Property giants including China Vanke, Country Garden splash out US$16 billion on 80 plots of land in Greater Bay Area

- China Poly Group was the most aggressive, spending 42.9 billion yuan on land in the area, according to property data consultant Real Estate Foresight

- The Greater Bay Area, the size of Croatia, is destined to be China’s new innovation and financial powerhouse

Some of China’s biggest property developers spent a combined 110 billion yuan (US$16.25 billion) in just one year snapping up 80 parcels of land in the “Greater Bay Area”, according to figures released on Tuesday by Real Estate Foresight.

The Greater Bay Area, the size of Croatia and encompassing Hong Kong, Macau and nine mainland cities, is destined to be China’s innovation and financial powerhouse and embodies President Xi Jinping’s ambition to create a hub to rival Silicon Valley or the Tokyo Bay Area.

With its economic output and population set to skyrocket, the country’s leading builders including China Vanke, Country Garden Holdings and China Resources Land have been keen to get a slice of the action.

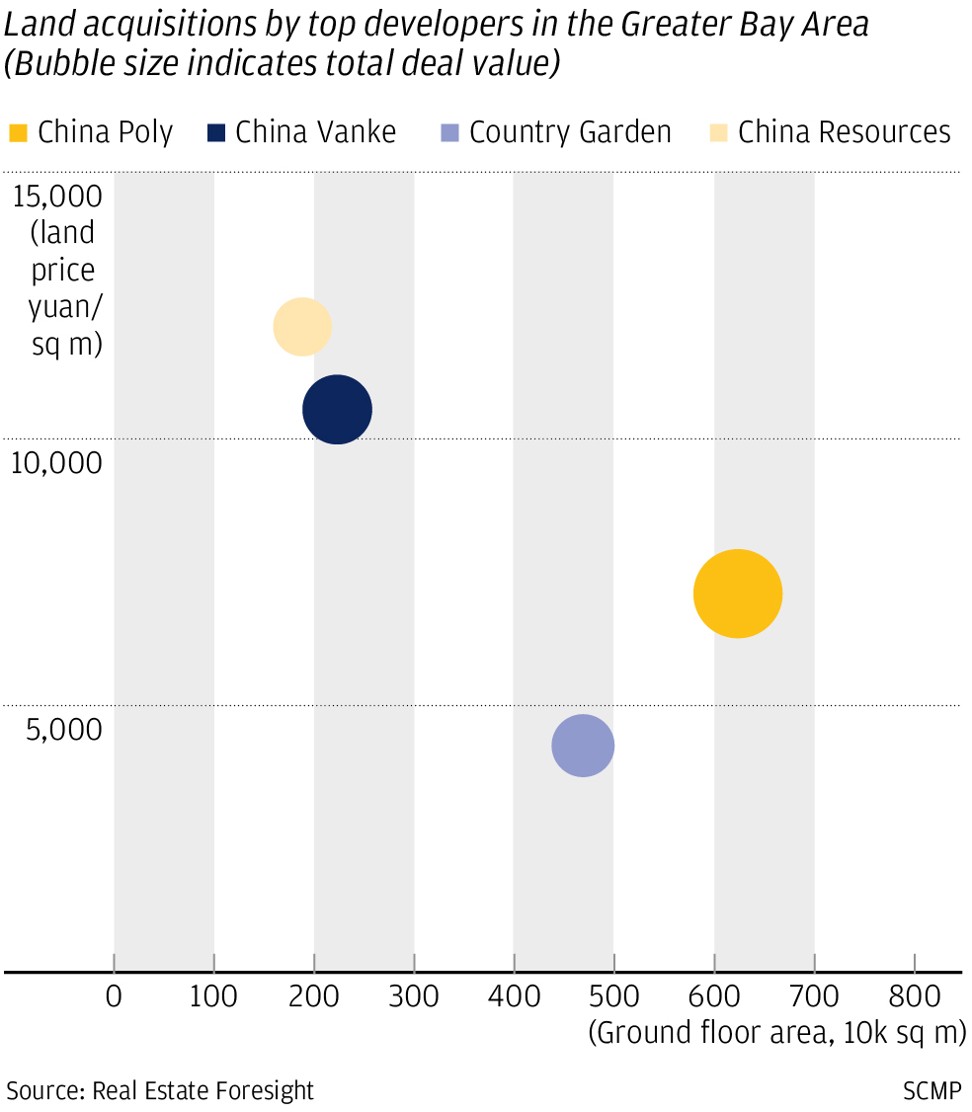

China Poly Group was the most aggressive, splashing out a hefty 42.9 billion yuan for more than 6 million square metres of land in the area between December 2017 and November last year, according to the Chinese property data consultancy’s data.

“The largest developers in the country have all had their eye on the cluster of 11 cities, betting on the value appreciation of land favoured by the central government’s new policies,” said Van Liu, an analyst at Guotai Junan Securities.

The battle among developers expanding their footprint in area is likely to intensify as the zone takes shape.

The central vision of the Greater Bay Area was finally unveiled by Beijing late on Monday in a long-awaited document.

In the development blueprint, the Chinese government has pledged to turn the 11-city megalopolis into a leading global innovation hub, boost infrastructure connectivity and strengthen Hong Kong’s role as an international centre of finance, shipping, trade and offshore yuan business.

“As a result, an influx of people will come to settle down in the area and thus there will be an increasing demand for houses,” said Danielle Wang, a China property analyst at DBS Vickers.

“Every developer knows that they must have exposure in the market, but small ones will find it very hard to grab a piece. We will see top developers buying more land in the area.”

According to the data from Real Estate Foresight, property giant China Vanke paid 26.1 billion yuan for land in the Greater Bay Area, the second largest amount in the 12-month period.

The third biggest spender was Country Garden Holdings, mainland China’s largest builder, which paid 21.4 billion yuan. Seeing out the top four was China Resources Land, which invested 18.6 billion yuan in the same period.

The top four buyers between them bought 80 sites covering more than 15 million square metres in the nine cities in Guangdong Province: Shenzhen, Guangzhou, Zhuhai, Zhongshan, Dongguan, Foshan, Huizhou, Jiangmen and Zhaoqing.

About a third of all the land bought by the four developers was in Foshan, formerly known as a manufacturing hub for air conditioners and refrigerators.

As of January, prices for new and used homes in the city had risen 35 per cent since July 2017, according to the Centaline Greater Bay Area Index. Zhaoqing ranked number two with a 22 per cent gain in property prices, followed by Jiangmen with a 16 per cent gain.

Amid the land buying frenzy, the top buyers have accrued debt. Country Garden Holding’s debt to equity rate grew to as high as 206.34 in the first half of 2018 from 184.17 at the end of 2017.

Country Garden Holding’s total debt to equity rate grew to as high as 206.43 in the first half of 2018 from 184.17 at the end of 2017, while net debt to equity was up to 59 per cent as of June 30 from 56.9 per cent.