlook. For example, the [Hang Seng Index] getting back to 30,000 points or above,” said Nicole Wong, regional head of property research at CLSA. The Hang Seng closed at 25,504 on Friday.

The fall won’t be as bad as some past ones because of the city’s overall good economic health, including a 3.7 per cent growth in GDP in the first three quarters of the year and a low 2.8 per cent unemployment rate.

Another braking factor is a large number of mainland Chinese – 21,000 – who can become Hong Kong permanent residents in 2019, after living in the city for seven years since a 30 per cent tax was slapped on foreign buyers. That could lead to about 7,000 home purchases next year, according to Wong of CLSA. For context, about 50,000 flats are expected to be sold in 2019 in Hong Kong, Ricacorp Properties estimates, underscoring that 7,000 flats would be substantial.

Purple Wong, a mainlander who will get permanent residency next year, has moved five times to rental flats in the past six years, and hopes to get a deal on a home next year.

“If I get lucky enough, I might get a bigger flat,” she said, “something like 500 square feet if the prices continue to drop.”