Vanke to sell 251 flats in Tuen Mun on Sunday, defying downbeat mood amid trade war, street protests and rising rates

- Vanke Property (Hong Kong) said it will proceed with selling 251 flats at its Le Pont project in Tuen Mun on Sunday, with prices starting from HK$4.66 million for a 353 square foot unit

- Sun Hung Kai Properties and Wheelock cancelled a press conference for next week’s sale of Mount Regency in Tuen Mun, without saying if the sale will proceed as scheduled

The Hong Kong unit of China’s most valuable property developer said it is putting 251 flats up for sale this Sunday, in a defiant launch against downbeat sentiments amid a worsening US-China trade war and the city’s biggest street protests in two decades.

The sale, the biggest since 1,148 flats were offered by three developers in early May, would test buyers’ appetite for committing to big-ticket purchases in a city where real estate plays an outsize role as barometer of residents’ moods.

Sentiments in Hong Kong had been downbeat since May 10, when talks between the United States and China to end their year-long trade war ended in impasse. US President Donald Trump slapped 25 per cent tariffs on US$200 billion of Chinese products, and is holding the duties over another US$300 billion of imports to push China to give in to his demands.

The blockade, the latest rally after hundreds of thousands of protesters took to the streets on Sunday, took the wind out of the city’s stock market, driving down the Hang Seng Index by as much as 1.8 per cent. The overnight cost of borrowing among banks, or the Hibor, jumped by 29 basis points to 2.42 per cent, the highest since 2008.

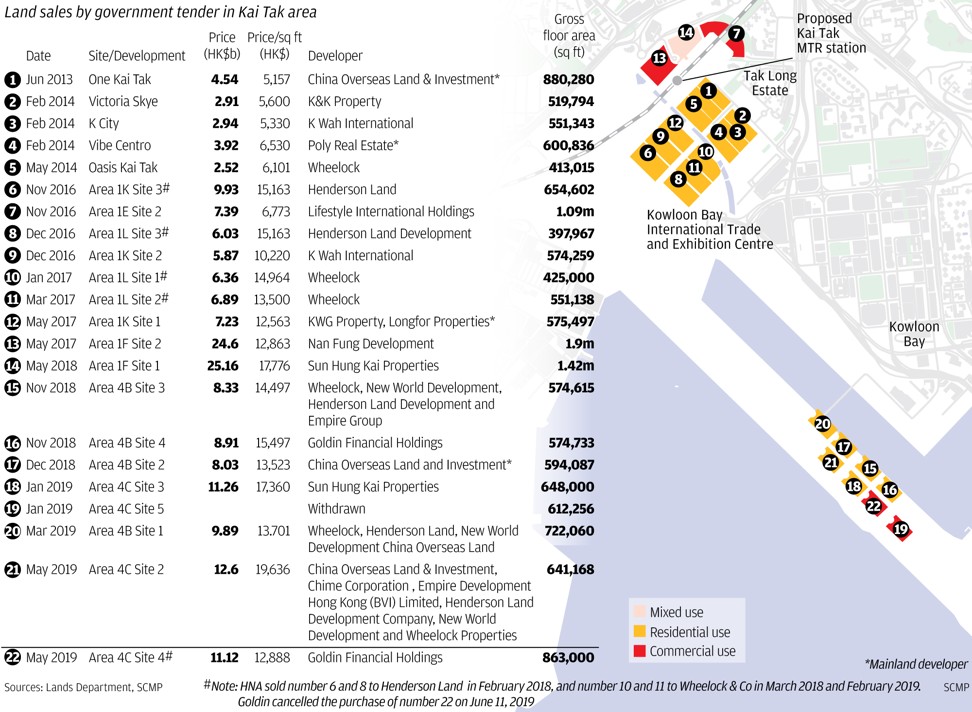

Goldin would have to invest an estimated HK$18 billion to develop the site into a shopping centre, including a hotel.

“The recent disharmony in society and the trade war are [among the] number of reasons that worries me,” said Abraham Shek, an independent non-executive director of Goldin, speaking to South China Morning Post in a telephone interview. “If [property] prices fall by 10 to 15 per cent, what will happen? I am responsible for minority shareholders.”

Leung, who is also the chairman of Hong Kong’s Real Estate Developers Association (Reda), said Goldin’s move to renege on its Kai Tak purchase is unlikely to be a blow to the city’s property industry because it was “an individual case.”

“It will have a bigger impact on investors who are more sensitive to market uncertainties while end users are taking wait and see attitude,” said Louis Ho, director at Centaline Property Agency. “Overall property sales would be slowed amid the current situation.”

Another test lies waiting on Friday, when a government tender closes for a residential plot on the former Kai Tak runway.

Area 4C Site 1 is valued at between HK$12.5 billion and HK$13.6 billion, and will require a development cost of between HK$18 billion to HK$20 billion.

“There may be fewer bidders. Those who join may reconsider their offer price,” said Kevin Tsui, associate professor of economics at Clemson University in South Carolina.

To be sure, Vanke said it will be pushing ahead with its sales schedule.

“So far, we don’t have any changes in our sales plan,” said a Vanke spokeswoman in Hong Kong, adding that the city’s protests are visible to her at her office in Central. “So far, we have not been affected. The sales launch will go ahead as originally planned.” The developer’s shares fell 1.2 per cent in a declining market to 28 yuan in Shenzhen. The stock rose 0.2 per cent to HK$29.25 in Hong Kong.