Micro apartments are still popular because their rental yields top the average in Hong Kong’s notoriously costly housing market

- A flat at The Garrison in Hong Kong’s Tai Wai that sold in July 2018 for HK$4.4 million (US$563,000) has been put on the market for rent at HK$13,500 per month, even before its owner took possession

- The yield, at 3.7 per cent, tops returns on rental properties across the city, which stood at 2.63 per cent in May

A flat at The Garrison in Hong Kong’s Tai Wai that sold in July 2018 for HK$4.4 million (US$563,000) has been put on the market for rent at HK$13,500 per month, even before its owner took possession of the 201 square-foot (18.7 square metres) micro apartment.

The average rental yield across 50 of Hong Kong’s largest residential estates stood at 2.63 per cent in May, while the 21 estates in the New Territories – where Tai Wai is – stood at 2.65 per cent.

Micro apartments, sometimes called nano flats, “are good deals in terms of high rental yield and the small amount that buyers need for initial payment,” said Vincent Cheung, managing director of Vincorn Consulting and Appraisal. “They can easily get a yield of 3 per cent, while those in prime location can fetch 4 per cent.”

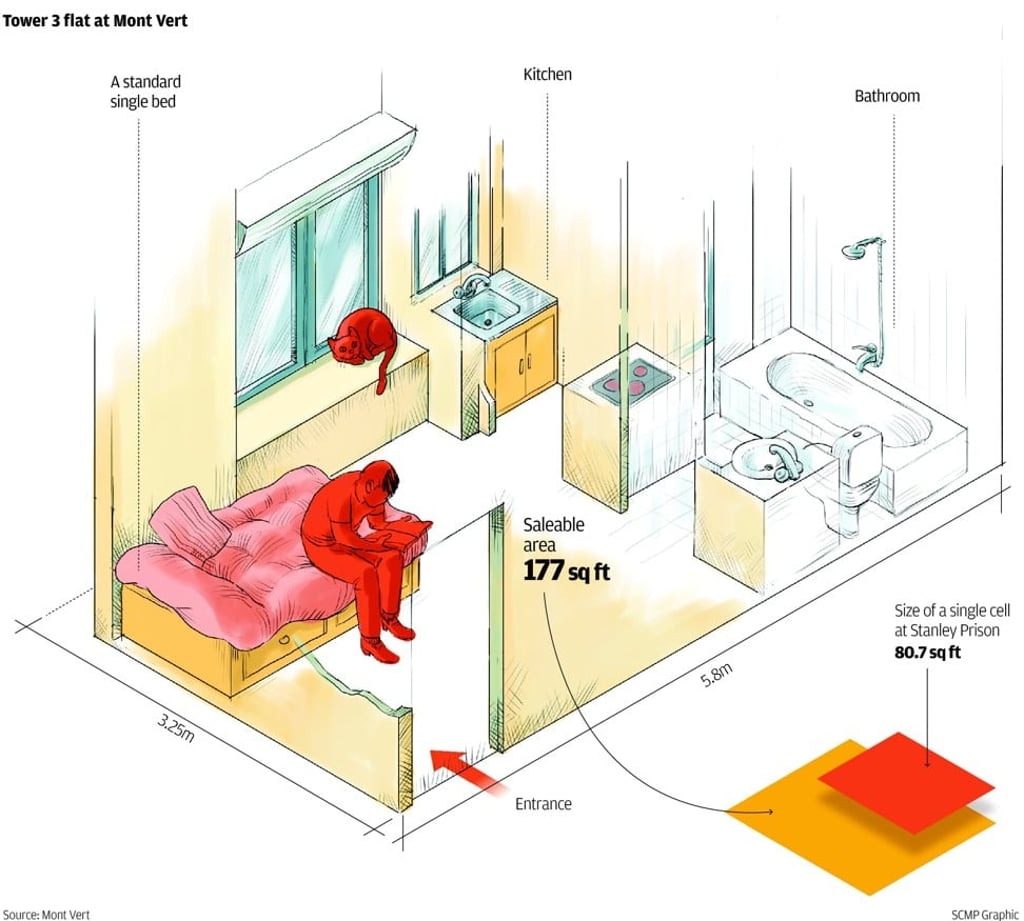

Housing affordability is one of the key policy challenges faced by Hong Kong’s Chief Executive Carrie Lam Cheng Yuet-ngor, as many low-income earners are forced into subdivided flats, or living space that’s been carved out of tiny flats, usually old tenement buildings that are not served by lifts. The cost of renting a subdivided flat was HK$5,030 per month, for a space measuring 58.2 sq ft, according to June data released by the city’s housing authority.