CK Asset plans to convert hotel site into Hong Kong’s biggest housing estate of the last decade, with up to 50 flats on every floor

- The flagship company of retired tycoon Li Ka-shing wants to turn its Harbour Plaza Resort City hotel into 5,000 flats

- The project would become Hong Kong’s densest residential estate, with up to 50 units per floor, prompting criticism from analysts

A hotel in the New Territories will be converted into what may be the biggest private housing estate to be built in Hong Kong in the last decade, under plans submitted by CK Asset Holdings, the flagship company of retired tycoon Li Ka-shing.

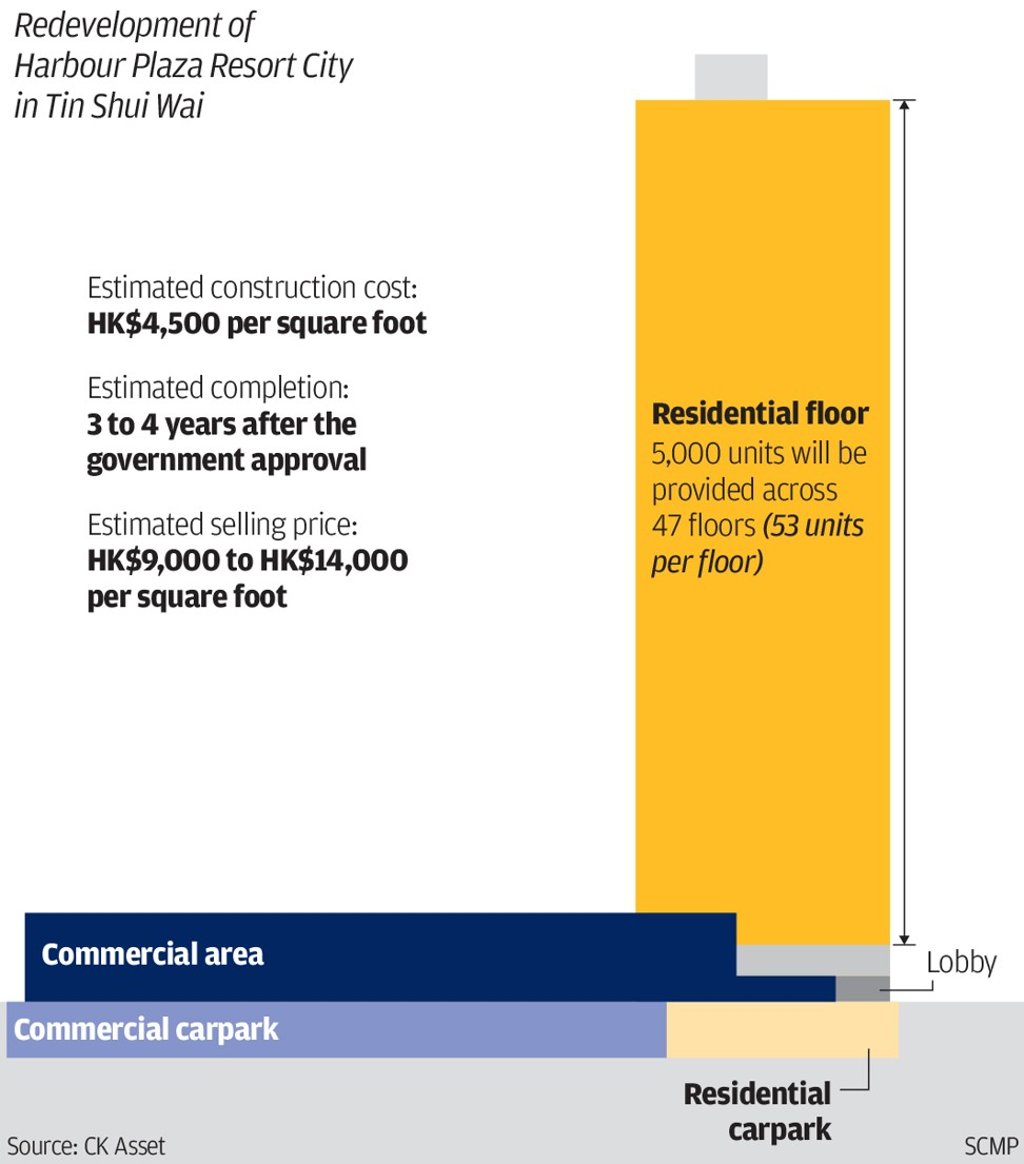

The conglomerate has submitted an application to redevelop its 1,100-room Harbour Plaza Resort City hotel in Tin Shui Wai into a dense housing estate comprising 5,000 flats, according to a document filed with the town planning board.

“It will be a single private housing estate by one developer with the largest number of units in the past 10 years,” said Vincent Cheung, a veteran surveyor. “There’s a good chance it will get approved as it could help increase the housing supply in the short run.”

The proposal is to turn the existing 19-year-old Harbour Plaza Resort City into two 53-storey residential towers yielding gross floor areas of up to 185,817 square meters (2,000,117 square feet). The 5,000 flats would be spread across 47 floors in each converted building.