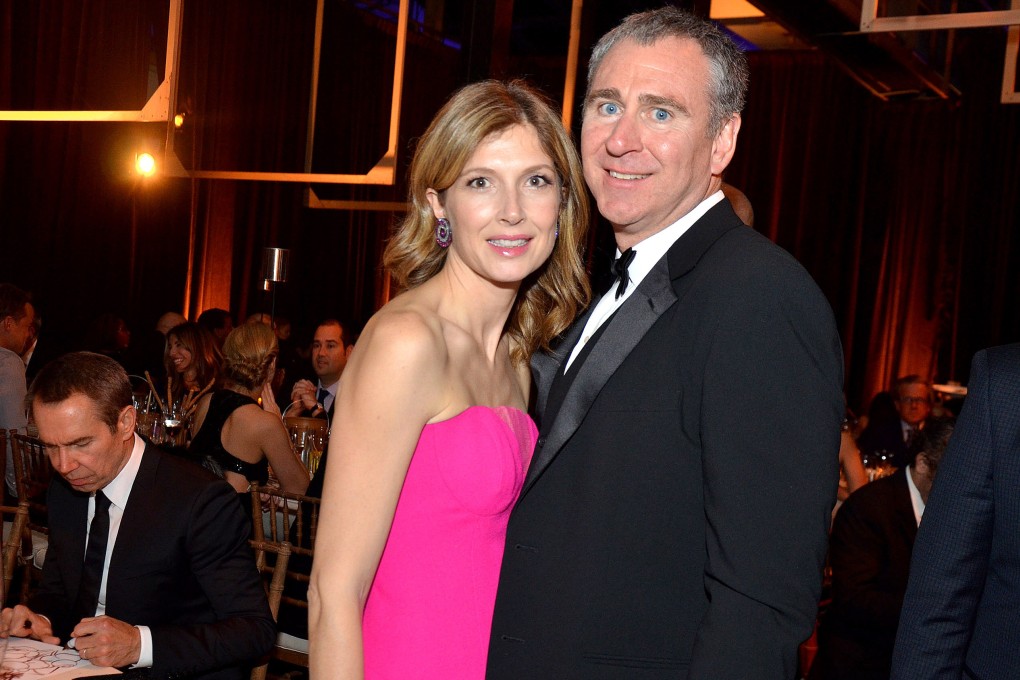

Billionaire Ken Griffin sets US record for most expensive property with US$238 million New York penthouse

- The founder of hedge fund Citadel is known for collecting trophy assets

- Griffin bought one of London’s most expensive residential properties only a few days ago

Ken Griffin is showing how a billionaire goes on a shopping spree.

Just days after buying one of the most expensive residential properties in London, the Citadel founder set a US record with the US$238 million penthouse at 220 Central Park South. The 24,000 square feet flat will give him a place to stay when he is working in New York, a Citadel spokeswoman said. The price makes it America’s most expensive home.

“He’s definitely a global trophy hunter and he bought what would arguably be now the number one building in New York,” said Donna Olshan, president of Olshan Realty.

“I don’t think that the fact that he buys an extraordinary trophy property speaks anything about the market. It’s just this is what he does and you have to look at it as a one-off. Hats off to the developer for that kind of sale.”

Earlier this month, Griffin paid about £95 million (US$122 million) for a 200-year-old home overlooking London’s St James’s Park about half a mile from Buckingham Palace. The 20,000 sq ft home includes a gym, pool and underground extension.